Zim Now Writer

Government has introduced a a 2% sugar levy on beverages. The comes as the World Health Organisation has called on countries to impose the sugar tax in order to curb obesity and other lifestyle diseases.

“Taxes on sugar-sweetened beverages can be a powerful tool to promote health because they save lives and prevent disease, while advancing health equity and mobilizing revenue for countries that could be used to realize universal health coverage,” said Dr Ruediger Krech, Director of Health Promotion at WHO.

The tax is likely to increase the cost of beverages thereby reducing consumption.

Delta and Varun, the biggest beverage manufacturers in the country have been embroiled in price wars as they both push volumes. The sugar tax is likely to impact on their production figures.

In other highlights of the budget, government has introduced a US$300 cushion, pensionable for civil servants in a budget statement that also announced the introduction of a wealth fund and upward review of toll fees on premium roads.

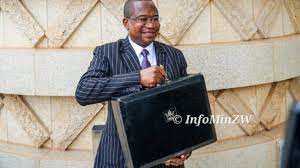

Presenting the 2024 National Budget today at the Mt Hampden Parliament Building, Finance, Economic Development and Investment Promotion Minister, Professor Mthuli Ncube said revenue raised will be ring-fenced to fund specific social services as well as road repairs.

The Finance, Economic Development and Investment Promotion Minister also allocated the Ministry of Primary and Secondary Education ZWL$8 trillion with the said the funding goes towards ensuring the safety of learners and sanitary wear, especially for marginalised students.

“Therefore, the 2024 National Budget prioritises provision of quality and easy access to education and other learning opportunities for children which are central to the attainment of SDG 4.85.

“In this regard, ZWL$8 trillion has been set aside for the Ministry of Primary and Secondary Education for teaching and learning materials, as well as teacher capacitation at primary and secondary education level,” Professor Ncube said.

Last year, the Ministry received ZWL$631.3 billion.

Mr Speaker Sir, the security forces play an important role of protecting the country’s territorial integrity, national interest and sovereignty over land and air space, against both internal and external aggression.

“Peace is key to economic development”.

Related Stories

Treasury has assigned ZWL$8.6 trillion to the Ministry of Defence, Home Affairs and Cultural Heritage to meet their remuneration, food rations, operational equipment and the necessary infrastructure compared to the ZWL$331.1 billion received for 2023.

The Ministry of Health and Child Care was allocated ZWL$6.3 trillion which is an upgrade from the 2023 budget whereby the treasury had allocated ZWL$473.8 billion for the Ministry.

Professor Ncube said the funding seeks to consolidate recovery of public health sector services, across all levels of health care, through provision of the requisite tools of trade such as adequate working space, manpower, drugs and medical supplies across the value chain.

Ministry of Lands, Agriculture, Fisheries, Water and Rural Development was assigned ZWL$4.3 trillion to spearhead the implementation of Agriculture and Food Systems Transformation Strategy.

The Transport Ministry was allocated ZWL$1.2 trillion which Ncube said will be channelled towards improvements in the transport systems remain critical given the need to enhance connectivity and access, including promotion of regional and international trade.

“In this regard, ZWL$1.2 trillion has been allocated to the Ministry of Transport and Infrastructural Development to facilitate the rehabilitation and construction of transport infrastructure such as roads, ports of entry, airports, as well as facilitate the turnaround of the National Railways of Zimbabwe,” he said.

Previously, the ministry of Transport has received ZWL$144.6.

The Ministry of Higher and Tertiary Education, Innovation, Science and Technology Development has been allocated ZWL$2.4 trillion to the to support implementation of Education 5.0 which promotes a knowledge driven economy that is sustained by innovation, industrialisation and modernisation.

With regard to tax and revenue contribution, Professor Ncube proposed that all documents or agreements for the transfer or disposal or lease of mineral rights be lodged with the State for review and approval before the transaction is concluded.

“In addition, I propose that no transfer of mining rights shall be approved without payment of capital gains tax and stamp duty or any other tax due on the value of the transaction. Failure to abide by this condition shall render the disposal or lease of mining rights null and void.

“In view of the recent developments where mining rights are disposed of privately outside the country and at astronomic prices, I propose that revenue derived therefrom be shared equally with the State.

“Furthermore, in order to enable Government to track the movement of mining rights for tax purposes, I, propose that a register of mining rights with a record of applications, grants, variations, dealings, assignments, transfers, suspensions and cancellations of rights be maintained and accessible to the Zimbabwe Revenue Authority,” he added.

Leave Comments