Cabora Bassa Factfile

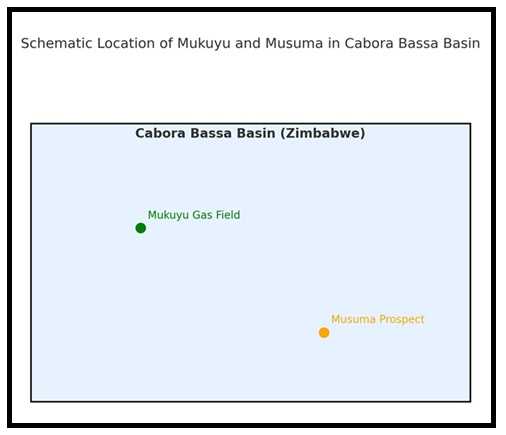

- Location: Northern Zimbabwe, near Mozambique border

- Size: 360,000 hectares across 3 licence blocks

- Discoveries: Mukuyu (2023) + multiple prospects

- Current target: Musuma-1 well, H2 2025 spud

- Potential impact: Local energy supply, regional exports, investment inflow

·

ZimNow Business Desk

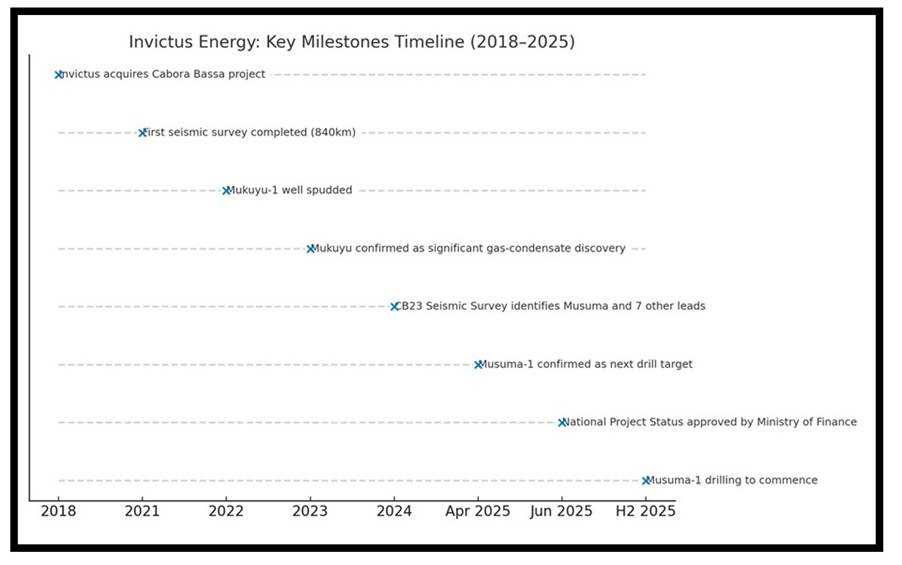

Australian-listed Invictus Energy is preparing to drill a high-impact exploration well, Musuma-1, in Zimbabwe’s Cabora Bassa Basin—marking the company’s boldest step yet beyond its proven Mukuyu gas-condensate discovery. Backed by promising seismic data and now designated for National Project Status by the Zimbabwean government, the venture signals more than a shift in drilling—it could be a pivotal moment for Zimbabwe’s energy independence and investor rebrand.

Musuma-1: A new chapter outside Mukuyu

Musuma-1 is the first well to be drilled outside the Mukuyu discovery area and targets a new geological “play type” within the basin. Seismic data indicates strong Direct Hydrocarbon Indicators (DHIs)—notably “flat spots” typically associated with gas-water contacts.

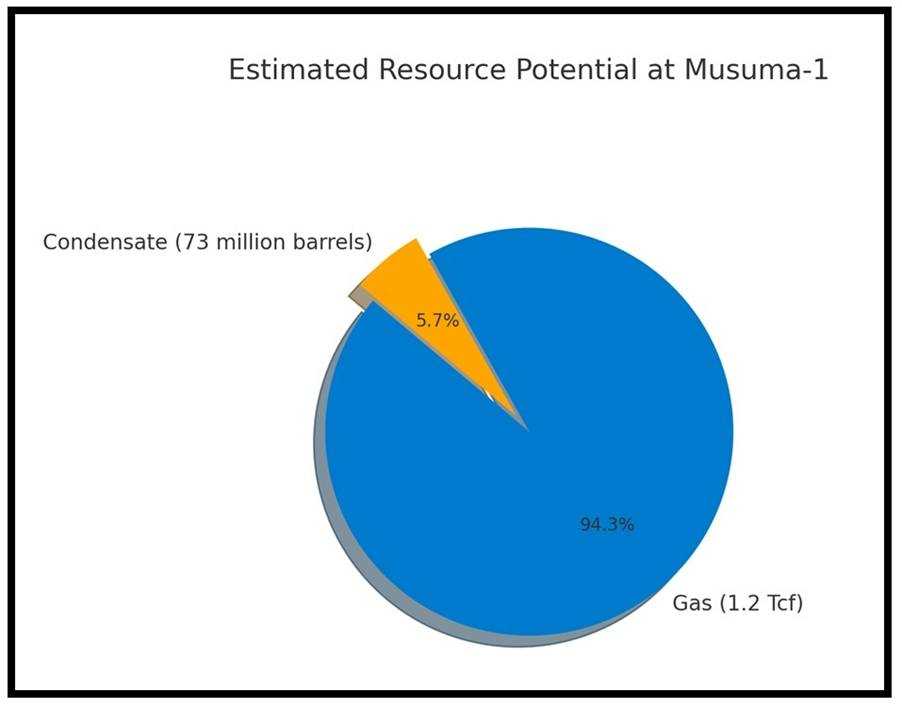

The well aims to tap into an estimated 1.2 trillion cubic feet (Tcf) of gas and 73 million barrels of condensate, offering a potential energy resource that rivals many in the region. With a planned depth of just 1,500 meters, it is also designed as a low-cost, low-risk vertical well, increasing its commercial viability.

If successful, Musuma-1 could open up a broader resource base in the basin and accelerate the company’s transition from explorer to developer.

“A discovery at Musuma would be transformational,” Invictus noted in its Q2 report. “It could fast-track development initiatives such as the pilot gas-to-power project at the Eureka Gold Mine.”

What National Project status really means

In June, Zimbabwe’s Ministry of Finance identified the Cabora Bassa Project for National Project Status (NPS)—a significant recognition that brings both symbolic and material benefits. Once formalized, the NPS will unlock a suite of incentives, including

- Duty exemptions on capital equipment,

- Expedited permitting, and

- Priority access to infrastructure and utilities.

For Invictus, this represents a smoother operational runway. For Zimbabwe, it’s a step toward creating an enabling environment for responsible resource development.

Related Stories

At a time when policy consistency is under the spotlight, the government’s backing could also help reduce the “country risk” perception that often deters major energy investors.

Investor momentum: strategic partner talks in progress

Behind the scenes, Invictus is actively negotiating with prospective farm-in and strategic partners. These include established oil and gas operators and institutional investors, many of whom the company engaged during the Africa Energies Summit in London.

The goal? To bring on board technical and financial firepower to commercialize both existing and future finds.

While no agreements have been finalized this quarter, the momentum points to a strategy that not only de-risks the venture but also places Zimbabwe on the radar of international energy markets.

A glimpse at the bigger picture: Local power, regional relevance

A successful Musuma campaign could help Zimbabwe leap from energy deficit to energy exporter—if paired with the right infrastructure. Invictus has long discussed ambitions to:

- Power local mines and industries via gas-to-power projects.

- Develop compressed natural gas (CNG) for domestic use, and

- Potentially export surplus energy or liquefied gas to regional neighbors.

The pilot gas-to-power plant planned at Eureka Mine would serve as a proof of concept for wider energy rollouts.

Zimbabwe’s energy moment?

Since acquiring the Cabora Bassa acreage in 2018, Invictus has invested heavily, acquiring over 1,400 km of seismic data and drilling two wildcat wells. Mukuyu, discovered in 2023, remains one of the largest untapped conventional gas finds onshore in Africa. Musuma now raises the stakes.

In a nation struggling with power cuts, energy imports, and underutilized industrial capacity, the development of local gas resources could be transformative. But it also depends on broader government readiness—across infrastructure, regulation, and energy policy.

Between promise and proof

Invictus has positioned itself as a first mover in one of Africa’s most underexplored basins. With the drill bit turning soon at Musuma and government support firming up, Zimbabwe may be edging closer to its long-promised energy breakthrough.

Political willpower is crucial not only to ensure that a fully-fledged energy industry develops, but also to engender sustained investor confidence as other players look to become part of Zimbabwe’s economic development story.

Leave Comments