Oscar J. Jeke, Zim Now Reporter

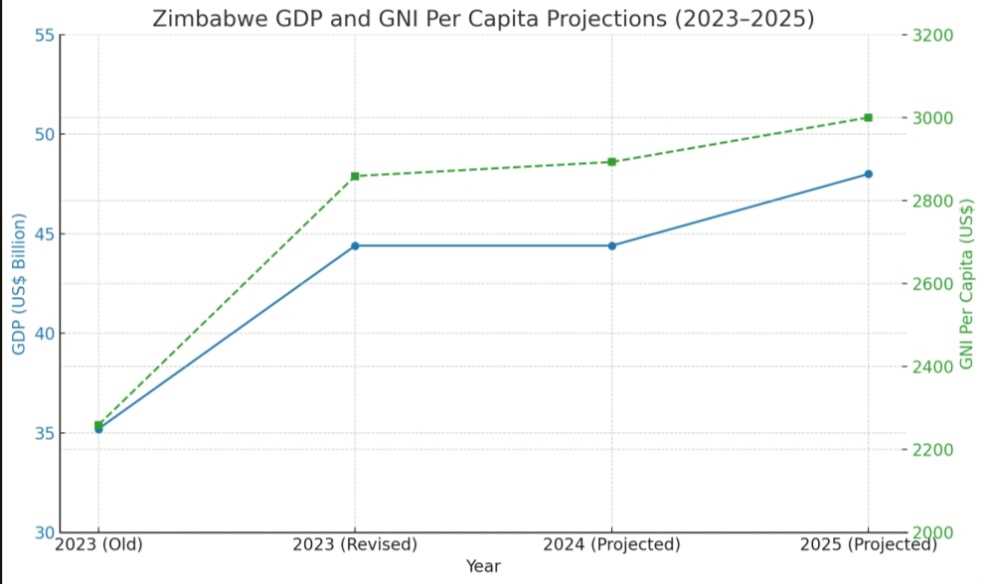

Zimbabwe’s economy is now officially valued at US$44.4 billion, a sharp upward revision from the previous US$35.2 billion, according to the Zimbabwe National Statistics Agency.

The 26% increase follows an extensive Economic Census conducted throughout 2024 and early 2025, which incorporated more comprehensive data on both formal and informal enterprises.

The revised GDP is based on an economic baseline last updated in 2019. The new estimate—amounting to ZWL$168.5 trillion—reflects the emergence of new economic players and improved sectoral coverage, including micro-enterprises, wholesale and retail trade, and informal services.

The Minister of Finance, Economic Development, and Investment Promotion says the recalculation is not just a statistical formality but a realignment with global best practices and a recognition of previously unmeasured economic activity.

He added that the revision follows an economic census that captured “a larger number of business entities that have emerged since 2019.”

Zimbabwe’s Gross National Income (GNI) per capita also rose to US$2,859 in 2023, up from US$2,259. It is projected to reach US$2,893 in 2024, with estimates exceeding the US$3,000 threshold by 2025. These figures signal tangible progress toward the country’s goal of achieving upper-middle-income status.

The African Development Bank (AfDB), in its 2024 economic outlook, reported that real GDP growth slowed from 6.1% in 2022 to 5.0% in 2023, mainly due to drought and high fuel import costs. A more modest 2.0% GDP growth is projected for 2024, largely due to El Niño-related agricultural setbacks.

Related Stories

Still, the AfDB noted that Zimbabwe’s services sector remains dominant, contributing 55% to GDP in 2023, with positive current account and fiscal deficit ratios of 1.3% and 2.0% of GDP, respectively.

A June 2025 IMF Article IV mission confirmed that GDP growth is expected to reach 6% in 2025, spurred by “better climate conditions and historically high gold prices,” especially benefiting agriculture and mining.

Mission Chief Wojciech Maliszewski stated that “the economy has shown signs of resilience, aided by strong mineral exports and stabilizing reforms.”

However, the Fund warned of fiscal imbalances. The Treasury’s increasing reliance on central bank financing and Treasury Bills has placed pressure on the newly introduced Zimbabwe Gold (ZiG) currency. This led to a depreciation of the ZiG in late 2024 and a renewed surge in inflation.

Parallel market exchange rate premiums remain wide, estimated at over 20%, eroding public confidence in the currency, despite authorities' intentions to transition to a mono-currency regime by 2030. The IMF has urged the government to "clarify and communicate the operational framework for the ZiG, ensure transparency, and reduce quasi-fiscal spending.”

The World Bank, in its 2024 Zimbabwe Economic Update, acknowledged the improved statistical practices and the importance of revising GDP upwards to include previously excluded sectors. However, it emphasized that “better statistics do not automatically translate into improved livelihoods.”

The Bank revised Zimbabwe’s real GDP growth forecast for 2024 down to 3.5%, from 5.5%, citing El Niño-induced drought that slashed agricultural output and worsened food insecurity.

Crucially, public and publicly guaranteed debt remains at 87% of GDP, with over

Leave Comments