Philemon Jambaya

Assistant Editor

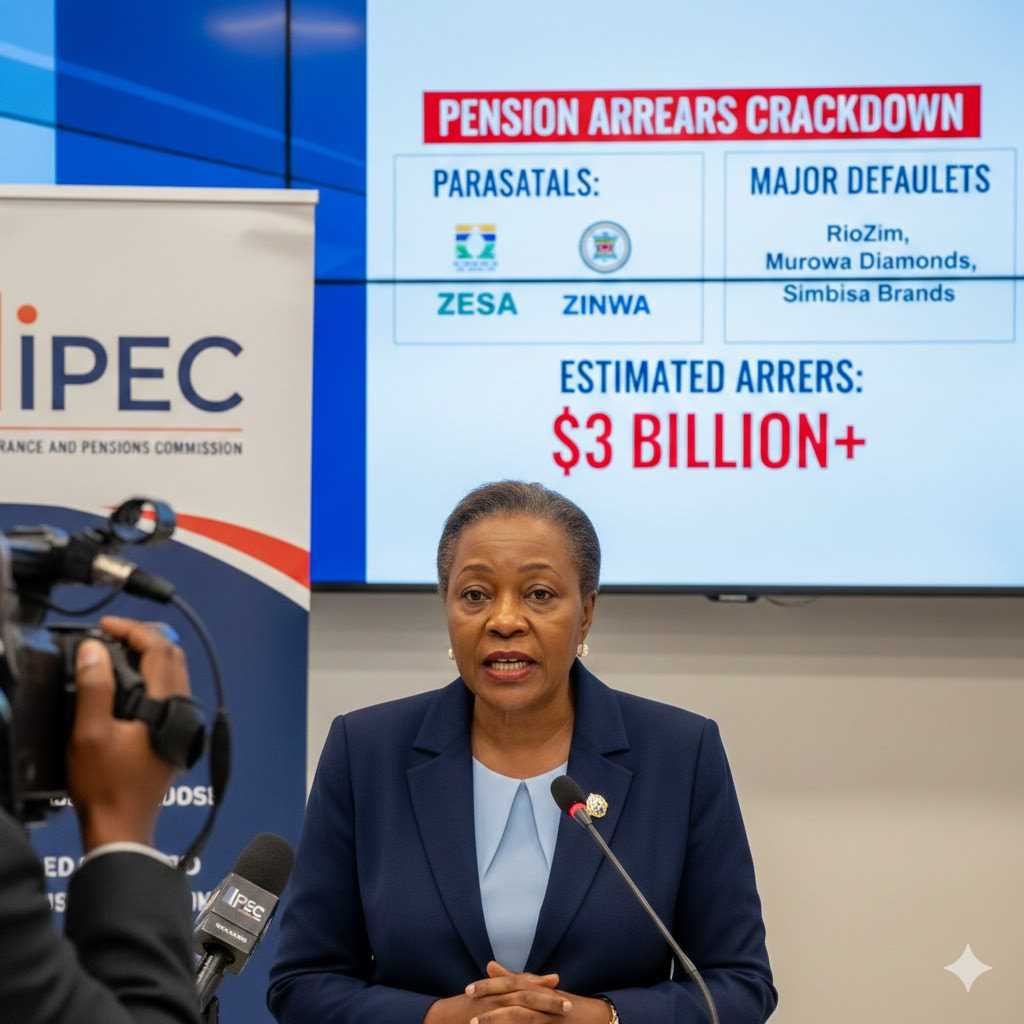

Zimbabwe's National Social Security Authority pensioners are up in arms over their meagre monthly pay-outs, which they say are insufficient to cover basic necessities. The pensioners are demanding an immediate upward review of their benefits, alleging their right to a decent life is being denied.

NSSA Pensioners Advocacy representatives petitioned Parliament, highlighting the dire situation faced by retirees. They explained that the current US$50 monthly payout falls far short of covering essentials like food, healthcare, and transportation.

Denford Mangwiro, a representative for the Advocacy group, emphasized the broader societal impact of the low pay-outs. He expressed concern that future generations of retirees would face similar hardships unless drastic changes are made.

Related Stories

Mangwiro further accused NSSA management of abusing pension funds, citing forensic audits that exposed mismanagement. He argued that these alleged financial improprieties directly contribute to the pensioners' plight.

However, Public Service Secretary Simon Masanga defended NSSA, pointing out that the organization is the only remaining government entity still able to pay out pensions. Many occupational pension funds have collapsed, leaving retirees with nothing.

NSSA acting general manager Charles Shava acknowledged that past payouts dipped as low as US$30 per month. He assured the Parliamentary committee that adjustments have been made, with the current payout reaching US$50. Shava explained that upward revisions are contingent on the availability of resources.

Regarding complaints about NSSA's investments, Shava admitted they have a low investment income but highlighted recent efforts to push this figure to 15%.

While acknowledging the pensioners' right to a decent life, Shava emphasized that the NSSA scheme is intended as a supplement, not a primary source of retirement income. He pointed out that NSSA contributions are relatively low compared to other deductions from salaries.

Shava elaborated on the structure of the NSSA pension scheme, explaining it was designed to coexist with other pension plans, ideally an occupational pension providing a larger payout. He added that NSSA operates under a "Partially Funded Pay As You Go Scheme," meaning benefits are paid from monthly collections and investment income.

The petition by NSSA pensioners has sparked a debate on the adequacy of social security benefits in Zimbabwe.

Leave Comments