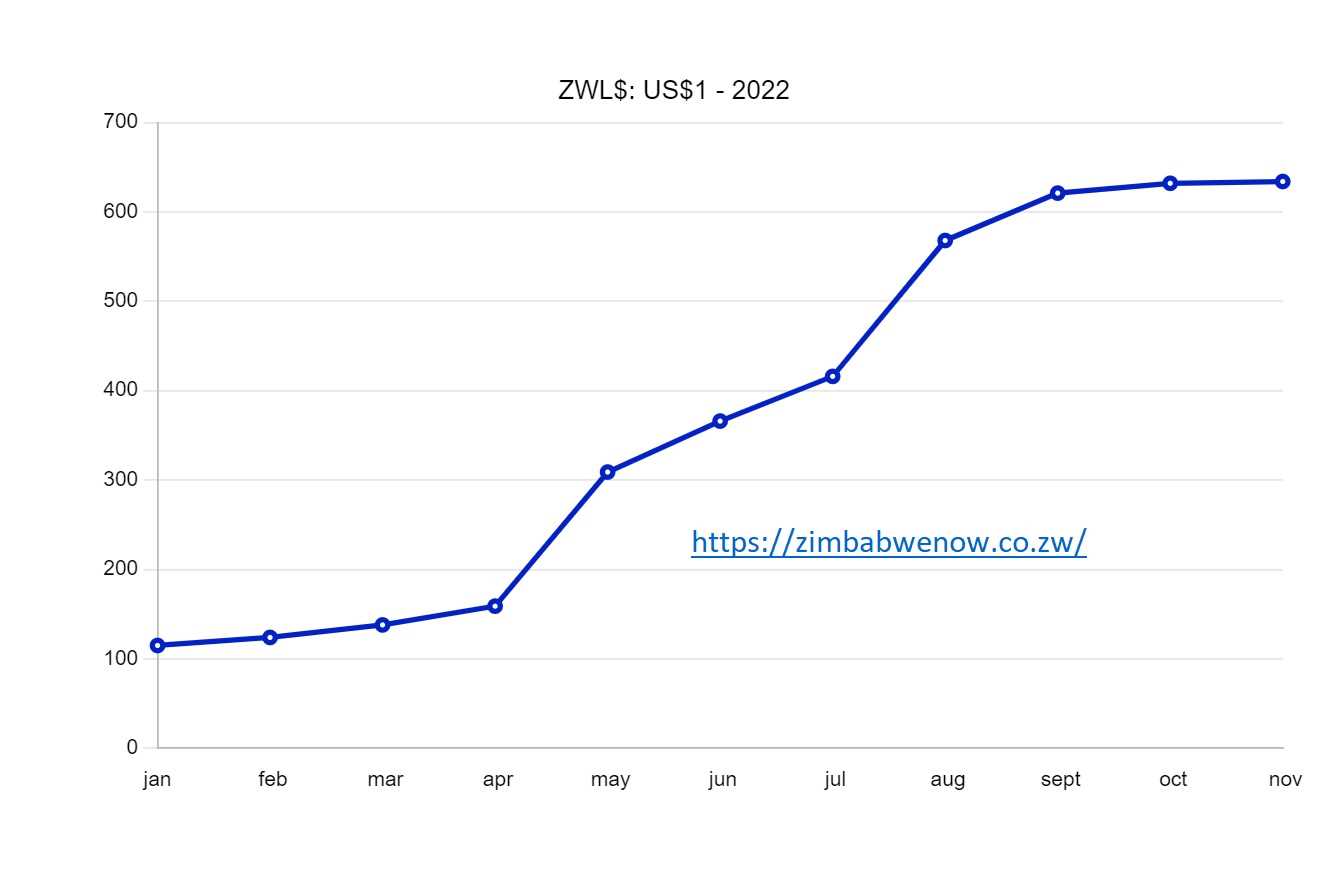

The Zimbabwe dollar is holding steady against the US dollar and with minimal losses since the Reserve Bank of Zimbabwe introduced a raft of measures to protect the currency in Q3 2022.

Almost all currencies across the world have been taking a beating against the US dollar as the US Fed keeps hiking interest rates.

But the Zimbabwe dollar had its own unique moribund trajectory with market watchers predicting its demise.

The Zimbabwe dollar went into free fall between April and August this year, setting off hyperinflation.

The market lost confidence in the local currency and de facto dollarization took place.

Related Stories

This was reflected in every individual and organisation - including government entities-preferring payment in USD with some outright rejecting ZWL$ transactions.

RBZ blamed speculative and downright criminal activities as being behind the fall of the ZWL$.

In Q3 the central bank came up with monetary policy tightening measures that included temporary block on payments to government contractors and stricter price monitoring.

Introduction of the Mosi-oa-Tunya gold coins helped mop up excess ZWL$ thus starving the black market of liquidity.

Closure of the gap between the official and black market rates has also meant more direct US$ payments for compliant businesses thus further cutting out black market dealers.

On recent visits, International Monetary Fund teams have said RBZ is on the right track with the tight monetary policy and recommended freer forex policies to spur black market redundancy.

Leave Comments