Audrey Galawu- Assistant Editor

Zimbabwe's banking sector has reported a sharp decline in profits for the first half of 2025, despite the economy enjoying a period of macroeconomic stability and exchange rate calm.

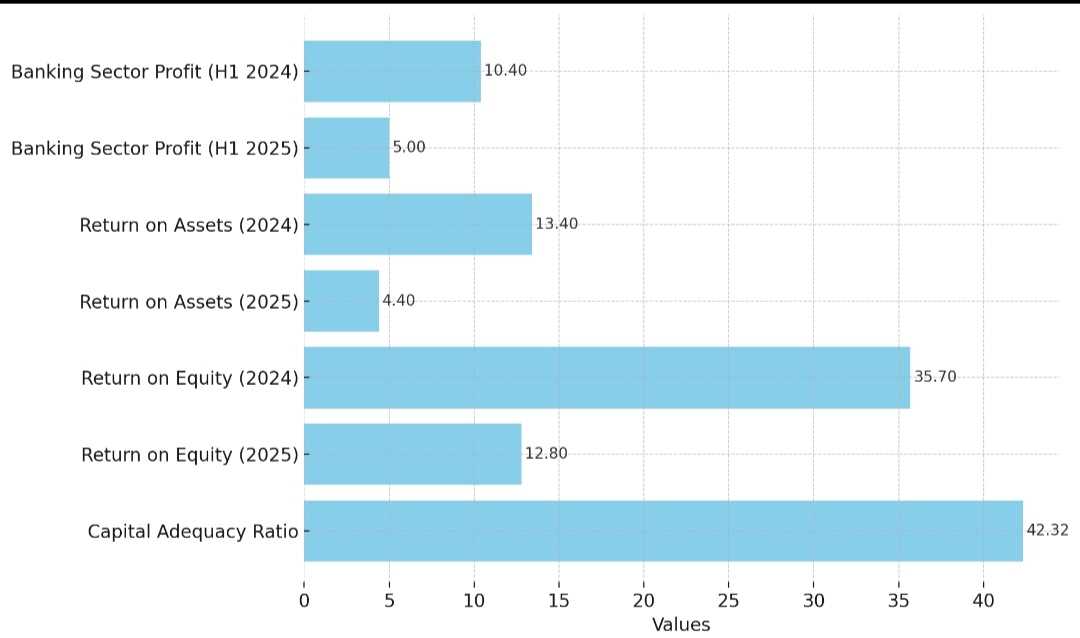

According to the Reserve Bank of Zimbabwe's Mid-Term Monetary Policy Statement released on August 7, 2025, aggregate banking sector profit dropped to ZiG$5.0 billion (approximately US$184.07 million), down from ZiG10.4 billion (US$760.37 million) in the corresponding period of 2024.

The decline in profitability is attributed to reduced reliance on non-funded income such as foreign exchange gains and revaluation profits. The MPS notes that the stability of the Zimbabwe Gold currency has contributed to this shift, as financial institutions now operate in an environment with fewer currency fluctuations.

Return on assets fell from 13.4% in June 2024 to 4.4% in June 2025, while return on equity (ROE) declined from 35.7% to 12.8%. This indicates a tightening of margins and earnings across the sector.

Despite the reduced profits, the Reserve Bank sees a silver lining in the form of a more sustainable banking sector.

"The anticipated continued ZiG stability will further result in improved quality and sustainability of banking institutions’ earnings," the MPS stated.

The MPS also highlights that financial soundness indicators remain satisfactory and that the sector is well-capitalized and liquid, with 17 out of 19 institutions compliant with minimum core capital requirements.

Moreover, the Bank reaffirmed its commitment to maintaining a robust supervisory and regulatory framework and promoting financial innovation and inclusion.

With average capital adequacy ratios at 42.32%, well above the regulatory minimum of 12%, the sector remains adequately cushioned against potential shocks.

Leave Comments