Nyashadzashe Ndoro

Chief Reporter

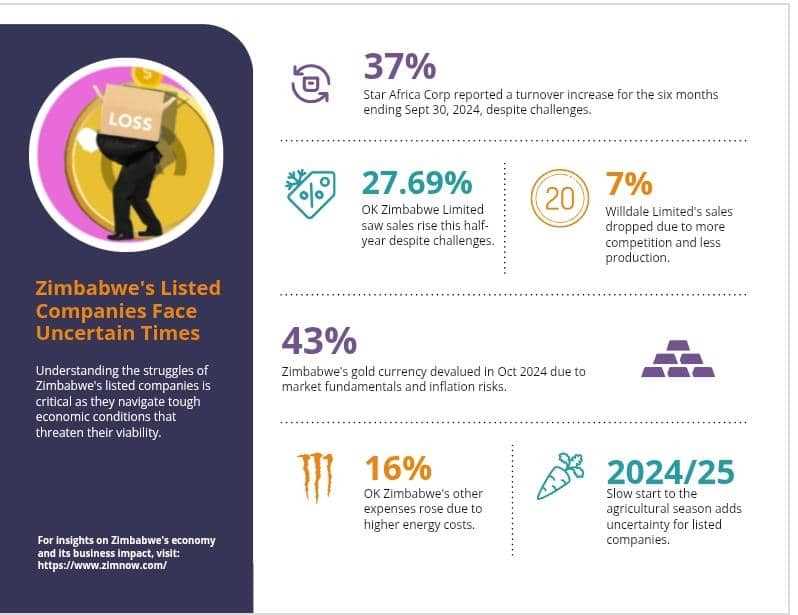

The Zimbabwean economy's ongoing struggles are taking a toll on the country's listed companies, with recent financial updates highlighting the significant challenges they must overcome to remain viable.

ZimNow analysed the latest reports from the Zimbabwe Stock Exchange listed giants, Star Africa Corporation, Willdale Limited, and OK Zimbabwe Limited.

Despite efforts to adapt to the turbulent environment, these companies are grappling with issues ranging from exchange rate volatility and power outages to liquidity constraints and policy uncertainty.

Star Africa Corporation, a leading sugar producer, reported a 37% increase in turnover for the six months ended September 30, 2024. However, the company's chairman, Dr. Rungano Mbire cautioned that the operating environment remains uncertain, with high inflation, exchange rate volatility, and power supply constraints threatening to undermine growth.

"The operating environment remains uncertain, with recurring challenges, such as exchange rate volatility, a slow start to the 2024/25 agricultural season, power supply constraints, limited access to affordable banking facilities, Government policies aimed at curbing the rate of inflation and subdued economic growth," the chairman said.

Willdale Limited, a brick manufacturing company, also faced significant challenges, including a 7% decline in sales volumes due to reduced production and increased competition.

Related Stories

"The operating environment was characterized by low liquidity, moderate inflation, and high levels of competition. The introduction of the Zig (ZWG) in April 2024 to replace the Zimbabwe dollar brought some stability to inflation.

"The ZWG was, however, devalued by about 43% in October 2024 to align it with market fundamentals. Limited government expenditure on capital projects impacted on revenue in the fourth quarter. Sales were also affected by unfair business practices by some competitors who were not charging VAT on bricks as required by the tax laws," the company said.

Chairman Cleopas Makoni noted that the company is exploring ways to improve production efficiency and reduce costs in response to the tough operating environment.

OK Zimbabwe Limited, a retail giant, reported a 27.69% increase in sales volumes for the half-year ended September 30, 2024. However, the company's chairman, Herbert Nkala, warned that power outages, liquidity challenges, and policy uncertainty continue to pose significant risks to the business.

"Despite the challenges in the trading environment during the half year period, the Group realised growth in both sales volumes and revenues. Sales volumes went up by 27.69% as compared to the prior period. while the gross profit margin improved from 16.83% in the prior period to 19.64% in the current period.

"The growth in volume was bolstered by a successful OK Grand Challenge promotion which included the OK Mart stores for the first time which resulted in growth in the contribution of bulk sales compared to prior period. Other expenses went up by 16,29% from USD17,3 million in the prior period to USD20,17 million in the current period largely due to the increased cost of energy supply which went up from USD5 million in prior year to USD8,2 million.

"The cost of electricity was driven by increased tariffs while power outages resulted in increased dependence on back-up power, compounding. the effects of the increased cost of utilities in the current period," Nkala stated.

Meanwhile, a common thread running through these reports is the impact of Zimbabwe's economic instability on listed companies.

The country's currency, the Zimbabwe Gold, which was introduced on the 5th of April last year, has been subject to significant fluctuations, while power outages and liquidity constraints have become endemic.

Leave Comments