Philemon Jambaya

Zim Now Editor

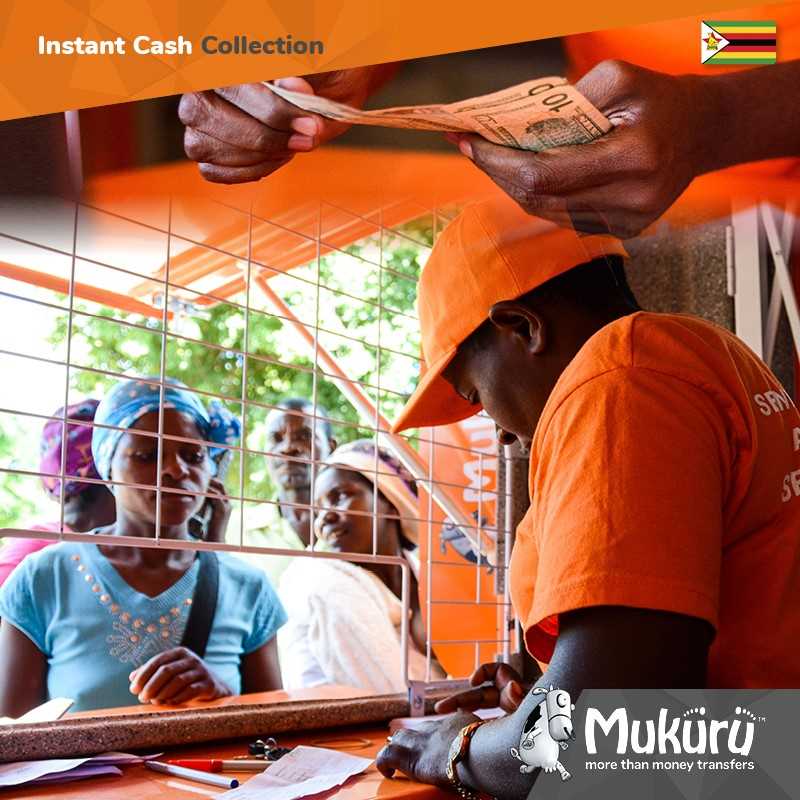

Zimbabwe's diaspora community continues to be a significant driver of the country's economy, with remittances surging to US$1.9 billion in the first nine months of 2024. This represents a 16.5% increase compared to the same period in 2023.

Related Stories

Finance Minister Mthuli Ncube unveiled these figures during the presentation of the 2025 National Budget. He highlighted that diaspora remittances now account for approximately 16% of foreign currency inflows, surpassing foreign direct investment and solidifying their position as the second-largest source of foreign exchange after exports.

The robust growth in remittances can be attributed to several factors, including a sound international reserve position and the increasing number of Zimbabweans living abroad. The government's efforts to streamline remittance processes and promote financial inclusion have also contributed to this positive trend.

In addition to the surge in remittances, Zimbabwe's international reserve position has strengthened significantly. The Reserve Bank's foreign currency reserves increased from US$285 million in April 2024 to approximately US$540 million by October 2024. This improvement is a result of deliberate reserve accumulation strategies aimed at enhancing foreign currency cash and gold holdings.

However, the country has experienced inflationary pressures in recent months, primarily driven by parallel market activities. To address this issue, the Monetary Policy Committee (MPC) implemented stabilization measures, including increasing interest rates and tightening foreign exchange regulations.

Leave Comments