Audrey Galawu

Assistant Editor

Axia Corporation’s Distribution Group Africa division faced a mixed performance across its regional operations during FY2024.

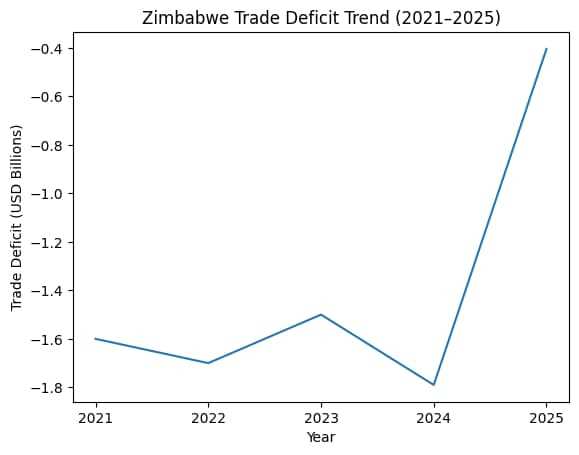

In Zimbabwe, DGA reported a 23% decline in turnover, driven by a 45% drop in volumes compared to the previous year. This downturn was primarily due to a strategic restructuring initiative, which included transitioning one of the division’s major distribution companies into a joint venture with a third-party partner.

Additionally, the country's modern trade sector continues to grapple with increasing informalisation, further pressuring sales volumes. Despite these challenges, management is optimistic that recent acquisitions of new agency contracts will help rebound revenues in the upcoming financial year.

In contrast, DGA Malawi performed well, with turnover increasing by 47% in Kwacha terms, although volume growth remained flat. The significant revenue increase was primarily driven by price adjustments, which helped counterbalance Malawi's persistent foreign currency shortages.

"Strong partnerships with key suppliers enabled DGA Malawi to maintain steady product flow and mitigate the impact of grey market competition. In USD terms, revenue grew by 9%, indicating the division’s ability to adapt in a challenging economic environment.

"Meanwhile, DGA Zambia faced a 14% decline in volumes, leading to an 11% revenue drop in USD terms, despite a 14% rise in Kwacha terms. The Zambian Kwacha’s depreciation—37% against the US Dollar and 43% against the South African Rand—heavily impacted DGA Zambia's performance.

"The price increases implemented to cushion against inflation and currency devaluation strained consumer demand. Nevertheless, DGA Zambia managed to secure sufficient foreign currency to meet its trade obligations, demonstrating strong financial management," reads the report for FY2024.

Related Stories

Despite DGA’s mixed results, Axia’s overall FY2024 performance was bolstered by strong growth in its other divisions.

The TSVH Group, which includes popular brands like TV Sales & Home, Restapedic, and Legend Lounge, delivered robust financial results. Year-to-date revenue for the group grew by 7%, with volumes increasing by 15%, underscoring the strength of Axia’s retail brands. TV Sales & Home, in particular, expanded its footprint with the opening of four new Bedtime stores in Harare and Gweru, capitalising on growing consumer demand.

Restapedic, a key player in the bedding sector, saw its volumes surge by 54%, while revenues climbed 31%. This impressive growth was largely driven by improved production capacity at its new facility in Sunway City and secured lines of credit that ensured a steady flow of raw materials. Restapedic’s focus on operational efficiencies and enhanced supply chain management helped it meet rising market demand, contributing to a 47% increase in production to 42,204 units. Management is now aggressively pursuing regional market expansion, building on this strong performance.

Legend Lounge also delivered positive results, with a 6% increase in revenue and a 15% rise in production volumes. As management works to mechanize labor-intensive processes, costs are expected to decrease, further boosting profitability and enhancing product margins.

Axia’s Transerv division had a strong year, with revenues increasing by 11% on the back of a 6% rise in volumes. A key driver of this growth was the division’s introduction of solar products, which have seen significant demand since their launch in late 2023.

"The rising interest in alternative energy solutions has positioned Transerv as a leader in this space, with solar products making a notable contribution to sales growth. Additionally, the expansion of credit sales, particularly in solar products, has further strengthened Transerv’s revenue streams.

"The division also expanded its retail footprint, opening eight new stores, including three launched in the final quarter of FY2024, and two service centers. With plans to continue expanding its retail network and product range in FY2025, Transerv is well-positioned to capitalize on emerging market opportunities in the renewable energy sector."

Axia’s FY2024 performance unfolded against a backdrop of significant macroeconomic volatility. In Zimbabwe, the widening gap between the official and parallel market exchange rates, which reached 54% by the end of the quarter, posed challenges for businesses operating in the local currency.

Leave Comments