Audrey Galawu

Assistant Editor

The manufacturing sector in Zimbabwe demonstrated resilience in the second quarter of 2024, as reflected in the Volume of Manufacturing Index report by ZimStat.

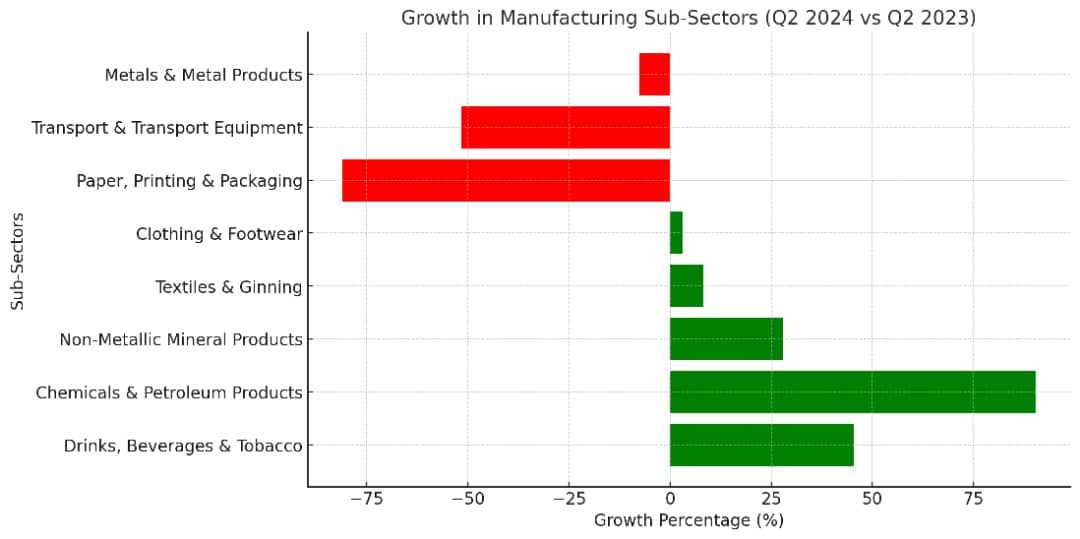

The VMI reached 135.24, marking a notable 19% year-on-year increase from 113.65 in Q2 2023. However, the report unveils mixed trends across various sub-sectors, revealing both growth opportunities and challenges.

The Drinks, Beverages, and Tobacco sub-sector exhibited robust growth with a production index of 191.39, surging by 45.53% compared to the same period last year. The remarkable increase underscores strong domestic demand and possibly expanded export markets.

Chemicals and Petroleum Products, another standout performer, this sector saw a dramatic 90.33% year-on-year increase, reaching an index of 99.39. This rebound reflects improved industrial capacity and supply chain recovery.

The Non-Metallic Mineral Products sub-sector with a 27.90% growth rate achieved an index of 164.92, buoyed by increased activity in construction and infrastructure development.

Related Stories

The textiles industry posted an 8.33% increase, indicating potential recovery in a traditionally underperforming sector. The index rose to 60.31 from 55.67 in Q2 2023.

Clothing and Footwear posted a modest growth of 3.11% brought this sector’s index to 122.83, highlighting stability amidst global headwinds.

While many sub-sectors thrived, others faced significant challenges. Paper, Printing, and Packaging sector experienced an 81.03% plunge, dropping to an index of 39.00. Rising production costs and reduced demand may have contributed to this steep decline.

Transport and Transport Equipment: The sub-sector's index fell by 51.52% year-on-year, indicating struggles in a segment crucial for industrial logistics.

The overall 19% rise in the VMI reflects resilience despite persistent macroeconomic challenges, including inflation and foreign currency shortages. The remarkable performance in beverages and chemicals suggests sectors that could benefit from targeted policy support, such as tax incentives or export promotion.

On the other hand, declines in paper packaging and transport equipment highlight the need for investment in modernization and cost reduction strategies to enhance competitiveness.

To sustain growth and address disparities, policymakers should enhance access to affordable financing for struggling sectors, invest in infrastructure to support transport and logistics and encourage innovation and value addition across all manufacturing segments.

The Q2 2024 VMI figures serve as a call to action for both private and public stakeholders to harness Zimbabwe’s industrial potential while addressing lingering bottlenecks.

Leave Comments