Audrey Galawu- Assistant Editor

TSL Limited has reported a strong financial performance for the half-year ended April 30, 2025, with profit from continuing operations surging 43% to US$4.3 million, despite operating in a challenging economic environment marked by inflation, high interest rates, and erratic weather patterns.

In the chairman’s statement accompanying the company’s interim results, Anthony Mandiwanza highlighted that the group demonstrated resilience and agility across its diverse operations — from agricultural inputs and tobacco services to logistics and infrastructure.

“The operating environment during the period under review remained complex and uncertain, characterized by liquidity constraints, persistent power outages, high lending rates, soaring inflation and policy changes,” said Mandiwanza.

Revenue from continuing operations rose 8% to US$19.6 million, buoyed by improved volumes in most business units. Earnings before interest, tax, depreciation, and amortization jumped 33% to US$7.5 million, underpinned by cost optimisation strategies and solid operational performance.

The roup’s agricultural arm showed a mixed but largely positive performance. Propak saw hessian volumes rise 28% and tobacco paper volumes grow 6%, supported by an increase in national tobacco output. Agricura, the Group’s agricultural trading unit, saw volume surges of 3% in insecticides and an impressive 235% in fungicides, with animal health remedies climbing 244% following the launch of a new plant.

On the tobacco services front, contract volumes rose 8% while independent volumes climbed 18%, bolstered by a better cropping season. According to Mandiwanza, “The strategy to serve the much larger contracted tobacco market continues to yield results, with 81% of the total volumes handled coming from this segment.”

Related Stories

TSL also announced progress on a major strategic acquisition — a 51.43% equity stake in Nampak Zimbabwe for US$25 million. The transaction is currently undergoing regulatory and shareholder approval processes and will be funded through internal resources and bridging finance.

“The Board approved the disposal of three properties to fund the acquisition of a 51.43% shareholding in Nampak Zimbabwe Limited,” said Mandiwanza. “These properties were identified based on their sub-optimal returns and limited strategic significance.”

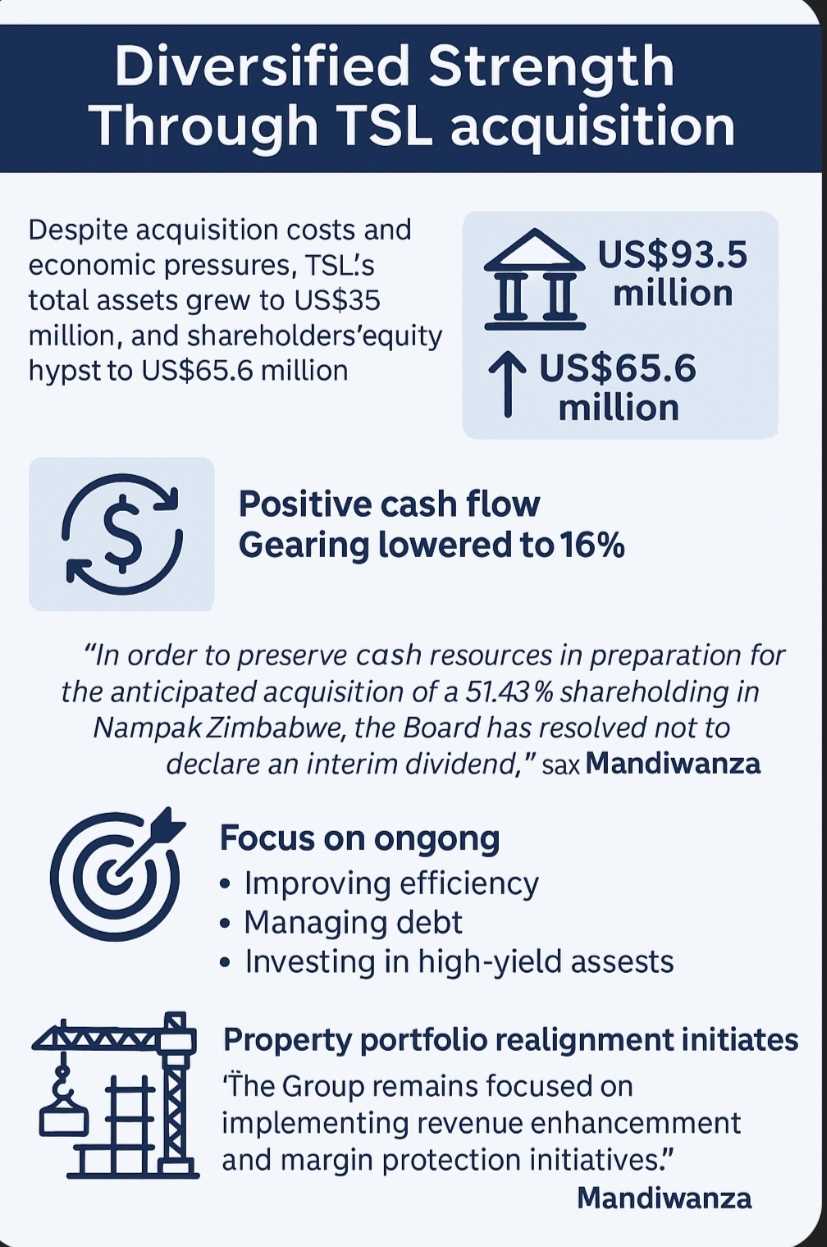

Despite the costs of the acquisition and economic pressures, TSL maintained a strong balance sheet, with total assets increasing to US$93.5 million and shareholders’ equity rising 7% to US$65.6 million. The Group also reported a positive cash flow and lowered its gearing to 16% from 17% previously.

However, due to the planned investment in Nampak, the company has opted not to declare an interim dividend.

“In order to preserve cash resources in preparation for the anticipated acquisition of a 51.43% shareholding in Nampak Zimbabwe, the Board has resolved not to declare an interim dividend,” Mandiwanza confirmed.

The company plans to focus on improving efficiency, managing debt, and investing in high-yield assets. It is also undergoing a property portfolio realignment to repurpose underperforming assets and strengthen long-term shareholder value.

“The group remains focused on implementing revenue enhancement and margin protection initiatives,” said Mandiwanza.

"We will continue with our efforts to enhance treasury management, including the exploration of efficient working capital and capital expenditure funding solutions.”

Leave Comments