Audrey Galawu

Bindura Nickel Corporation has revealed that the company is faced with several challenges that threaten the survival of the business and the restart of the mine following the replacement of the SVR bull gear.

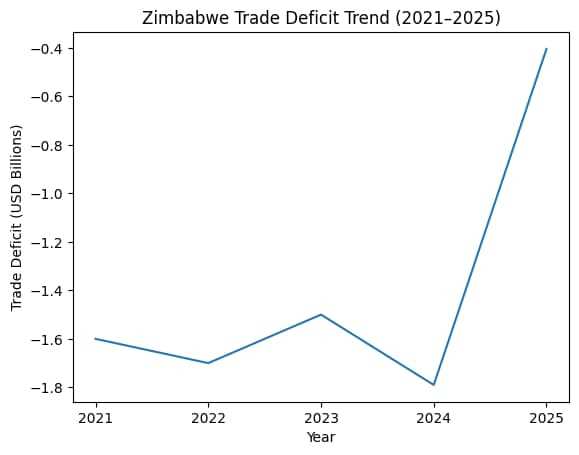

BNC highlighted that low Nickel price on international markets has been a major challenge for the company.

Nickel prices on the London Metal Exchange experienced a significant decrease of 48% during the calendar year 2023, dropping from US$31,200 per ton at the beginning of January to US$16,300 per ton at the end of December 2023.

In its 2024 interim results for the third quarter, BNC attributed the Nickel impulsive price fall to market surplus conditions which have arisen due to a surge in production from both China and Indonesia coinciding with subdued global demand.

“China has been producing high-purity class 1 Nickel, which is used in the production of Nickel sulphate and Nickel cathodes for Electric Vehicles. Indonesia, on the other hand, has been producing lower purity class 2 Nickel (nickel pig iron and ferronickel), which is used in products such as steel.

“The demand for Nickel has been negatively impacted by China’s slow recovery post Covid-19 lockdowns which has hurt the country’s construction sector and has weighed on demand for Nickel, particularly the type used for stainless steel.

“Demand was also affected by the slow uptake of EVs and increased competition from other battery alternatives utilising little or no Nickel such as Lithium Iron Phosphate,” reads the report.

Related Stories

The company has also been struggling with high domestic input costs, particularly electrical power costs, which have increased by more than 60% over the last 16 months.

The increase in electrical power cost compounded already inordinately high-cost structures threatening the viability of the local mining industry.

BNC further highlighted that the need for capital to refurbish underground mining mobile equipment and the concentrator plant, and development of the mine which has been lagging for the past two decades has been challenging.

“The Company recognises the need to acquire the required investment capital and for a sustainable electrical power tariff, considering the overall low resource grade and the prevailing depressed Nickel prices on global markets.

“Efforts are ongoing with respect to these critical issues that have a huge bearing on the viability of the business. The Company is cautiously optimistic that the success of these ongoing efforts will lead it onto a path of sustained gradual restart of the mine from the ongoing shutdown that started on 22 September 2023,” BNC noted.

The Nickel surplus for 2023 was estimated to be 200 000 tonnes (in an estimated 3.2 million tonnes market) while that of 2024 is expected to be 140 000 tonnes.

On the Safety, Health, and Environment front, the company attained a significant milestone by extending its fatality free shifts record to 4 018 010.

The last recorded fatality was in June 2015. No Lost Time Injuries were recorded in the quarter, unchanged from the same period last year.

Leave Comments