Nyashadzashe Ndoro

Chief Reporter

Zimbabwe Stock Exchange listed horticulture giant Tanganda Tea Company Limited has vowed to exercise caution when operating in Zimbabwe due to the country's volatile economic environment.

The company's cautious approach is aimed at mitigating risks and ensuring sustainability amidst the challenges.

Like many other companies in the country, Tanganda has already felt the impact of Zimbabwe's economic instability. The devastating El Nino phenomenon, which affected the agricultural sector, and the crippling rolling power cuts, have all taken a toll on the company's operations.

Against this background, the company has acknowledged the challenges and uncertainties of operating in a volatile economic environment, and the need for continuous assessment and adaptation to ensure the company's sustainability.

The Directors have outlined the steps they are taking to mitigate those risks and ensure the company's continued viability, including diversifying markets by expanding its regional and international markets and mobilising fresh equity capital.

"The Directors will continue to assess the impact of the volatile economic environment on the Company's operational and financial performance This will be mainly focused on continuous assessment of exchange rate volatility, its impact on suppliers, employees, lenders and other stakeholders as well as the impact of other micro and macro-economic indicators. The Directors are also looking at diversifying the markets for the Company's products.

"The Company's projections show that the Company has sufficient capital, liquidity and positive future performance outlook to continue meeting its short-term obligations and as a result it is appropriate to prepare these financial statements on a going concern basis even considering the impact of the local economic volatility. The projections have been prepared, covering its future performance, capital and liquidity for a period of 12 months from the sign off date.

"The Directors believe that under the current economic environment in Zimbabwe, a continuous assessment of such ability of the Company to continue to operate as a going concern will need to be performed to determine the continued appropriateness of the going concern assumption," the company stated in its abridged audited financial results for the year ended 30 September 2024

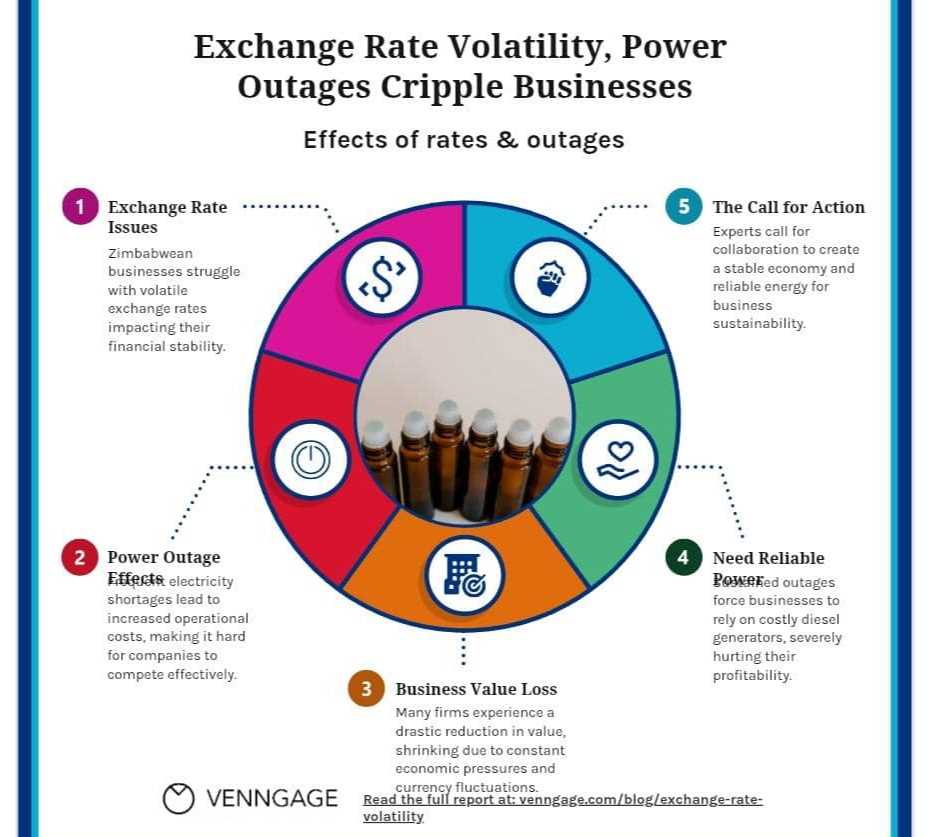

In an interview with ZimNow, renowned economist, Professor Gift Mugano has highlighted the devastating impact of exchange rate volatility on businesses in Zimbabwe. He noted that many companies have lost value and shrunk in size due to the constant fluctuations in the exchange rate. This has resulted in significant losses for formal businesses, particularly retailers, who are unable to recoup their costs due to the lower official exchange rate.

"Most companies now have lost value in terms of their size, in terms of their capital base, because of exchange rate volatility. Most companies have shrunk, so whenever the rate goes up, there's loss of value, from a number of angles.

"The first one is that you are aware that we have to exchange rate, and the official exchange rate is lower than the black market rate, so companies when they are pricing, or when they are trading, they use what is called replacement pricing, which helps them to restore the stocks, if they buy things for U$$10,000, after selling they must have at least US$10,000 and more, which include profit. So in many cases when the rates are lower, as you see, particularly the official rates, you see formal businesses experiencing exchange rate losses, and this hit harder, particularly on formal established businesses, your retailers in particular instance, because they will not be able to recoup their cost in terms of stock, they can't recoup the cost.

"That is why you see a number of big retailers have closed shops, like your Food World, that is why you are seeing that Choppies is exiting Zimbabwe, that is why you saw that retailers Association of Zimbabwe wrote a letter to Central Bank saying that if you do not address the exchange rate we are going to be closing, and that has not changed. It's still the same situation which we are in, and you are also aware that I think on the 27th of September, when the Central Bank devalued the exchange rate, companies lost almost half of their capital in a strike of a pen, and most companies have not recovered from that nightmare of exchange rate devaluation. So the exchange rate volatility has got a massive impact on business viability and sustainability.

"I have been talking to a number of companies which I consulted to, big companies, and they have told me that they have lost value in the last five years or so, their size, they have shrunk in a massive way, to an extent that their value is now 10% some of the companies telling me of what they were in the last five years ago, and one of the major drivers of this is the current crisis characterised by exchange rate volatility. So this is a menace affecting businesses and we are at a point where, as we are going forward, we will see more companies closing. Now this is happening at a time when the black market rate is working and the informal sector is growing and they are very competitive and they do not have similar challenges in terms of exchange rate losses."

"Now also a factor in companies which are exporting, which Central Bank takes 25% export retention, and they are giving that money at an official rate which is lower than the black market rate, which is kind of a true market rate. And again they are also making losses and some companies have stopped exporting and some are contemplating stopping exporting. So this is just to give you the picture of how the rate affects the viability of companies."

Related Stories

Mugano also emphasised the crippling effect of power outages on businesses. He cites the example of a company that used 3 million liters of diesel in a recent month, resulting in a massive bill of at least US$4.5 million. This has made it difficult for businesses to remain competitive, and many are struggling to stay afloat. The professor has stressed that the absence of reliable power supply is a serious threat to economic stability.

"Now, when it comes to power, electricity, it's a big thing. I have seen that in the news, a daily report is investing, I think, over $2 million in terms of solar in Shibinge, if I'm not mistaken, that money should have gone into other investment areas which are required by a daily report in particular, but looking at expanding the plant or even investing in a head of Ketro or supporting our grower schemes to drive raw materials. They are now investing in fixed infrastructure to save companies. I've seen that companies are also making losses on the back of power outages," Mugano stated.

"My analysis and my study have shown that the cost of diesel-powered generators is about $0.33 per kilowatt hour, which is almost more than two times the price of diesel if it is available. So it affects the competitiveness of companies if they are going to be using generators.

"I'm aware that Thickened Pay used over 3 million litres in the recent month, and that is a jump from 37,000 litres. Imagine moving from 37,000 litres per year to 3 million litres. 37,000 litres is just below $60,000 per year in terms of the bill for generators previous year.

"Now if they've used 3 million litres, how much have they used in terms of value? That's $4.5 million minimum just to power their shops. So how are they going to be competitive? Now factor in the situation where power is not there for 18 hours and you are supposed to be operating. How are you going to stay in business? So absence of enough power alone is a serious threat to economic stability.

"So this is where we stand as a country with real challenges. And unfortunately, if we cannot, as a country, attempt to carry the stability basically by powering the kind of production and having a master plan in terms of energy and coming up with various incentives to encourage use of solar energy without taxing the batteries and things like that, it's a tall order. Yeah, it's a tall order.

"But we are talking about the electricity and the exchange rate spikes. We are not talking abouttaxation that's been put by government, which is actually a kind of committing suicide on the businesses. We're not talking about what Zimra is doing, raiding companies, closing accounts, making everything difficult for anyone to breathe.

"So this is just something which is unbearable. It's happening at a time where the region is offering massive incentives for companies to invest in Zambia, Botswana, Namibia. So our companies are going to the region.

They are not waiting for this drama because we've been in this drama for the last 27 years. Remember, the currency crisis started on 14 November 1997. So we've just gone through 27 years of currency crisis and there's no direction from the government of Zimbabwe on how they're addressing this."

He added: "So how do we address it? It's a big issue. It needs a political approach. We need to collect our minds as Zimbabweans and work together as one team.

"We need to remove toxicity. We need to move in the same direction as a team. We need to have a national interview on how we address production.

"The issue is on production. But you can't go to an interview as one party. You need to join all the parties in Zimbabwe, civil society, political party, opposition, labour, academics, business, development partners, Team Zimbabwe."

Mugano noted the need for a collective approach to address the country's economic challenges. He suggested that Zimbabwe needed a national dialogue, involving all stakeholders, to come up with a plan to address production and economic growth. He cited examples of Malaysia and Zambia, which have successfully implemented national dialogues to drive economic growth and development.

According to Tanganda chairman, Hebert Nkala, the operating environment was characterised by exchange rate volatility, depreciation of the local currency, and upward inflationary pressures.

The introduction of the ZWG local currency in April 2024 was followed by a resurgence of exchange rate and inflationary pressures, leading to a 43% devaluation of the currency in September 2024.

The El Nino climatic phenomenon also had a significant impact on the agricultural sector, with the company's tea production affected by the late onset and uneven distribution of rainfall. However, production gradually improved over the course of the year, with 8,113 tonnes produced, representing a 3% increase over the previous year.

The company's revenue for the year grew by 9% to US$25.7 million, primarily due to an increase in avocado export volumes and the recovery of their selling prices as Covid-19 pandemic restrictions y The company achieved a profit after tax of US$1.4 million, compared to a loss of US$3.1 million in the previous year.

Leave Comments