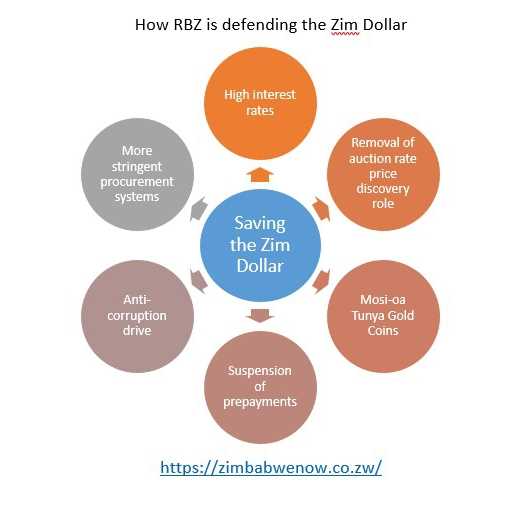

The Reserve Bank of Zimbabwe says month on month inflation decrease from 25.6% in July 2022 to 12.4% in August 2022 is the result of strong measures to defend value of the local currency.

“The MPC noted with satisfaction that a combination of the tight monetary policy stance, favourable uptake of gold coins, effective monitoring and enforcement of market discipline by the Financial Intelligence Unit (FIU) and the review and enhancement by Government of its procurement processes and practices to ensure value for money had resulted in the stability of the exchange rate and a decline in inflationary pressures,” the RBZ said in a statement.

The Consumer Council of Zimbabwe CCZ has acknowledged that the prices have come down slightly, though they credit fuel prices for the stability.

The consumer rights watch body attributed the price decrease to a corresponding decrease in fuel prices. But in reality fuel prices decreases effected

Between 27 July and 3 August petrol prices have come down from USD1.70 to USD1.60 which has impacted on USD prices.

Local currency prices have been more impacted by the arrest of black market rates for the Zim Dollar. By 24 July, the ZWL$ was practically at 1:1000 against the greenback and losing value at hyperinflationary rates.

Zimbabwe was named as the country with the second highest inflation rate in the world by some economic analysts. It is therefore a victory for the Reserve Bank of Zimbabwe to not only have reversed the inflation, but to actually be on the cusp of bringing prices down.

The street rate of the local dollar against the USD is now around 1:750 depending on amounts.

This article looks at some of the measures that the monetary authority has undertaken and how they are working.

Mosi-oa-Tunya Gold coins

Launched on 25 July as a value preservation and savings option, the gold coins have proven to be a legal attractive route for excess local currency position holders.

According to RBZ demand for the coins is high:

“As at 26 August 2022, a cumulative total of 10 000 gold coins had been minted and out of which 8 076 gold coins had been distributed to the Bank’s agents for sale. A total of 6 799 gold coins had been sold as at 26 August 2022, with 75% having been bought by corporates and 25% by individuals. Ninety-five per cent (95%) of the gold coins sold were purchased in local currency and the balance in foreign currency,” reads a statement from the RBZ.

While there was an outcry that gold coins were elitist because their value is above reach of ordinary people, it is undeniable that everyone is now benefitting from the rate stability that the coins have helped induce.

Removal of auction rate price discovery role

After a period of official prices being pegged at the auction rate rather than market prices, the RBZ finally admitted that policy was counterproductive and liberalized the system:

“…the foreign exchange auction system is no longer a price discovery mechanism but instead the most ideal allocative platform of foreign currency in the domestic economy given the geo-political constraints facing the local banking industry to establish an efficient interbank foreign exchange market,” RBZ governor Dr John Mangudya announced in August.

Price discovery is a process which determines market prices, mostly through interaction between sellers and buyers.

Most businesses had prices set in local currency and when converted to USD at auction rates, it meant that their goods and services became unaffordable. Clients thus opted to convert USD to local currency on the black market to get the best value from the transaction.

Thus such organisations had little or no USD revenue and were forced to procure on the black market as the auction system has not been adequate to meet demand.

Suspension of prepayments

The RBZ informed Public Accounts Committee in parliament this week that they have started curtailing prepayments to government contractors in order to cut down on speculative forex trading transactions and more measures are in the pipeline:

Related Stories

“To mitigate that risk (of abusing advance payments), Treasury will consider mechanisms for safeguarding public resources through a combination of more stringent due diligence processes, calling for advance payment guarantees in stable currencies and amending the provisions to restrict their application to specified categories of procurement.”

There is evidence that some contractors who were prepaid by government used the money to speculate on the black market with some not delivering on the contracts at all.

Government has since moved to limit prepayments and set stringent guidelines for the few permitted cases.

More stringent procurement systems

Finance Permanent Secretary George Guvamatanga recently conceded that loopholes in the procurement system have created a feeding trough for criminal elements to siphon public funds.

“…over and above the issues that were arising from these contractors and service providers on overpricing, some of them demand advance payments, so creating problems of non-delivery, and then use our advance payments to go on the parallel market,” Guvamatanga told Parliament this week.

Payments for work that is never done, overcharging and wildly speculative exchange rates are some of the ways that were being used to steal from government. Among the alleged looters are a travel agency, hotels and contractors.

Ministries and departments will now have need to check out the pricing and be able to certify that it is market rate compliant before Treasury pays.

The ministries, departments and agencies must submit due diligence reports by September 2 on all contracts that were submitted as at July 31.

The reports should also include existing procurement contracts and should be in line with the

FIU monitoring and enforcement

Government agencies working on tracking illegal financial flows are targeting individuals across the board.

The National Prosecuting Authority has obtained unexplained wealth orders at the High Court against former Finance and Economic Development Ministry official Marcos Nyaruwanga who must explain how he acquired a Hatfield property plus five 15 vehicles Mercedes Benz vehicles.

Prominent politician Mayor Justice Wadyajena and four Cottco top executives are facing charges of fraud and money laundering involving US$5 million of Cottco money after the five allegedly converted money which was meant for the importation of bale ties and to buy trucks through Mayor Logistics and energy companies.

Traditional healer Ester Mutesvu who is facing money laundering charges has been barred from disposing her assets worth plus USD72 thousands including a house at Aspindale Park in Harare, vehicles and all her household property until the criminal matter is settled.

If these and other prosecutions end in convictions and restitutions, market confidence in the system will strengthen greatly.

Conclusion

RBZ has clearly illustrated that with political will, the Zimbabwean economy is capable of not just stability but growth within very short periods.

The challenge is now on sustainability of the current drive to defend the local currency value. This must be shown by decisive moves to close off all loopholes before rent seeking behaviour manifests in other ways.

The justice system must also play its part with effective prosecution, deterrent sentences and full restitution.

Leave Comments