Audrey Galawu

Assistant Editor

CBZ Holdings has invested US$150m in an 8 000 high-end Housing Project through its subsidiary, Datvest.

The project called Northgate, is a mixed-use residential park consisting of 8,000 housing units, including flats, residences, cluster houses, schools, hospital, and a shopping mall.

The projected is expected to be completed in December 2025.

The group’s asset management business through Datvest demonstrated resilience and profitability in 2023.

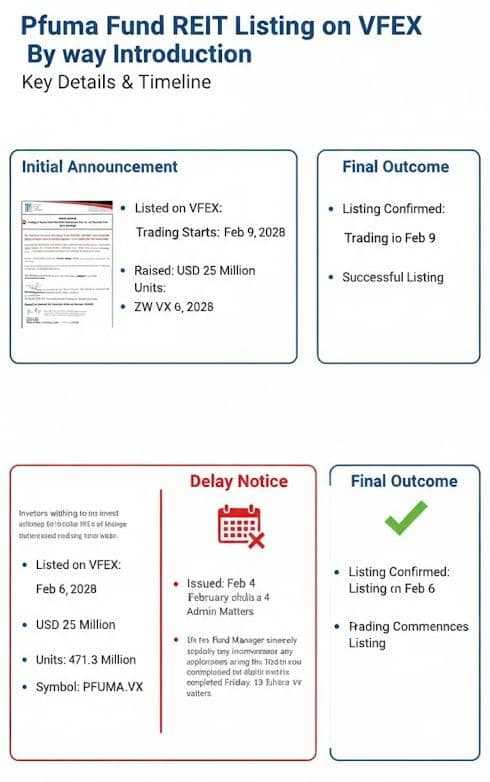

“Datvest played a substantial role in the development of new initiatives, including the recently listed National Railways of Zimbabwe REIT and significant property ventures.

“Datvest is implementing its regional diversification strategy to address risks specific to Zimbabwe. Our advisory arm, CBZ Capital, was involved in substantial mandates and capital raising transactions. Going forward, the group through CBZ Properties, will concentrate on the development of a strong property business model that is expected.

Related Stories

“The value traded on the ZSE decreased by 51% year on year, from US$262 million in 2022 to US$128 million. This contrasted with a challenging year in the capital markets, which saw the Zimbabwe Stock Exchange All Share Index record a 7.78% year-over-year decline in real terms, with only 19 of the 42 active counters experiencing real-term price appreciation,” said CBZ CEO Lawrence Nyazema.

Profit after tax in historical terms stood at ZWL$1.0 compared to ZWL$81.03 billion reported in 2022. This growth was supported by a larger customer base, higher transactional volumes, robust deposit growth, and increased disbursements to our valued clients.

“We are extremely grateful to our clients for embracing our approach and allowing us to be their partners for success. Our transactional, loan, and deposit activity have experienced substantial growth, while the demand for our investment and insurance products has seen a notable increase.

“The group’s financial position remains strong, with loans and advances to customers reaching ZW$2.07 trillion, supported by a customer deposit base of ZW$5.6 trillion.”

Under the Banking Cluster, CBZ Bank maintained its status as the group’s flagship entity in terms of financial performance and market leadership.

The bank maintained its dominant market share positions in the following categories: total deposits (26%), loans and advances (31%), total assets (24%), POS Acquiring (24%), assets under custody (19%), and VFEX Settlements (42%).

The bank also launched a revamped Private Banking branch that prioritises the provision of highly personalised financial solutions to the more affluent.

“To serve the stratum immediately below private banking, the Bank introduced a new segment called Prime Banking. The Bank closed the year with US$22.8 million in lines of credit, with a significant portion to be finalised in 2024. Securing lines of credit continues to be the top priority for the wholesale banking division.

“We are delighted that the Bank was able to preserve its Global Credit Rating despite the operational challenges it faced. This achievement is indicative of our efforts to reduce the risk associated with obtaining new assets,” Nyazema added.

Leave Comments