Zim Now Writer

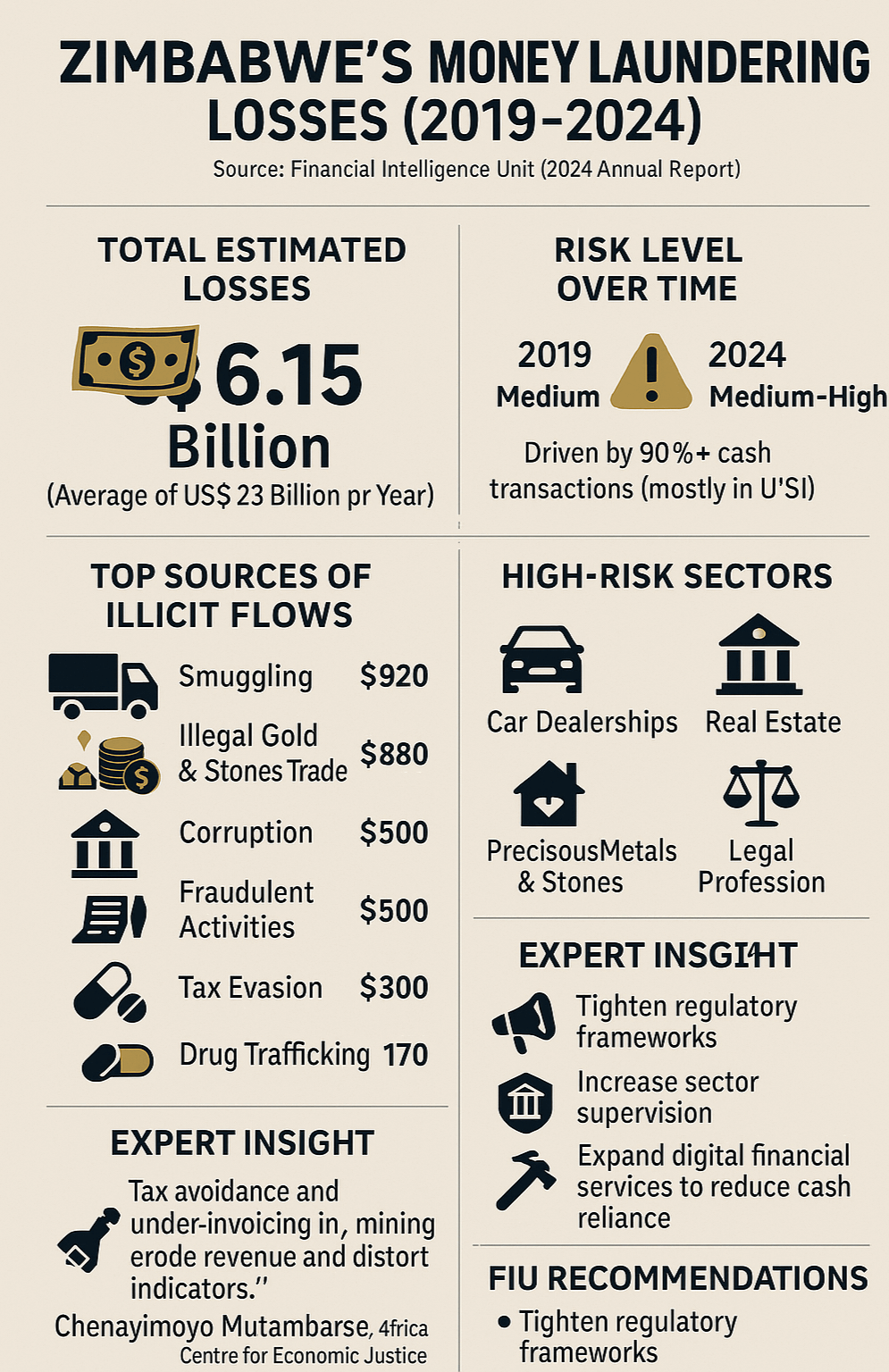

Zimbabwe has been hemorrhaging, more than a billion US dollars annually to money laundering activities, with the Financial Intelligence Unit estimating total losses of US$6.15 billion over the past five years.

The illicit financial flows—driven by gold smuggling, corruption, and shadowy cash transactions in sectors such as car dealerships—are undermining the economy and exposing regulatory weaknesses.

In its 2024 annual report, the FIU revealed that money laundering-related crimes are costing the country an average of US$1.23 billion each year, amounting to roughly 3.4% of Zimbabwe’s gross domestic product.

The report warns that if left unchecked, these flows will continue to weaken the already strained financial system.

The FIU identified six major sources fueling illicit money circulation: smuggling (US$920 million), illegal trade in gold and precious stones (US$880 million), entrenched corruption (US$730 million), fraudulent activities (US$500 million), tax evasion (US$300 million), and drug trafficking (US$170 million).

Zimbabwe's exposure to money laundering risks has worsened over the past five years, with the FIU raising the country’s vulnerability status from “medium” in 2019 to “medium-high” by 2024. A key contributor is the country’s overwhelmingly informal and cash-heavy economy, where over 90% of financial transactions are conducted in cash—mostly in US dollars—making them difficult to trace.

Related Stories

One of the most problematic sectors flagged by the FIU is the motor vehicle dealership industry. “The car dealers sector was identified as the most vulnerable, with a high risk primarily due to its cash-intensive nature and lack of regulatory oversight,” the report stated. Car sales are often conducted using large volumes of physical cash, with minimal documentation or financial reporting.

Other high-risk sectors include real estate, precious metals and stones trading, and the legal profession. While the banking industry was rated as moderately vulnerable, the FIU commended its adherence to compliance frameworks and the professionalism of its staff.

By contrast, the insurance and securities industries were considered low-risk, although concerns remain regarding newer financial instruments—particularly those traded on the Victoria Falls Stock Exchange.

The report calls for stronger regulatory frameworks, tighter supervision of high-risk sectors, and broader adoption of digital financial services to reduce the country’s dependency on cash and improve accountability.

Development economist Chenayimoyo Mutambasere, from the Africa Centre for Economic Justice, warned that illicit flows are draining the country of resources that could be used for development. “Tax avoidance and under-invoicing in critical sectors like mining significantly erode Zimbabwe’s revenue base and distort key macroeconomic indicators,” she said.

She also highlighted the exploitation of exchange rate fluctuations and unregulated accounting practices that mask the true financial positions of some corporations. “Curbing illicit flows must be at the heart of Zimbabwe’s long-term economic planning,” she added.

The FIU has urged policymakers to act swiftly in strengthening enforcement and closing regulatory loopholes, warning that failure to do so will only deepen Zimbabwe’s vulnerability to illicit financial crimes.

Leave Comments