Audrey Galawu- Assistant Editor

Zimbabwe’s 2025 Mid-Year Fiscal Review reveals a government increasingly capable of mobilising revenue in a maturing, formalised economy.

Backed by solid foreign currency collections and driven by an economic rebound following the 2024 drought, the nation’s revenue trajectory is pointing toward cautious optimism—with promising implications for business confidence and sectoral investment.

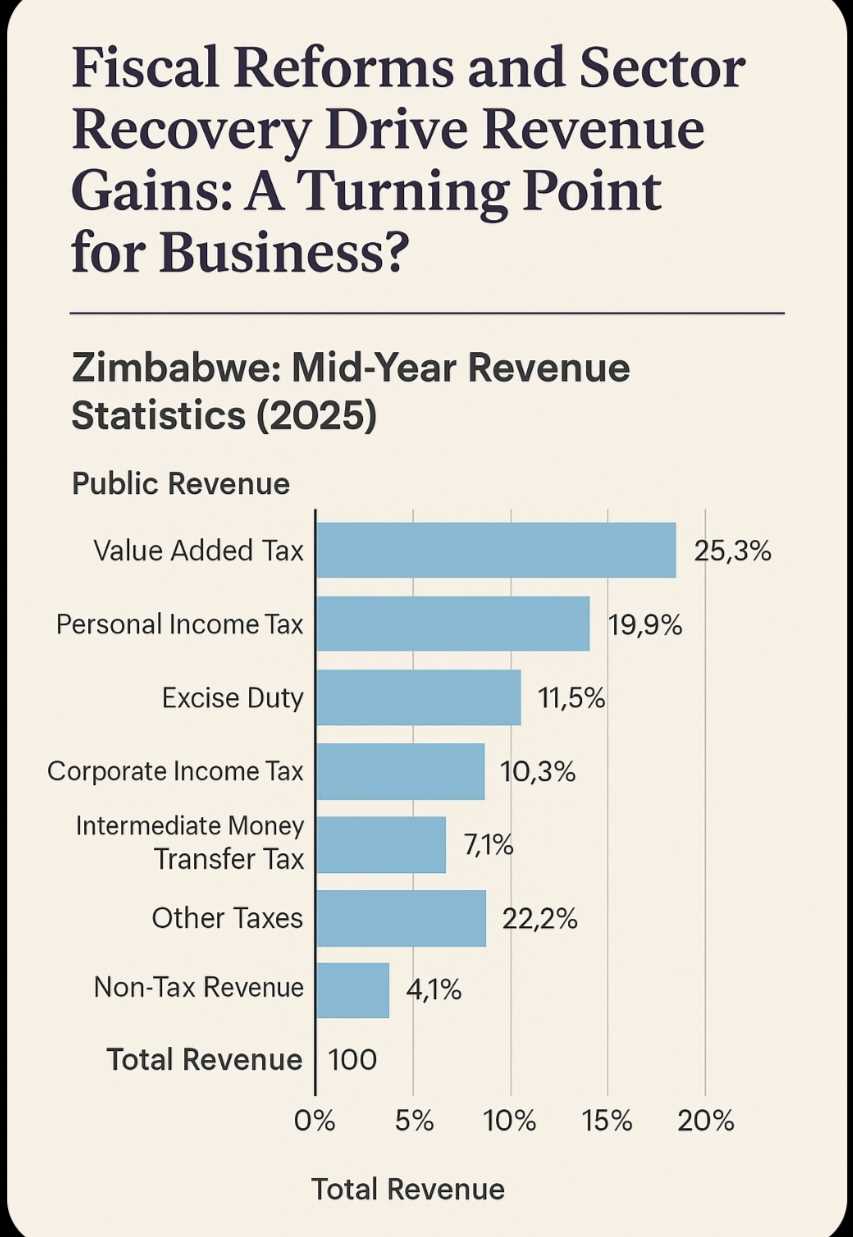

From January to June 2025, Zimbabwe’s public revenue reached ZiG$101.2 billion, exceeding expectations in foreign currency terms. Tax collections dominated, bringing in ZiG$97.1 billion, while non-tax revenue accounted for ZiG$4.1 billion.

The composition of collections shows a tax system more attuned to formal activity, with Value Added Tax, personal income tax, and corporate tax emerging as the backbone of the revenue framework.

VAT topped the list at 25.3% of total revenue—mirroring rising consumer spending and greater formal transactions. Personal income tax contributed 19.9%, reflecting improved employment data in both public and private sectors.

Corporate income tax at 10.3% and excise duty at 11.5% illustrate a post-pandemic resurgence in manufacturing, mining, and alcohol and fuel consumption.

But it’s not just headline numbers that matter—the underlying trends show a tax system adapting to Zimbabwe’s changing economic landscape.

What is driving this growth is a mix of macroeconomic discipline, improved compliance, and sectoral tailwinds. Treasury's efforts to widen the tax net through digitisation and formalisation are paying off.

From gold exports—up 93% year-on-year in the first five months—to a strong harvest season in agriculture, Zimbabwe’s productive sectors are feeding into the revenue engine.

Stable inflation and an anchored exchange rate have also provided predictability, allowing firms and individuals to plan and meet obligations with fewer shocks.

However, revenue in local currency terms still fell short of projections—a signal that dollarization remains entrenched and Zimdollar liquidity remains tight.

For businesses, the review reads like both a roadmap and a warning. On one hand, the government’s fiscal discipline and above-target revenue suggest more spending power, especially in infrastructure, agriculture, and mining. Companies aligned with these sectors may benefit from public procurement opportunities, logistics demands, and reinvestment across value chains.

On the other hand, increasing tax scrutiny and a shrinking informal space mean companies—particularly SMEs—must prepare for tighter compliance requirements. The push for digital record-keeping, VAT registration, and income tax adherence is no longer optional. It’s becoming a cost of doing business.

Zimbabwe is transitioning from reactive fiscal policy to strategic revenue planning. Proposed reforms include:

Widening the tax base to include the informal sector and new economic activities such as digital platforms and small-scale trade.

Revising incentive structures to align private sector growth with national revenue goals.

Scaling up e-government systems to enhance tax collection and public finance transparency.

If implemented effectively, these measures could tilt Zimbabwe further into a modern fiscal state—one where the tax system supports development without stifling enterprise.

While Zimbabwe’s tax revenue growth paints a promising fiscal picture, businesses warn that the underlying tax framework may be undermining long-term competitiveness.

From a flat 25% corporate income tax to a 2% IMTT on every electronic transaction, Zimbabwean companies face a thicket of levies. Withholding taxes, capital gains taxes, VAT, and even fringe benefit taxes chip away at already thin margins.

According to the 2024 National Competitiveness Commission Report, the result is a discouraging business climate that stifles formalisation and investment.

Leave Comments