4475 Mosi-oa-Tunya coins sold in 2 weeks

Black market top buyer rate falls 220 points from a high of 990 in July to 800

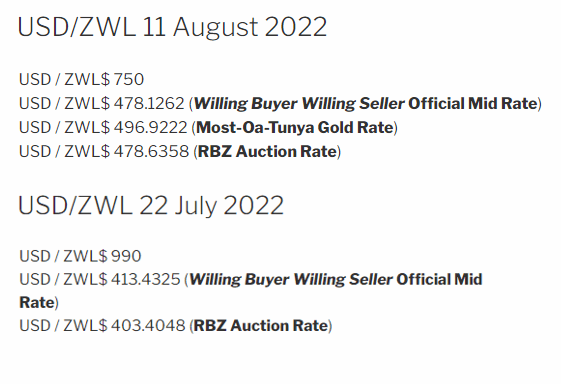

Auction rate rises 75 points to 479

Sharp ZWL price hikes curtailed

Smaller coins to hit market in November

The Reserve Bank of Zimbabwe is momentarily winning the war against inflation and the devaluation of the local currency after introducing gold coins is a value preservation alternative end of July.

Economist Brian Sedze predicts that convergence of rates is imminent with the local currency gaining traction as preferred medium of exchange. “In Harare there is shortage of cash, Ecocash and bank balances. This should depress the exchange rate and likely to find convergence of the three exchange markets…. ZWL increasingly is becoming a preferred transaction currency for the masses,” Sedze said.

The United States dollar has fallen marginally on the black market while rising on the official auction system, bringing the divergent rates closer to parity and arresting inflation.

The first 1500 gold coins were snapped up quickly, mopping up an excess of ZWL 1 billion off the market. The RBZ immediately announced that 2000 more coins would be availed to the market.

A total of 4475 coins has been sold with 90 percent of them being paid for in the local currency, so starving the parallel market of ZWL and forcing a halt to the speculative runaway devaluation.

Prior to gold coin introduction, corporates with large ZWL balances could only preserve value by investing on the stock exchange or buying forex on the black market.

Bringing in ordinary citizens

Following complaints that ordinary citizens are shut out due to the high price of the gold coins, RBZ is set to introduce smaller gold coin denominations worth around USD200 in November.

“At the current price of about US$1 800, the coin is inaccessible to the wider majority of citizens,” Zimcodd said in its weekend reader released last Friday.

“As such, it is pertinent that a cheaper option is availed for those who seek to hedge their savings against inflation, but are unable to afford the current cost,” said Zimbabwe Coalition on Debt and Development (Zimcodd) in a statement recently.

In countries that have gold coin systems like the US, UK, Australia, Canada and South Africa, gold coins are not mainstream saving channels but the preserve of investors and collectors, even when smaller denomination currencies are available.

But in Zimbabwe opening up access to the gold coins will improve confidence in the system as it negates the allegations that this is an elitist looting scam.

A golden chance to formalise more MSMEs?

Zimbabwe has a vibrant economy over which the RBZ seems to have no control. Some estimates put the figure at USD 7 billion. The African Journal of Social Work estimates that 90 percent of Zimbabwe’s labour force is in the informal sector.

Previous efforts to get such operations registered and formalised have failed. This means that the Government is missing out on individual and business taxes on a potentially large scale. Regulation of the economy by RBZ and other authorities is limited because of the high level of activity outside their control.

Compliance by this sector would greatly widen the tax base leading to improved social services and an economy that is generally easier to regulate.

With the stringent KYC requirements for buying gold coins, the authorities could use this opportunity to encourage more businesses to register. Formalising businesses could get a tax break in addition to access to the forex auction and gold coins, among other incentives.

How are the gold coins benefitting ordinary Zimbabweans?

Disparate rates and loss of value through hyperinflation had become the biggest enemies of the Zimbabwean dollar.

“It is difficult to work with a currency whose value is unknown. You could get ZWL 300 cash from one person as the equivalent of 50 US cents. But the next person would tell you that they want ZWL 400 for the same amount.

Exploitative behaviour by some retailers was also worsening the situation. A number of shops would use the black market rate if a customer was paying but give change at the official rate.

Some locally produced products were now priced exclusively in USD are now once again be accessible in the local currency.

Legally compliant retailers that were losing business to rate distortions as their USD prices became almost double those of the black market operators can now become more competitive again.

All this ensures a stable economy and ease of doing business that benefits everyone, especially ordinary Zimbabweans with no access to the gold coins.

Leave Comments