Audrey Galawu- Assistant Editor

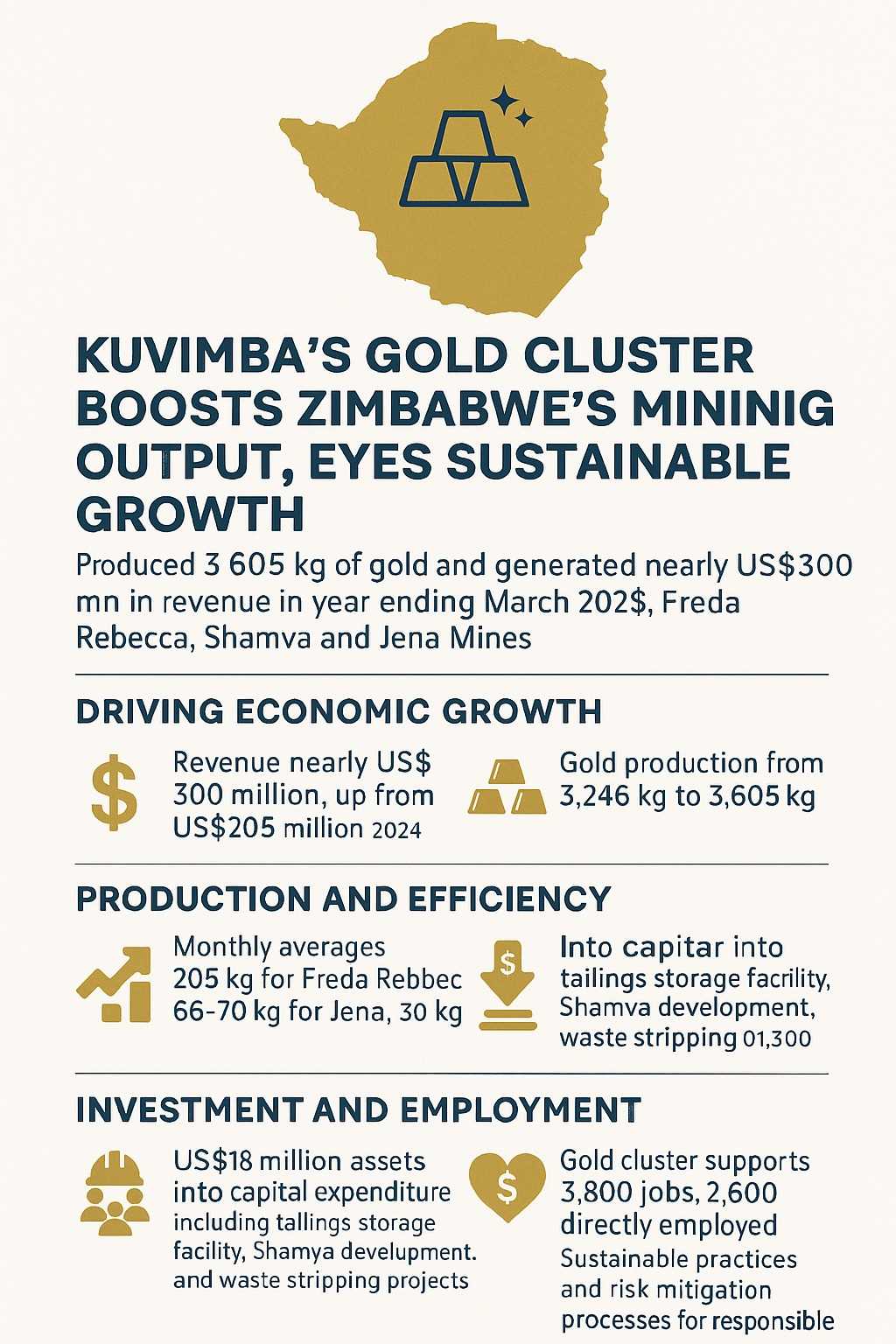

Kuvimba Mining House’s gold cluster—comprising Freda Rebecca, Shamva, and Jena mines—has emerged as a key economic contributor, producing 3,605 kilograms of gold in the financial year ending March 2025 and generating nearly US$300 million in revenue.

More than just a financial milestone, the achievement underscores the cluster’s growing role in employment, capital investment, and long-term sustainability within Zimbabwe’s mining sector.

The cluster’s performance marks a steady year-on-year growth, up from 3,246kg in 2024, driven by improved operational efficiency and favorable global gold prices. Revenue surged from US$205 million to nearly US$300 million, reinforcing KMH’s position as a vital pillar of Zimbabwe’s extractive industry.

Patrick Maseva-Shayawabaya, Head of KMH’s gold cluster, attributed the success to the miner’s hybrid operating model, robust partnerships, and an uptick in gold prices over the year.

“We are pleased with the results given the numerous challenges faced. This reflects the collective effort of our teams, partners, and leadership,” he said during a results presentation on Wednesday.

Monthly averages reveal the output distribution: Freda Rebecca contributed 205kg, Shamva 65–70kg, and Jena 30kg, combining to maintain a monthly average of 300kg.

Despite a 6% increase in cash costs, the cost per ounce of gold fell to US$1,421 from US$1,490, with further reduction targeted in the current financial year to US$1,300—a move that could improve margins if gold prices remain strong.

Related Stories

A significant portion of KMH’s earnings—US$18 million—was reinvested into capital expenditure, highlighting the company’s focus on sustainability and risk management. One such investment, the tailings storage facility, identified as a critical risk in previous years, is now nearing completion and is expected to be operational by end-June 2025.

Additional spending included: US$1.7 million for Shamva’s capital development and waste stripping, and US$500,000 for Jena’s limited but essential infrastructure needs.

These investments not only support productivity but also signal KMH’s intent to balance profit with responsible resource management.

Beyond gold output, KMH’s gold cluster plays a substantial role in employment. The three operations directly support 2,600 jobs, while an additional 1,200 subcontracted workers bring the total to 3,800 livelihoods tied to KMH operations.

However, only 6% of the directly employed workforce are women, revealing an ongoing gender gap in mining employment—a point that could become a focal area for inclusion and empowerment efforts going forward.

KMH’s gold cluster is not only fuelling revenue growth and mining output—it’s positioning itself as a cornerstone in Zimbabwe’s broader economic and industrial strategy.

As infrastructure is strengthened and cost efficiencies improve, the company appears set to consolidate gains while facing down long-term risks and pushing for more inclusive participation in mining.

With global gold prices remaining buoyant, KMH’s ability to sustain and expand its impact will depend on continued investment, operational resilience, and how well it navigates the social and environmental dimensions of large-scale mining.

Leave Comments