Zim Now Writer

Reserve Bank of Zimbabwe deputy governor Innocent Matshe has said that Zimbabwe’s central bank digital currency plans will not be thrown off course by the slow uptake of the eNaira in Nigeria.

“Certainly it’s a point to consider that there is hesitancy in the market

“We don’t think that it is a deterrent at this point, we just think that it is a learning point for us. We can then adopt measures to try and mitigate the factors that are causing that hesitancy in the Nigerian market,” Matshe said yesterday (Tuesday) in an interview at a conference near Port Louis, Mauritius.

Matshe said Zimbabwe is still exploring its option on the CBDC.

“It will have its own specificities. We are not expecting that it will be directly linked to any currency, we are keeping all our options open.”

Related Stories

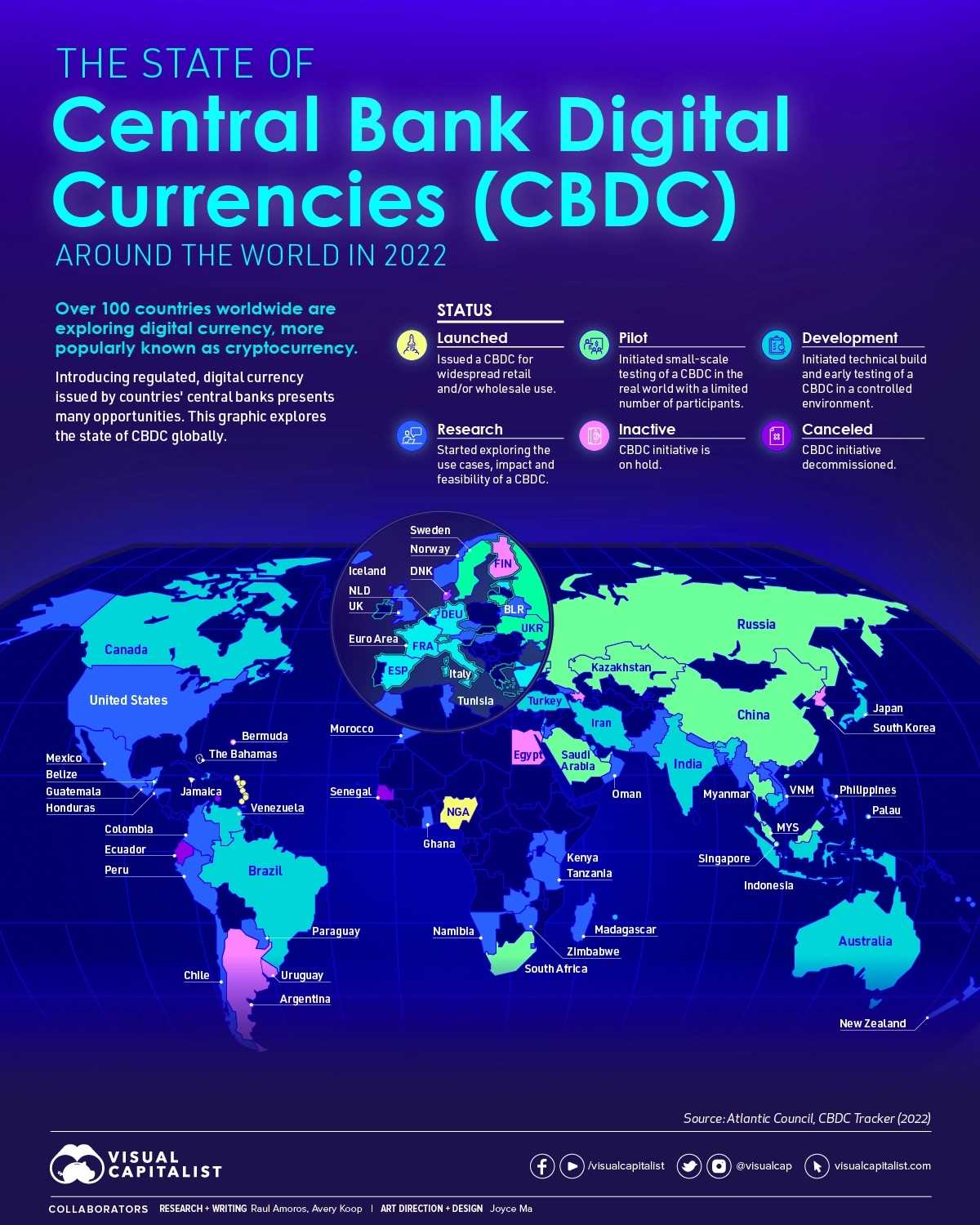

Matshe said Zimbabwe government teams been studying plans of CBDC for banks around the world and have visited several central banks including Ghana and China.

Nigeria was the first African country to introduce a CBDC but uptake has been very low with less than 0.5% Nigerians transacting in the digital currency.

Nigeria’s central bank has been offering incentives to drive the market to the digital currency and these include discounts for drivers and passengers of three-wheeler taxis to using the eNaira.

Digital currencies have been around since the 1980s, but didn’t become widely popular until the launch of Bitcoin in 2009. Today, there are thousands of digital currencies in existence, also referred to as “cryptocurrencies”.

A defining feature of cryptocurrencies is that they are based on a blockchain ledger. Blockchains can be either decentralized or centralized, but the most known cryptocurrencies today (Bitcoin, Ethereum, etc.) tend to be decentralized in nature. This makes transfers and payments very difficult to trace because there is no single entity with full control.

Government-issued digital currencies, on the other hand, will be controlled by a central bank and are likely to be easily trackable. They would have the same value as the local cash currency, but instead issued digitally with no physical form.

Zimbabwe already has an RTGS currency which is mostly in digital form as ordinary people often struggle to access hard cash.

Leave Comments