Audrey Galawu

Assistant Editor

Hippo Valley Estates Limited has released its Reviewed Abridged Interim Financial Results for the half-year ended 30 September 2024, revealing a complex operating environment shaped by monetary policy changes, currency volatility, and cost pressures.

Revenue surged by 24% to US$102.6 million, up from US$82.7 million in the previous period. The recovery was driven by higher local market sales volumes and improved price realizations following the reimposition of import duties on low-cost, non-fortified sugar brands.

Despite the revenue growth, operating profit plummeted by 56% to US$13.7 million, down from US$31.1 million, largely due to exchange rate distortions affecting the valuation of biological assets.

Net profit also declined by 29% to US$18.2 million, while Adjusted EBITDA increased by 17% to US$29.0 million, reflecting operational improvements that partly offset rising costs.

Related Stories

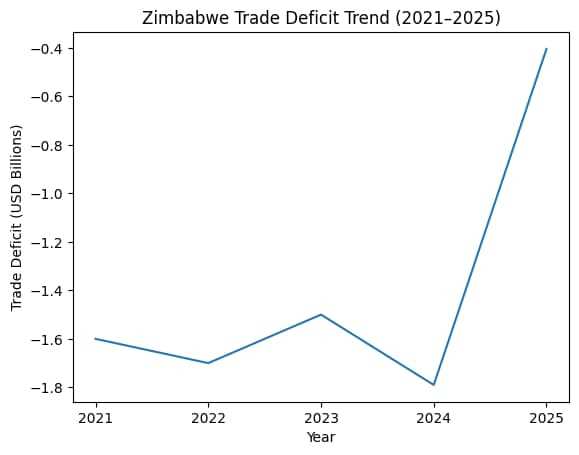

The introduction of the Zimbabwe Gold currency in April 2024 significantly impacted the business. Initially pegged at US$1:ZWG13.56, the ZWG devalued to US$1:ZWG25.88 by the end of September, exacerbating liquidity challenges.

The mismatch between ZWG earnings and the preference for US$ settlements by suppliers strained the company’s cash flow, with net borrowings rising to US$10.9 million from US$9.4 million in the prior period.

Sugar production rose by 8%, while cane harvesting grew by 12%, thanks to improved yields, early cane deliveries by private farmers, and enhanced mill uptime following a successful maintenance program. Local sugar sales volumes rebounded by 31,716 tons, reclaiming market share lost to imported brands during the previous year.

Export volumes, however, suffered a 69% drop due to delays in shipment approvals, particularly for the US market. Although these shipments have since been delivered, the delays underscored the challenges of navigating regulatory hurdles in export markets.

The company faced escalating costs for goods, services, and manpower, primarily priced in US$, which compressed profit margins from 30% to 28%. In response, Hippo Valley launched Project Zambuko, a comprehensive initiative aimed at reducing operating expenses and enhancing long-term competitiveness.

Hippo Valley maintained its commitment to sustainability, earning a Gold Medal for Safety, Health, and Environment (SHE) performance in Masvingo. Investments in renewable energy, reforestation, and waste management remain a priority as the company seeks to minimize its environmental footprint and support local communities.

Citing elevated borrowing levels and ongoing financial obligations, the Board resolved not to declare an interim dividend for the period, opting instead to focus on maintaining liquidity and navigating the challenging economic landscape.

Leave Comments