Nyashadzashe Ndoro

Chief Reporter

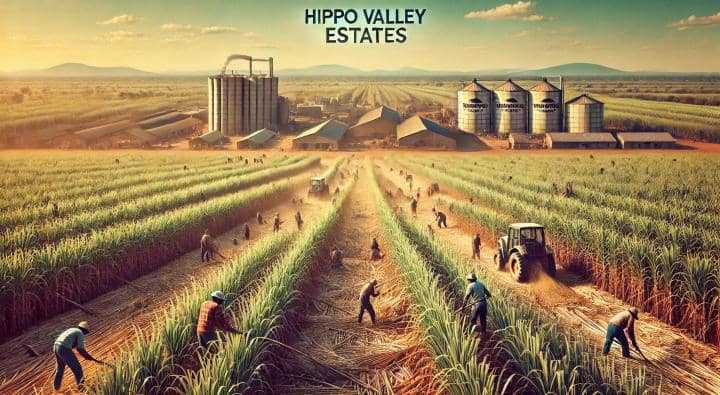

Delays in shipment approvals from United States authorities have taken a toll on Zimbabwe's leading sugar producer Hippo Valley Estates Limited's export market sales volumes, ZimNow can report.

The Zimbabwe Stock Exchange listed company, a subsidiary of Tongaat Hulett Limited, has released its reviewed abridged interim financial results for the six months ended September 30, 2024.

The results show the company's financial performance was impacted by various factors, including competition from duty-free imported sugar and delays in obtaining shipment approvals from US authorities.

The company has, however, acknowledged the repeal of Statutory Instrument 80 of 2023 on 31 January 2024, leading to the reinstatement of import duties on low-cost non-fortified imported sugar brands that had resulted in an erosion of the local sugar industry market share by as much as 25%.

"Resultantly, the industry's customers have largely switched back to locally produced sugar, with the domestic market industry sales volumes recovering by 31 716 tons. There are adequate sugar stocks to satisfy demand locally and meet critical export markets requirements, even after the earlier closure of the crushing season at the end of November.

"While prioritisation of the local market remains key, export market sales volumes were largely affected by delays in obtaining shipment approvals from the USA authorities which has since been delivered and paid for post the reporting period. Unfortunately, unfortified sugar brands not compliant with regulations are still being illegally imported and relevant authorities have been alerted," Hippo Valley chairperson Canaan Dube stated.

The US Embassy in Harare has declined to comment on the matter at hand, failing to respond to questions submitted to them prior to our publication deadline.

Related Stories

Tongaat Hulett Limited, the company's major shareholder, is currently undergoing a business rescue process in South Africa. However, Hippo Valley Estates' operations are not financially distressed and will continue trading as usual.

Tongaat Hulett’s Botswana, Mozambique, and Zimbabwe sugar operations are funded independently from the company.

Tongaat Hulett holds a 50.3% shareholding in Hippo Valley Estates. Tongaat Hulett's shares were suspended from trading on the Johannesburg Stock Exchange on July 19, 2022 for failing to publish financial results within the required time period. In August 2024, Tongaat shareholders rejected a debt-for-equity swap that would have given a consortium called Vision 97.3% of the group.

Hippo Valley is progressing with Project Kilimanjaro, a 4,000-hectare sugarcane development venture. Project Kilimanjaro is a partnership between Tongaat Hulett, the Government of Zimbabwe, and commercial banks to develop 4,000 hectares of virgin land for sugarcane farming. The project aims to benefit more than 200 indigenous farmers.

Hippo Valley Estates is also engaging with the government regarding the issuance of 99-year leases and amendments to current leases for bankability and transferability.

The company's directors believe that the going concern presumption is still appropriate, given the company's good operational performances and sustainable business strategies.

Hippo Valley Estates Limited has reported a 24% increase in revenue to US$102.6 million for the half-year ended September 30, 2024. This growth is attributed to the reinstatement of import duties on non-fortified imported sugar brands, which led to a recovery in local market sales volumes. The company's customers have largely switched back to locally produced sugar, resulting in a 31,716-tonne increase in domestic market sales volumes.

Despite the revenue growth, Hippo's profit after tax decreased by nearly 29% to US$18.18 million due to price distortions caused by exchange rate and inflation dynamics. The company adopted the US dollar as its reporting currency, which resulted in pricing distortions in the movement of fair value of biological assets. Operating profit also decreased by 56% to US$13.7 million due to these distortions.

The company's agriculture and manufacturing operations showed improvement, with a 12% growth in cane harvested from its plantations and an 8% growth in sugar production. Hippo's private farmer performance also increased, and the company has adequate sugar stocks to meet local demand and critical export market requirements. As of September, the company had a liquid position, with US$2.30 for every dollar of short-term debt.

Hippo Valley Estates Limited is a leading sugar producer in Zimbabwe, with operations including sugarcane farming, milling, packing, and distribution, as well as cattle ranching.

Leave Comments