Monica Cheru

Managing Editor

The recent indictment of Kenneth Newcombe and Tridip Goswami, executives of C-Quest Capital on charges of a substantial carbon credit fraud scheme has raised significant concerns for the integrity and future of Zimbabwe's carbon credit industry.

The allegations involve the falsification of emissions-reduction data, resulting in the unlawful issuance of over $100 million in carbon credits.

https://zimbabwenow.co.zw/articles/12621/us-indicts-zim-carbon-credit-duo

This scandal is poised to impact not only CQC but the entire market, including Zimbabwe, which has been striving to establish itself as a key player in the carbon credit sector.

Concerns Over Market Integrity

The fallout from this indictment threatens to undermine the credibility of carbon credits globally.

Zimbabwe, which is already grappling with issues of transparency and fairness in its carbon credit transactions, may face heightened scrutiny from investors and regulatory bodies.

The skepticism surrounding the legitimacy of carbon credits could deter foreign investments critical for local projects aimed at sustainable development

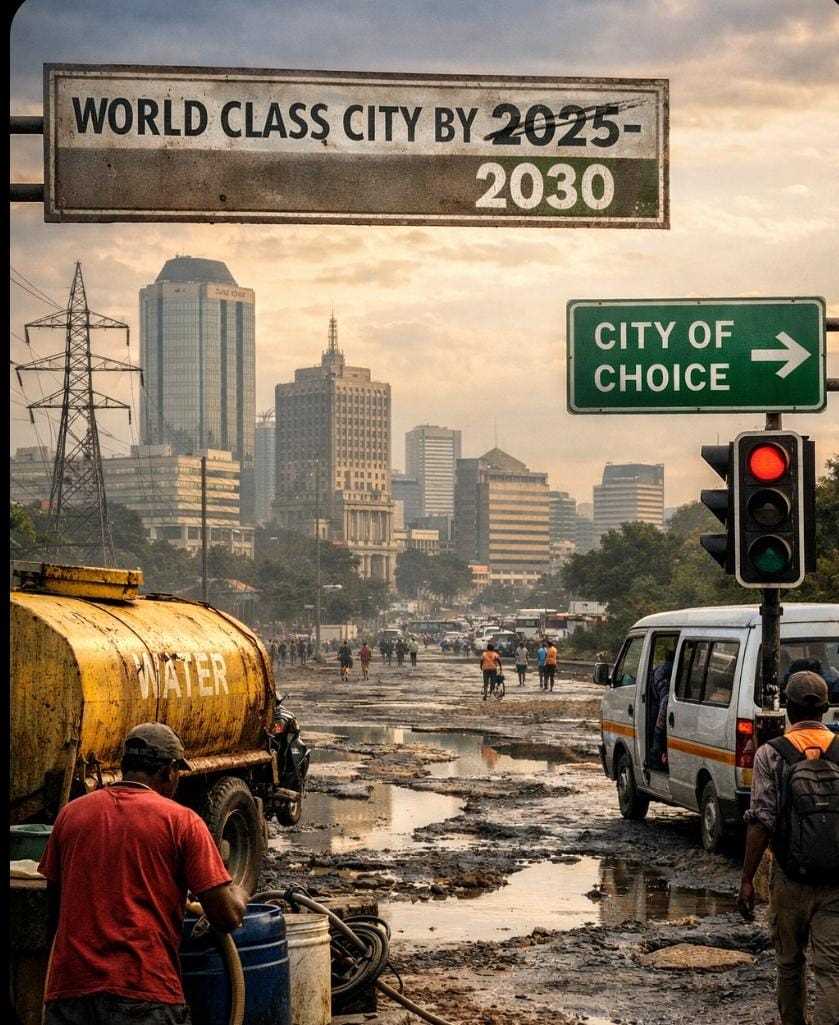

As the carbon credit market is projected to grow significantly—estimated to reach $6 billion by 2030 in Africa alone—Zimbabwe's aspirations to become a central hub in this market could be jeopardized.

Background on Zimbabwe's Carbon Credit Developments

The government’s recent demands for a larger retention share from carbon credit revenues reflect a growing recognition of the need for more equitable profit-sharing mechanisms.

Related Stories

The Zimbabwean government has been increasingly vocal about its desire to reform the carbon credit market, seeking a more substantial share of the revenues generated from carbon trading.

This demand stems from concerns over the lack of transparency and accountability in how profits are distributed.

Reports indicate that a significant portion of the revenue from carbon credits often benefits foreign companies rather than local communities, raising ethical questions about the exploitation of Zimbabwe's natural resources.

Recent discussions have highlighted the government's intention to overhaul the carbon credit regulatory framework, aiming to ensure that local communities and the national treasury benefit more equitably.

For instance, proposals suggest that Zimbabwe could retain up to 50% of carbon credit revenues, a significant increase from the current arrangements, which often leave local populations marginalized.

This shift towards greater regulation is indicative of a broader trend among Global South countries seeking to establish more robust frameworks for managing their natural assets. However, it also reflects fears that without proper oversight, foreign entities may continue to profit disproportionately from carbon credit schemes.

Looking Ahead: Challenges and Opportunities

The CQC scandal and Zimbabwe's regulatory response highlight both challenges and opportunities for the nation's carbon credit industry.

On one hand, the indictment may lead to tighter regulations and greater oversight, which could restore some level of trust in the market.

It also awakens the whole carbon credit chain to the chicanery that global players like CQC are up to and makes it that much harder for the continued hoodwinking of nations and corporates.

On the other hand, there are concerns about the potential impact on investment and operational costs for local carbon credit projects.

Ultimately, Zimbabwe's ability to navigate this complex landscape will be crucial in determining its role in the global carbon market.

Enhanced transparency and equitable distribution of carbon credit revenues will be essential to ensure that both local communities and the government can sustainably benefit from their natural resources.

Leave Comments