Audrey Galawu

Assistant Editor

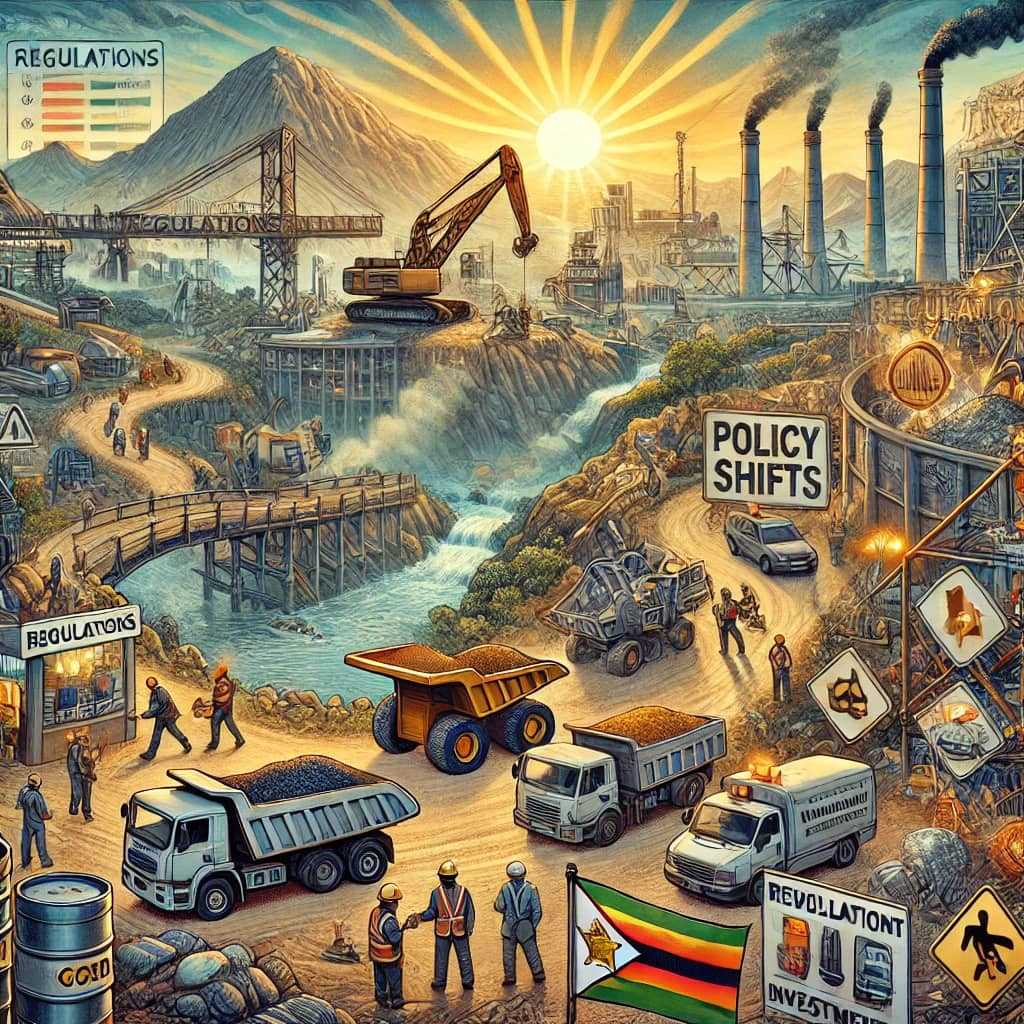

The mining sector in Zimbabwe has historically been the backbone of the economy, contributing significantly to employment, export revenues, and overall economic activity.

As we move through 2024, an analysis of the sector reveals mixed but largely positive signals, suggesting that investment is improving, albeit with challenges.

Growth Signals from 2023

According to the Zimbabwe Investment and Development Agency 2023 Annual Report, the mining sector remained a crucial focal point for both foreign and domestic investment.

In 2023, ZIDA issued 277 new mining licenses, the highest among all sectors, which reflects strong investor interest in the country's mineral resources. Furthermore, mining attracted one of the largest projected investment values of US$3.524 billion, only trailing behind energy investments.

This demonstrates that despite Zimbabwe’s economic and political challenges, investors are still drawn to the sector’s vast potential, especially in minerals such as gold, platinum, and lithium.

Factors Driving Investment Growth

Several factors contribute to the improvement in mining investment including high Global Commodity Prices.

The global demand for minerals such as gold, lithium, and platinum has remained strong. Zimbabwe, which holds some of the largest reserves of these resources, has been benefiting from this demand surge, with investors looking to capitalise on favourable market conditions.

Related Stories

“Government’s initiatives to create a more investor-friendly environment, including Special Economic Zones and the Foreign Direct Investment attraction campaign, have played a crucial role. SEZs, such as the new Power and Metallurgical Processing SEZ in Beitbridge, are designed to attract investors with favourable tax regimes and streamlined processes.

In November 2023, ZIDA gazetted the Special Economic Zones Regulations (S.I. 226 of 2023) and General Investment Regulations (S.I. 227 of 2023). These regulations were designed to improve transparency, streamline processes, and create a clearer investment framework.

The global transition to green energy has spurred interest in lithium, an essential component in electric vehicle batteries. Zimbabwe is poised to become a key player in this market, with several new lithium mining projects in the pipeline.

Challenges Facing the Sector

However, despite these positive developments, there are significant challenges that could hamper long-term growth policy Inconsistencies, infrastructure inconsistencies, and political and economic risks.

One of the critical barriers to sustained investment in Zimbabwe's mining sector has been inconsistent policy enforcement. The 2023 report highlighted issues such as foreign currency retention regulations and the ban on unprocessed lithium exports, which have created uncertainty for investors. While ZIDA has actively engaged investors on these matters, the policy shifts can still cause hesitancy.

Additionally, the country’s aging infrastructure, particularly in transport and energy, is a bottleneck for the mining sector. Efficient mining operations require reliable electricity and transport networks, and the slow pace of infrastructure rehabilitation remains a deterrent for many large-scale investments.

Comparison with Previous Years

In comparison to the preceding years, the mining sector has shown marked improvement. For instance, in 2022, there was less optimism, with fewer licenses issued and lower investment values.

The significant increase in licenses and projected investment in 2023 highlights that Zimbabwe is making headway in attracting foreign interest.

ZIDA's new Customer Relationship Management system, which reduced licensing times from 21 to 7 days, has been instrumental in improving investor experiences.

Leave Comments