Nyashadzashe Ndoro

Chief Reporter

The Zimbabwe Stock Exchange has issued a cautionary notice to its shareholders, advising them to exercise caution when dealing with their shares due to potential delays in its scheme of reconstruction.

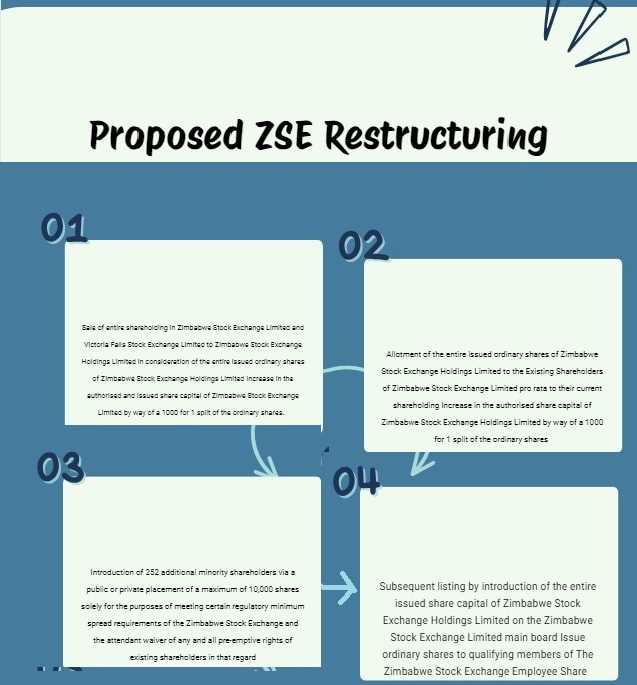

The scheme, unanimously approved by shareholders on October 9, 2024, aims to streamline operations, improve liquidity, and unlock shareholder value by creating a more robust corporate entity.

Related Stories

The ZSE is currently awaiting regulatory approvals from the Zimbabwe Revenue Authority and the Securities and Exchange Commission of Zimbabwe. While these approvals are expected to be obtained in due course, delays may occur due to the need for amendments to Self-Listing Rules (S.I. 147 of 2024) to facilitate the listing of ZSE Holdings Limited on the ZSE Main Board.

ZSE Holdings Limited, a newly incorporated entity, is in the process of consummating the scheme of reconstruction, which involves share splits and an employee share option plan. The group will also make a buyout offer to shareholders of the ZSE. Shareholders will receive regular updates on the progress of fulfilling the conditions precedent prior to the release of the Pre-Listing Statement.

"...while it is anticipated that these approvals will be obtained in due course, delays may be occasioned by the need to effect certain amendments to S.I. 147 of 2024 to facilitate the listing of ZSEH Ltd on the ZSE Main Board," Lyndon Nkomo, ZSE Company Secretary, said in a notice.

The transaction will significantly alter the corporate structure and governance of both entities. ZSE Limited shareholders will receive the entire issued ordinary shares of ZSE Holdings, creating a listable holding company that will control the existing structure of ZSE Limited.

The operations of both the ZSE and VFEX will remain independent due to separate securities exchange licenses.

Leave Comments