Audrey Galawu

Assistant Editor

Starting January 2025, businesses in emerging sectors will be mandated to register for and comply with Corporate and Personal Income Tax requirements. This move, announced in the recent budget proposal, seeks to formalise a growing segment of the economy that has previously operated largely outside the formal tax net.

Government has identified specific operators—ranging from car dealerships and grocery merchants to boutique owners and lodges—that are required to register with the Zimbabwe Revenue Authority. The initiative is designed to bolster the national revenue base by ensuring these businesses contribute to the fiscus.

The sectors earmarked for mandatory tax compliance include: fabric and clothing merchants, grocery and kitchenware traders, spare parts and car dealerships, hardware operators and lodges.

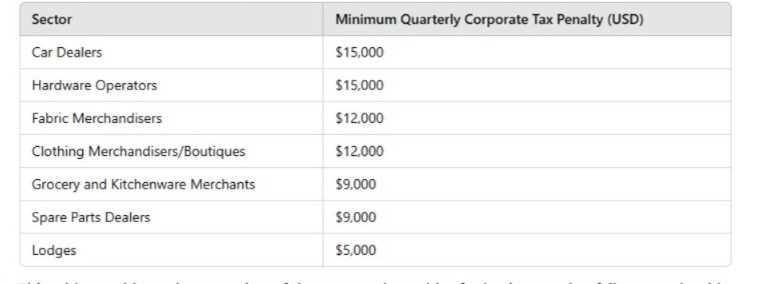

Businesses falling under these categories must regularise their operations, maintain accurate financial records, and transact using Point-of-Sale systems. For operators who fail to meet these requirements, the government proposes stringent penalties, including mandatory quarterly tax payments and temporary business closures. The minimum quarterly Corporate Income Tax for non-compliant businesses is set as follows:

Car Dealers and hardware operators will be fined US$15 000, while fabric and Clothing Merchants US$12 000 each, grocery and Kitchenware Merchants; US$9 000 and lodges will pay US$5 000.

Related Stories

ZIMRA will have the authority to enforce compliance by shutting down businesses until they meet their tax obligations.

Government has highlighted that many operators in these sectors engage in substantial economic activities but often evade taxes. While some operators maintain financial records, they reportedly withhold this information to avoid tax liabilities.

“This deliberate concealment of records under the guise of lack of capacity to maintain accounts amounts to tax evasion and avoidance,” noted the Finance Minister in his address.

For many operators, this shift marks a new era of accountability and financial discipline. While some businesses may struggle with the transition, the government views this as a critical step in leveling the playing field and ensuring all economic players contribute fairly to national development.

Operators are encouraged to take immediate steps to regularise their operations before the January 2025 deadline. Businesses that fail to comply risk significant financial penalties and disruptions to their operations.

While the government’s intentions are clear, industry players have expressed concerns about the readiness of some businesses to meet these requirements. The emphasis on record-keeping and POS systems, coupled with substantial penalties, could pose challenges for small-scale operators.

As government moves toward formalising its emerging sectors, the success of this initiative will depend on how well ZIMRA and the government support businesses in transitioning to compliance. Financial literacy programs, simplified registration processes, and clear guidelines could ease the burden for small-scale entrepreneurs.

Leave Comments