Audrey Galawu

Assistant Editor

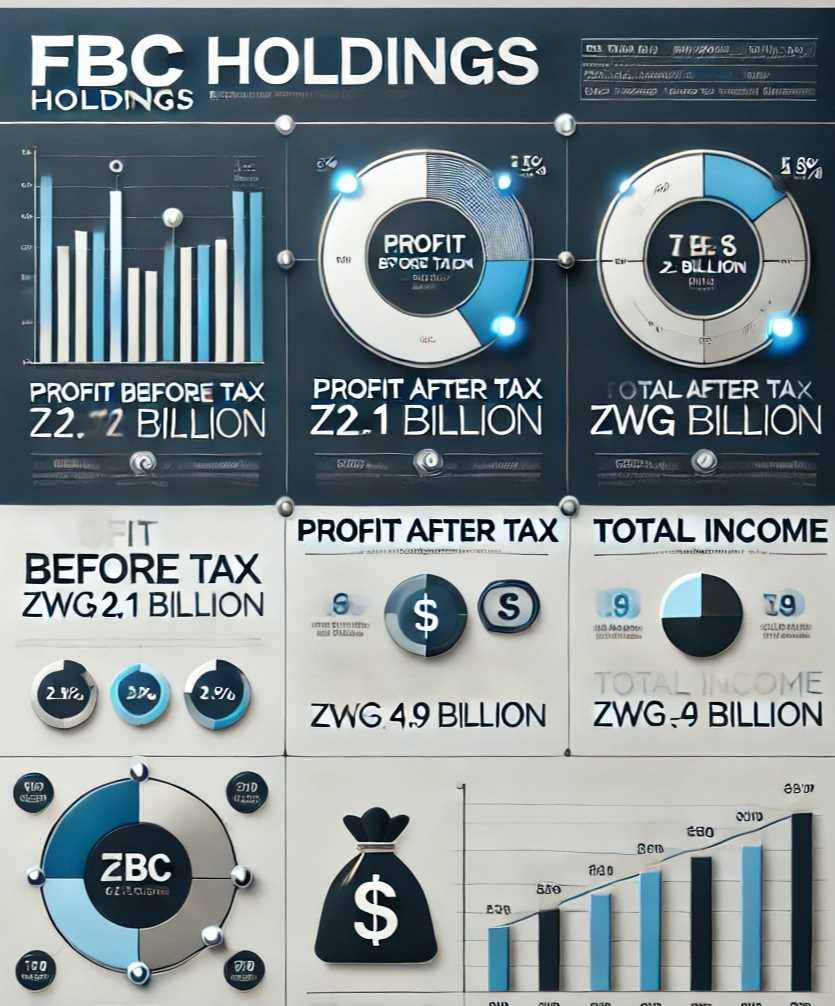

FBC Holdings Limited has announced a robust third-quarter financial performance, posting a profit after tax of ZWG$1.9 billion. This result underscores the Group’s resilience and ability to navigate Zimbabwe's challenging economic environment.

For the period ending September 30, 2024, FBC Holdings reported: Profit After Tax: ZWG$ 1.9 billion, Profit Before Tax of ZWG$2.1 billion and and a Total Income of ZWG$4.9 billion.

Related Stories

The group’s disciplined approach to cost management is reflected in its operating expenses of ZWG$1.97 billion and a cost-to-income ratio of 40%, positioning it for sustained profitability.

The operating environment during the third quarter remained complex, influenced by factors such as currency volatility, inflation, and the introduction of Zimbabwe Gold (ZiG) in April 2024. While these challenges continued to affect business operations, FBC’s diversified business model provided a strong buffer against market fluctuations.

FBC’s strong performance was primarily driven by significant income from foreign currency dealing and trading activities, which helped offset inflationary pressures and the impact of a volatile exchange rate. Despite the economic headwinds, the Group’s ability to maintain profitability highlights its strategic agility.

The group remains confident in its ability to continue capitalizing on emerging opportunities, supported by its experienced management team and diversified financial services. As of September 30, 2024, the Group’s shareholder funds stood at ZWG 3.9 billion, further strengthening its financial position.

Leave Comments