Audrey Galawu and Patience Muchemwa

Misheck Mukohwazhizha, a civil servant walks into a bank and withdraws US$200 dollars from his nostro account. The US dollar allowance makes the biggest chunk of his earnings from government.

Mukohwazhizha then walks to downtown Harare CBD where he buys groceries from vendors on the pavements and the semi-formal “tuck shops” that make up the bulk of the businesses there.

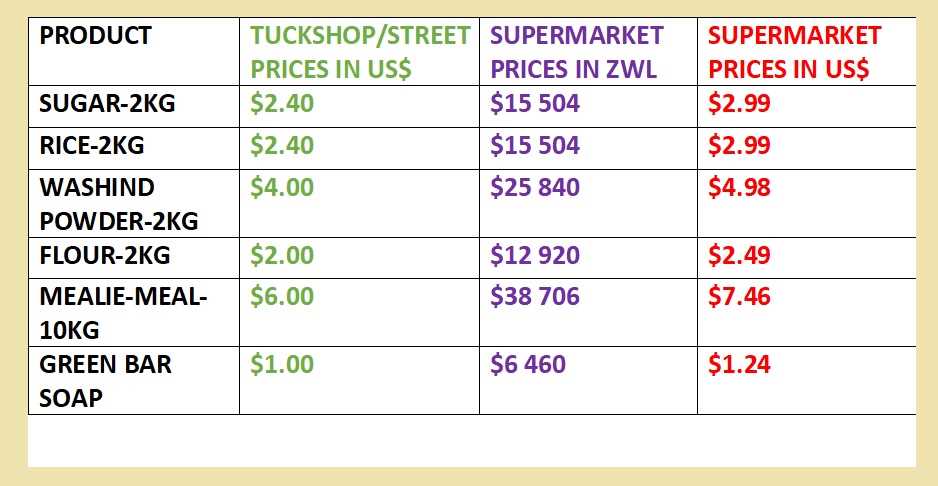

“The prices are much cheaper here than in the supermarkets like Pick n’ Pay and OK,” says Mukohwazhizha.

Little does Mukohwazhizha realise that he is a part of the vicious circle that keeps his salary low and makes access to amenities like education and health services a headache for him and the majority of Zimbabweans.

Formal retailers flounder

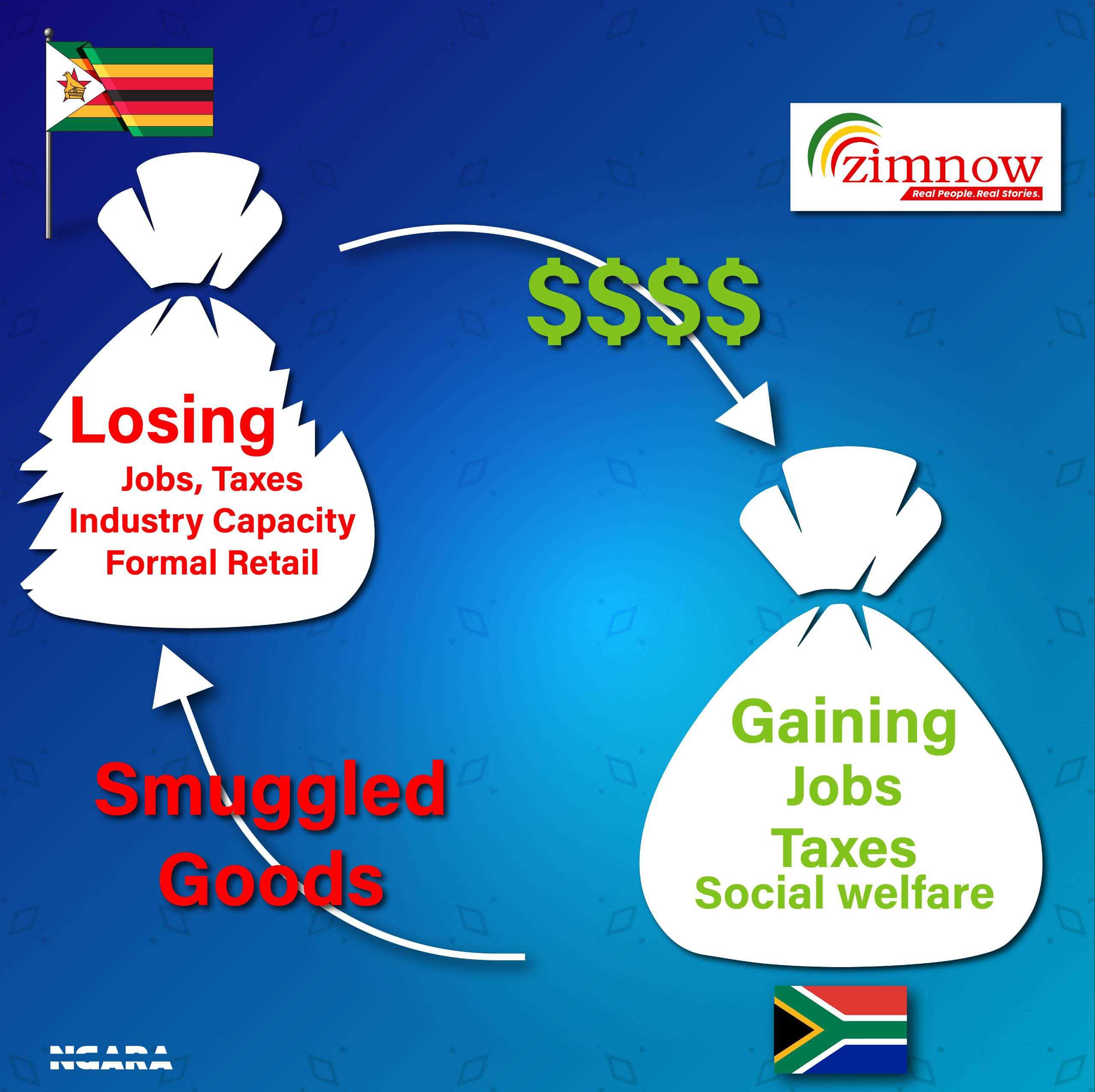

Closures and job losses in the formal retail sector can be directly linked to the proliferation of smuggled goods mostly from South Africa on Zimbabwe’s streets.

“Metro Peech was also unable to respond to the rise of informal traders. There is competition from the informal sector which is not subject to similar regulatory compliance.

“The informal sector traders generally do not comply with the payment of tax in comparison with established businesses such as Metro Peech & Browne,” said corporate rescue practitioner Dr Oliver Mtasa.

Metro Peech has closed six branches in Rusape, Marondera, Mutare, Murehwa, Shurugwi, and Mbare and its balance sheet looks terrible.

The retail giant at time of going under corporate rescue held only US$12.8 million assets far outweighed by its liabilities totalling US$21.7 million of which US$9 835 088 was owed to suppliers.

While street vendors almost exclusively trade in hard currency, and are thus protected from exchange rate fluctuations, the formal retailers a hamstrung by restrictive policies meant to protect the same consumer who then opts to go on the streets.

“… loss of customers continued disparity on the black-market vs interbank rate exchange rates to the ZWL/US$ have affected stock valuations. A conversion of Zimdollar loans to USD led to the “ballooning of the debt and interest payments,” reads the Dr Mtasa Metro Peech report.

Zim Now also spoke to a worker from Mohammed Mussa who said the popular grocery department is no longer as busy as it was in the past. “Things at Mohammed Mussa are not the same anymore. The grocery department has become really low in terms of sales. People are going for tuckshops to get their groceries,” he said.

He added that customers are forced to buy groceries from Mohammed Mussa when they have the local currency which they cannot use on the streets.

The story is the same for all formal retailers as they struggle to keep stock moving as the economy re-dolarises in spite of government’s stated policy saying the local currency is here to stay.

Millions flow out each month

A bus driver who plies the Johannesburg-Harare route and interviewed at Road Port told these writers that smuggling is at an alarming scale meaning millions of dollars are being siphoned out of the Zimbabwe into South Africa every month.

“There is a house called Kwa Mai Maria at a nearby village at the South African side where all the goods that need to be transported across the border unofficially are stored,” said the driver who reported that masses of goods are moved every day.

Unlike supermarkets and formal retailers, vendors do not have electricity bills, rentals and taxes to pay and most of them are also selling smuggled goods that have paid no duty.

While no official figure is available, several estimates do put the amount that Zimbabwe loses to smuggling in triple digit million annually with South Africa being the destination of a sizeable chunk of the total.

South Africa is Zimbabwe’s largest trade partner with the balance skewered in favour of the former as Zimbabwe imports many goods from its neighbour.

Zimbabwe's government has temporarily lifted duty on importation of basic commodities to control inflation, but the bus driver said a lot of goods are still smuggled across the border

Related Stories

Zimbabwean street vending boosting South African economy

Confederation of Zimbabwe Retailers, Denford Mutashu told Zim Now that smuggling hinders economic development as it stifles formal business in Zimbabwe.

“It affects viability and sustainability of compliant businesses. It must nip in the bud for economic progress and development. It's one of the biggest enemies to greater national good,” Mutashu said.

The dollars paid by Mukohwazhizha and thousands of other Zimbabweans accumulate into millions as they feed into smuggling chain and ends up in the formal South African economy, creating jobs and paying taxes that in turn fund amenities like education and health delivery in that country.

Zimbabwe National Chamber of Commerce spokesperson, Jephias Makiwa said with over 65% of the economy being informal, many people are all just trying survive through vending, but this has serious impact at national level.

“Smuggling implies that goods will be entering the country and exiting unaccounted for. Thus, the Government is losing billions of dollars annually on customs revenue as a result of goods entering through unofficial channels or undeclared at the ports of entry. In this regard, funding for service delivery and industrialisation is jeopardised,” Makiwa said.

“The textile and clothing industry has suffered massively from the proliferation of second-hand clothing over the years. Sales and revenue for the local industry and retailers have been negatively affected as they have to compete with dumped clothes and players who don’t contribute to the fiscus and sell in front of a store that is in similar business. Due to smuggling, any anti-dumping mechanism is rendered ineffective,” said Makiwa.

The impact of unpaid taxes and fees extends to councils. Harare Metropolitan Province Secretary for Provincial Affairs and Devolution said Harare has the largest number of vendors but collects low revenue.

As a result the city’s service delivery capacity is seriously hindered. For example finding a free public toilet in Harare and many other urban areas is a serious challenge.

Is there a solution in sight?

Harare City Council spokesperson, Hope Chizuzu said the authority is open to working with street vendors although he did not elaborate what strategy is in place to bring them into the system.

“All vendors selling their wares from undesignated places are breaking the law and we encourage them to approach the city for assistance.”

Mutashu said that there is need for the responsible authorities to ensure that there is effective taxation across all sectors instead of overburdening compliant entities.

“The responsibility of tax payment lies on each business enterprise big or small, formal or informal. It's a prerequisite. The amount of tax evasion in this economy is a great cause for concern. There is greater need to incorporate all for the country's development,” he said.

The Customs and Excise Act Chapter 23.02 and the Customs and Excise (General) Regulations Statutory Instrument 154 of 2001 provides for punitive provisions for various offences committed on import and export of goods.

The standard scale of fines was revised, promulgated and gazetted through Statutory Instrument (S.I.) 14A of 2023 on 22 February 2023, Statutory Instrument 209 of 2021 of 30 July 2021 was therefore revoked.

According to the SI, smuggling is a level 14 offence and attract a fine of US$2 000, while bribery and collusion attract US$5 000 fine.

Municipal and Zimbabwe Republic Police cops routinely raid illegal vendors and confiscate their goods.

But this does not seem to have any lasting impact and the vendors are back once again on the streets.

Vendors who spoke to Zim Now said it has become routine for them to just pay bribes to the raiding gangs and continue with their business.

The vendors also stash most of their goods in drains or in nearby shops in the safekeeping of complicit staff.

This article was produced after an investigation with funding from the Voluntary Media Council of Zimbabwe (VMCZ) Investigative Journalism fund on transnational crimes

Leave Comments