Nyashadzashe Ndoro – Chief Reporter

The ripple effects of post-election civil unrest across the Southern African Development Community region are now being acutely felt as far as the United States, with significant disruptions to vital sugar shipments.

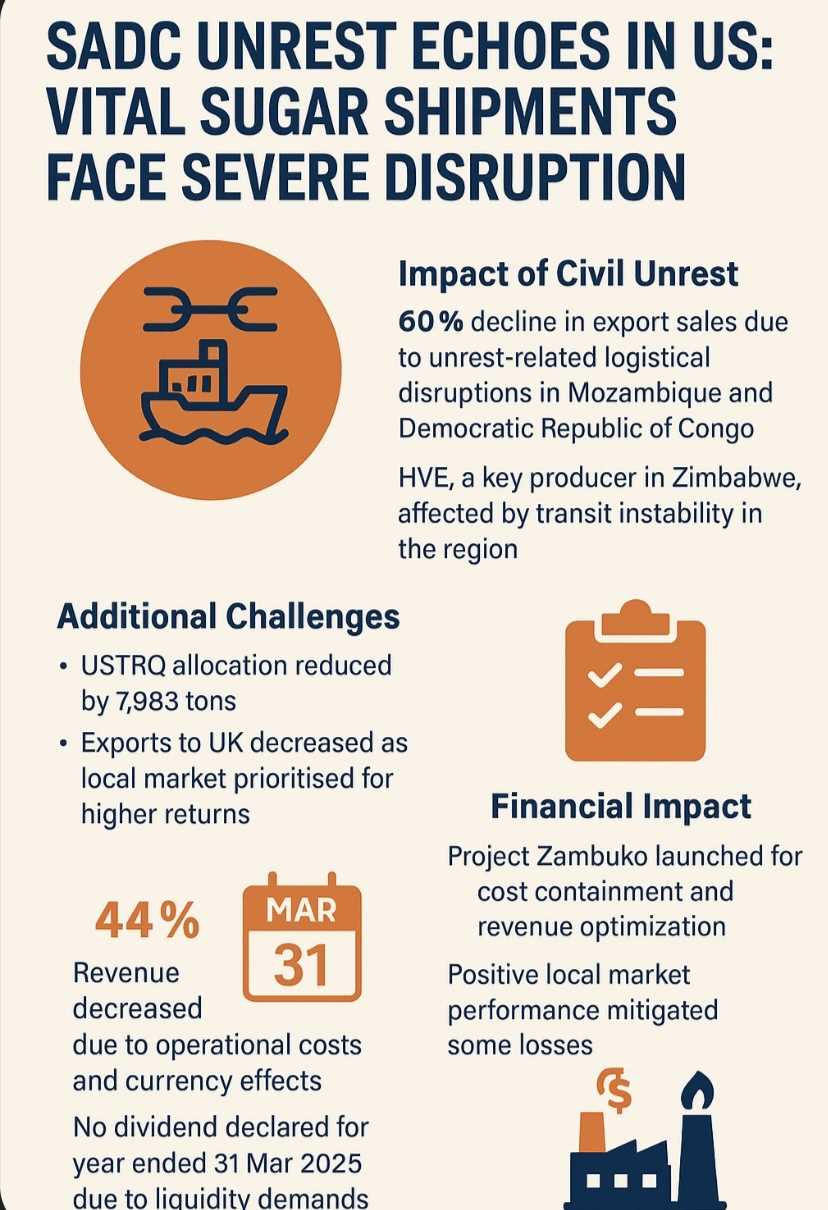

Zimbabwe’s Hippo Valley Estates Limited, a key regional producer, has reported a drastic 60% decline in its export sales—a plunge directly linked to logistical nightmares and instability in transit nations like Mozambique and the Democratic Republic of Congo.

The situation underscores how regional turmoil can jeopardise international supply chains and impact consumers thousands of miles away.

“This was largely due to delays in fulfilling export orders following post-election civil unrest and associated logistical disruptions in Mozambique and the Democratic Republic of Congo,” the Zimbabwe Stock Exchange-listed sugar producer noted in its abridged annual financial results for the year ended 31 March 2025.

The company’s industry export sales, in which it accounted for 49.8% during the current reporting period (down from 52.5% in 2024), saw a substantial 60% decline compared to the prior year.

Civil unrest in Mozambique—a key transit route for Zimbabwean exports—led to delays in fulfilling export orders. These disruptions, coupled with similar issues in the Democratic Republic of Congo, severely hampered Hippo Valley’s ability to move its products to international markets.

Beyond regional instability, Hippo Valley’s export challenges were compounded by other factors. The company experienced a reduction in its United States Tariff-Rate Quota (USTRQ) allocation by 7,983 tons.

Furthermore, exports to the United Kingdom declined as the company strategically prioritised the local market. This decision was driven by the stronger returns offered by the Zimbabwean market, compared to currently depressed global sugar prices.

Despite a robust operational recovery and an increased local market share for its Huletts sugar brand, the elevated cost of doing business continued to erode profit margins. The company cited high cane and manpower costs as primary contributors. While overall industry sales volumes declined by only 3%, Hippo Valley’s revenue dropped by 44%.

The company clarified that this variance was primarily due to distortions in the prior year’s reported revenue, which was inflated by inflationary adjustments and currency effects under IAS 29 before translation into US dollars.

Hippo Valley’s shift in functional and presentation currency to the US dollar at the beginning of the current financial year also affected its financial reporting. The company did not apply the provisions of IAS 29: Financial Reporting in Hyperinflationary Economies, and its comparative financial statements—previously reported in Zimbabwe Dollars (ZWL) under IAS 29—were restated and presented in US dollars. This change in accounting methodology led to a “different logic” in the current financial results compared to management’s “best estimate” of the prior year, which was accounted for without hyperinflation indices.

Related Stories

The company’s adjusted EBITDA, excluding non-cash movements, increased significantly to US$13.7 million, up from a negative US$19.5 million the previous year. However, the full benefit of increased sales volumes was not realised due to the high proportion of goods and services priced in US dollars, expensive cane purchases from private farmers (US$71 per ton, equivalent to US$575 per ton of sugar—exceeding export market revenue), and a minimum wage of US$280 per month, which is significantly higher than comparable rates in the agricultural sector.

In response to persistent cost pressures, Hippo Valley has launched “Project Zambuko,” a margin improvement initiative focused on cost containment and revenue optimisation. This includes an employee rationalisation process, with the first phase of retrenchments initiated in February 2025.

The company’s operating cash flows—after interest, tax, and working capital changes—increased significantly, improving by US$10.7 million to US$8.7 million. This was largely driven by gains from recovering local market share, which offers stronger margins than export markets.

However, the shift in private farmers’ cane supply from the Cane Milling Agreement—where payments are made upon sugar sales—to the Cane Purchase Agreement, which requires payment upon cane delivery, has created a timing mismatch that continues to strain the company’s liquidity. This change has significantly increased peak funding requirements, and the company’s borrowing facilities have yet to be adjusted to reflect this.

Due to ongoing liquidity demands associated with the CPA, elevated cost pressures, and broader macroeconomic uncertainty, the Directors have resolved not to declare a dividend for the year ended 31 March 2025. This decision prioritises financial stability and will be reviewed once the funding structure and cash flow generation are better aligned with operational requirements.

Despite the challenges, Hippo Valley remains focused on its strategic growth plans, aiming to increase sugar production, expand its revenue portfolio, contain costs, and generate positive cash flows.

The company anticipates stable sugar availability in the local market for the coming season and does not expect a recurrence of sugar import pressures in the short term. Efforts are also underway to address long-term challenges such as water availability and electricity supply interruptions through investments in alternative energy solutions like solar power.

In an important development concerning its corporate structure, Hippo Valley Estates Limited has also provided an update on the ongoing business rescue proceedings of its parent company, Tongaat Hulett South Africa.

While the South African entity continues to finalise an equity subscription with Vision Partners, Hippo Valley Estates has clarified that its own sugar operations are not financially distressed and are not, nor will they be, subject to business rescue.

The company has emphasised its strong financial position and assured stakeholders that it will continue trading normally, with minimal exposure to the South African developments due to being in a net owing position on intercompany transactions.

Further reinforcing its independence and stability, Hippo Valley Estates highlighted recent updates concerning the sale of Tongaat Hulett Limited’s shares in Triangle Sugar Corporation (Hippo Valley’s majority shareholder) to Vision Sugar Holdings (Mauritius). Additionally, Vision Investments 155 (Pty) Ltd has fully settled its outstanding debt to the Lender Group, positioning Vision as the sole lender to Tongaat Hulett Limited.

Leave Comments