Audrey Galawu

Assistant Editor

In a year marked by economic turbulence, OK Group has proven its resilience, reporting impressive growth in both sales volumes and revenue for the period ending 30 September 2024.

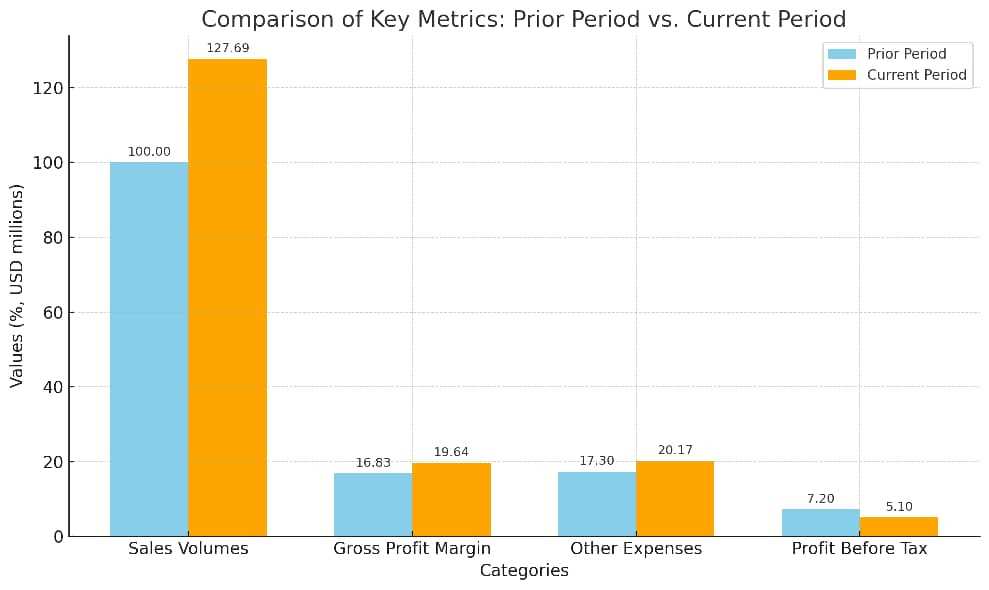

Despite facing significant operational hurdles such as power outages, liquidity challenges, and a volatile exchange rate environment, the retail giant has managed to achieve a remarkable 27.69% increase in sales volumes compared to the same period in the previous year.

This surge in sales can be attributed to several key factors, including the successful OK Grand Challenge promotion, which brought in new business and saw the inclusion of OK Mart stores for the first time. This expansion contributed significantly to bulk sales, driving up overall sales performance.

The company’s gross profit margin also showed a positive trend, rising from 16.83% to 19.64%, representing better cost control and efficiency in operations.

Despite these positive results, the company faced challenges that impacted profitability. Although revenue grew, profit before tax saw a 30% decline, dropping from US$7.2 million to US$5.1 million. This decline can be attributed to factors like increased depreciation and amortization costs, which rose significantly due to inflation adjustments and remeasurement of right-of-use assets.

Related Stories

Additionally, the prior period had benefitted from net monetary gains of US$2.6 million, which were not repeated in the current period, further distorting comparisons.

However, it wasn’t all negative. Profit for the year showed a modest 5% increase, thanks to strong revenue performance and a turnaround in the company’s net exchange position. Exchange gains were realized as the ZWG was devalued, bringing the exchange rate closer to market realities. The company also made notable strides in improving its working capital, with the current ratio improving from 0.98 to 1.1, signalling a healthier financial position.

The year’s performance is also underscored by an evolving economic environment. The introduction of the Zimbabwe Gold initially brought some measure of stability, lowering inflation and easing exchange rate pressures. However, the country’s ongoing foreign currency shortages continued to strain the formal banking sector, leading to increased reliance on USD settlements.

This environment of currency instability prompted the company to review its functional currency, with the directors concluding that USD should be adopted as the functional currency as of 1 April 2024.

Despite these currency challenges, OK’s strategic focus on diversification and sustainability continues to bear fruit. The company remains committed to its sustainability goals, including minimizing carbon emissions, managing resources, and reducing waste.

The group is also closely monitoring developments in international financial reporting standards (IFRS), ensuring compliance with emerging regulations on sustainability-related financial disclosures.

However, a significant shift in leadership also marked this period. Herbert Nkala, the Chairman of OK Group, announced his decision to step down after a long tenure of guiding the company through some of its most challenging years. Nkala’s leadership has been instrumental in steering the company through economic fluctuations and evolving market conditions. Under his leadership, OK not only weathered the storms of Zimbabwe’s economic crises but also found ways to thrive amidst adversity.

Leave Comments