Nyashadzashe Ndoro

CHIEF REPORTER

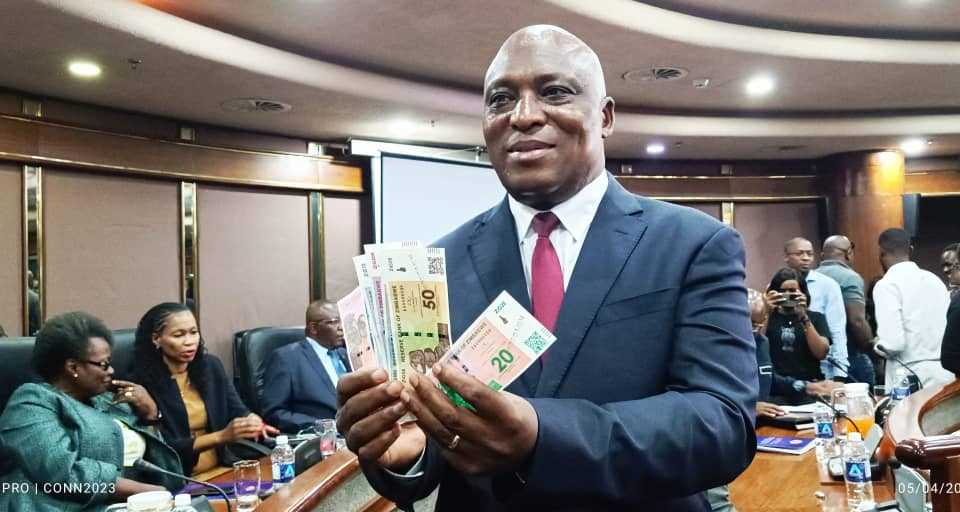

Just a month after its highly-anticipated launch, Zimbabwe’s new currency, Zimbabwe Gold, is facing a severe shortage, leaving businesses and residents scrambling for alternatives and raising concerns about the currency’s effectiveness and impact on the economy.

The scarcity of ZiG notes and coins has resulted in most transactions being conducted electronically, with physical cash remaining in short supply.

In an interview with Zim Now, Masimba Manyanya, former Reserve Bank of Zimbabwe Chief Economist, expressed his concerns about the situation, stating that the unavailability of the new notes and coins may lead to the “erosion of confidence in the currency among the public”.

“There are so many problems already emerging with the introduction of ZiG, there is erosion of confidence in the currency among the public. We are almost into June, almost a full month after the launch of the ‘structured currency’ and we are all still yet to see the new notes and coins,” Manyanya said.

He further highlighted the importance of a nation having a proper currency, saying, “Zimbabwe deserves a currency of her own, a currency that qualifies as a proper unit of account, store of value, medium of exchange, among other properties. When a nation cannot properly account for its wealth, then there are serious challenges in the market, and evidently, someone, usually the poor, will lose value during market exchanges.”

Manyanya also criticised the method that was used in launching the ZiG.

“The ZiG launch did not follow standard protocols of consultation within the National Assembly. No one in the Legislatures really knew what Structured Currency meant at the time it was introduced. Which throws in doubt and undermines public confidence, an important ingredient of any monetary policy initiative,” he said.

“The failure of the Government of Zimbabwe to even stick to their own schedule of introducing ZiG short-changes the poor, who particularly depend on small denominations for small transactions like transport and day-to-day household expenditure items.

“Because of the unavailability of small change, the poor have to pay double when they get on the bus or in the tuckshops. At an aggregate level, this represents a massive outflow of value from the poor, especially, to propertied classes who run private transport and trading services.”

Related Stories

In response to the concerns, RBZ Governor, John Mushayavanhu, issued a statement saying that the RBZ issued ZiG coins and notes in sufficient quantities to meet demand for small transactions and change.

He, however, acknowledged that there has been a breakdown in the cash transmission mechanism, with low levels of ZiG coin withdrawals from commercial banks.

To address this, Mushayavanhu encourages corporates and individuals to approach their banks and withdraw coins for their transactional convenience. He added that the central bank has maintained a constant ratio of currency in circulation to other monetary aggregates and reaffirms its commitment to providing adequate cash and ensuring the efficiency, safety, and soundness of the national payments system.

The RBZ also promotes a cash-lite economy and encourages the use of electronic means of payment, which Mushayavanhu says are key to financial inclusion.

“The Reserve Bank of Zimbabwe wishes to advise the transacting public that ZiG coins in denominations ZiG1, ZiG2, and ZiG5 were issued in quantities sufficient to meet demand for small denominations used to conduct low-value transactions as well as usage of small denominations for change.

“In addition, the Bank has also issued ZiG10 and ZiG20 notes in adequate quantities consistent with the optimal currency issuance ratios,” he said.

“The Bank reaffirms its unwavering commitment to ensuring the public’s convenience by providing adequate cash. It also assures the efficiency, safety, and soundness of the national payments system, which is well-suited to support electronic means of payment.”

Tuckshop owner who preferred to be called Mama Cindy expressed her frustration with the shortage of ZiG.

She told ZimNow: “As a shop owner, I’m finding it difficult to conduct daily transactions due to the shortage of ZiG notes and coins. Customers are struggling to get change, and I’m losing sales as a result. I urge the RBZ to address this issue urgently and ensure a steady supply of the new currency to avoid disrupting business operations.”

Meanwhile, the International Monetary Fund this week praised Zimbabwe’s introduction of the ZiG, as a significant positive move.

In its first comment on the new currency since its introduction last month, an IMF spokesperson said: “The launch of ZiG represents a crucial policy decision, accompanied by a range of supporting measures, including adjustments to monetary, exchange rate, and fiscal policies.”

Leave Comments