Nyashadzashe Ndoro

Hippo Valley Estates Limited, a Zimbabwean sugar processor, painted a bleak picture of their 2023 operations, citing a challenging business environment marked by high inflation, volatile exchange rates, and limited access to local and foreign currency.

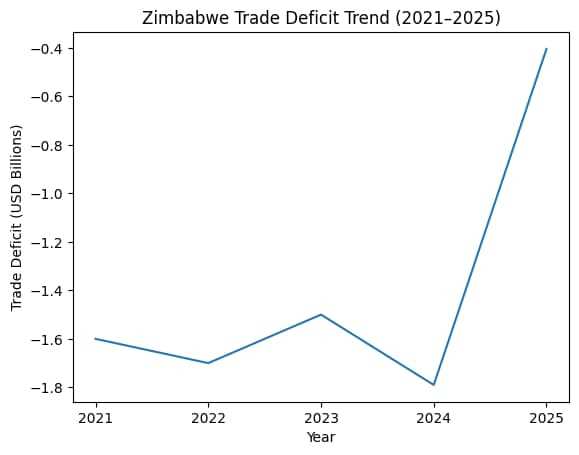

The company’s trading update for the third quarter, ending December 31, 2023, highlighted several hurdles. The official exchange rate between the Zimbabwe Dollar and the US Dollar skyrocketed by 556%, from ZWL930:US$1 at the beginning of the year to ZWL$6 105:US$1 at year-end, significantly impacting financial performance. Regional currencies also weakened against the USD, further inflating the cost of imported inputs.

Despite temporary exchange rate stability achieved through early-year monetary policies, the market currently grapples with significant discrepancies between the official interbank rate and the alternative market rate. Additional fiscal measures, including increased corporate taxes effective January 1, 2024, further burdened businesses. Global events like Eastern European and Middle Eastern conflicts threaten further hikes in logistical costs and global inflation.

“The Company operated in a difficult business environment with significant inflationary pressures, exchange rate volatility, constrained Zimbabwe Dollar and United States Dollar liquidity. The official exchange rate to the ZWL devalued by 556% from ZWL930:US$1 at the beginning of the year to ZWL6 105:US$1 at the end of December 2023, negatively impacting on financial performance,” the company said.

Related Stories

“Regional currencies also lost ground against the USD, further driving inflation of imported inputs. The high velocity of transacting locally in foreign currency continues, spurred by the constrained Zimbabwe Dollar liquidity. Exchange rate stability was temporarily achieved following monetary policy measures which took effect at the beginning of the year, but regrettably the market is once again experiencing significant rate differentials in the interbank and alternative market.

“Additional fiscal policy measures were pronounced in the third quarter, with the introduction of more aggressive corporate taxes effective 1 January 2024, increasing the cost of doing business for the whole economy. Continuing conflicts in Eastern Europe and the Middle East will likely lead to further increases in logistical costs of key commodities leading to fears of global inflation. The Company continues to proactively navigate these challenges to ensure ongoing value creation and preservation.”

The company said, notwithstanding El Nino episodes experienced in the third quarter characterised by dry spells, it envisaged the major water supply dams to provide sufficient cover for the industry’s irrigation regimes for approximately two seasons, with Tugwi-Mukosi at 85.95% and Mutirikwi Dam at 94.61% as at 31 December 2023.

“The Company’s strategic focus remains on improving yields and ensuring plant reliability, maximising capacity utilisation and achieving sustainable operating cost efficiencies in the medium to long term. In the short term, the priority is to successfully complete the off-crop programme, which is well underway to ensure an efficient and reliable milling campaign in the 2024/25 season, improving quality and safety performance, reconfiguring the route to market and implementing innovative work streams to contain the cost of goods and services. The Company will also leverage on available borrowing facilities up to the end of the financial year to cushion its working capital in light of off-crop requirements.

“The industry is looking forward to improved domestic sales volumes after the recent repeal of Statutory Instrument 80 of 2023, effective 1 January 2024, which previously allowed duty-free sugar imports into the country, although the benefit may not be realised immediately due to high stocks of imported sugar currently available in the market,” Hippo Valley Estates said.

Leave Comments