Nyashadzashe Ndoro

Chief Reporter

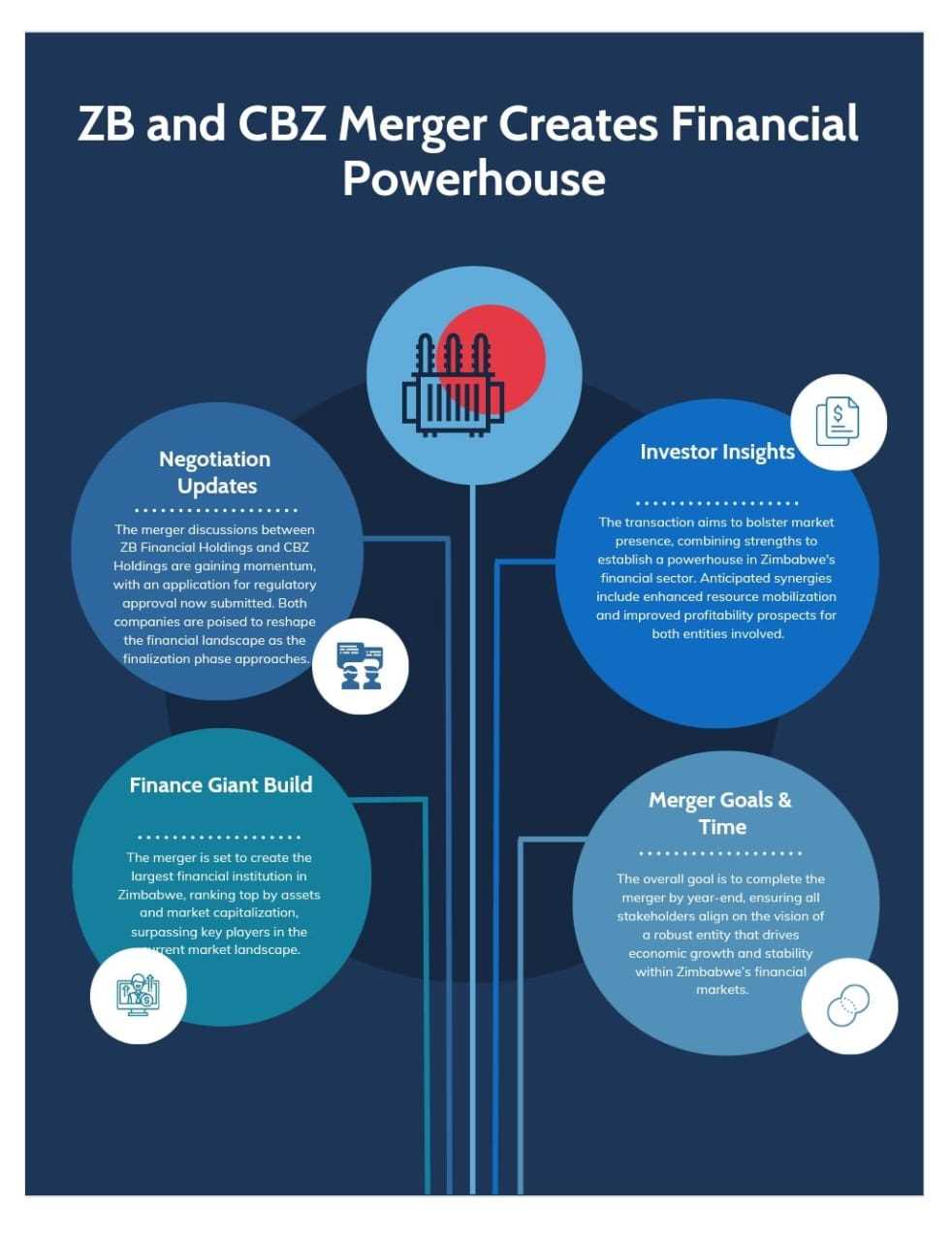

ZB Financial Holdings has announced that the negotiation process for the merger with CBZ Holdings has progressed, and the shareholder concerned has made an application for regulatory approval.

ZB Holdings, a public company incorporated in the Republic of Zimbabwe, on Wednesday issued a further cautionary statement to its shareholders and the investing public.

The merger process is at an advanced stage, and regulatory approval is yet to be obtained for the transaction. If concluded successfully, the transaction may have a material effect on the company's securities price.

“...shareholders and investing public are advised that the negotiation process has progressed, and the shareholder concerned has made an application for regulatory approval. The process is at an advanced stage and regulatory approval is yet to be obtained for the transaction.

“The transaction, if concluded successfully, may have a material effect on the Company's securities price,” ZB Holdings General Counsel, Tinashe Masiiwa said in a notice to shareholders.

The merger between CBZ Holdings and ZB Financial Holdings is expected to create a behemoth that will dominate Zimbabwe's financial and capital markets.

The company's formation is expected to be the largest financial institution, the most aggressive by assets in terms of net present value, and the largest by market capitalisation. It is likely to be the largest institution on the Zimbabwe Stock Exchange, surpassing the current big players, such as beverages maker Delta Corporation and telecommunications giant Econet Wireless Zimbabwe.

The ZSE is dominated by Delta Corporation, the bourse's most valued entity, followed by Econet Wireless Zimbabwe. Few months ago, CBZ Holdings' chairperson, Luxon Zembe stated that ZB Financial Holdings presented the most attractive prospects for the merger, as the country's second-best capitalised banking group after CBZ.

Related Stories

The merger is part of a grand scheme that also includes leading insurance services provider First Mutual Holdings Limited, with which the banking group is also pursuing a merger.

CBZ Holdings is creating an institution that is Zimbabwean, by Zimbabweans, which Zimbabweans can be proud of on the ZSE, driving the economy and economic development. The group is going through the final phase of the merger.

"We are creating an institution that is Zimbabwean, by Zimbabweans, which Zimbabweans can be proud of on the Zimbabwe Stock Exchange, which drives their economy and economic development,” Zembe said.

CBZ Holdings has already secured exchange control approval for the transaction, and there have been no hurdles in securing the nod from the ZSE, where both institutions are listed.

The target is to consummate the merger transactions for CBZ, ZB Holdings, and FMHL by the end of the year. All shareholders in the respective institutions are on the same page in terms of the need to combine the institutions to create a single entity with a bigger balance sheet for resource mobilisation and better prospects for profitability and growth.

The coming together will result in a very strong institution with a good balance sheet to be able to mobilise good resources, command a good share price on the market.

CBZ Group and ZB Financial Holdings are presently well-capitalised individually, in line with regulatory requirements, pointing out that it is ZB Financial Holdings' building society that requires fresh capital. Commercial banks are required to have a minimum capital of US$30 million.

Two banking institutions that are already well-capitalised and are meeting the regulatory capital requirements, when brought together, will release capital or resources for support to businesses.

CBZ Holdings settled on ZB Financial Holdings and FMHL for the mergers given the three institutions' dominant positions in the banking, insurance, and property sectors.

They want to create a very strong insurance company, as insurance companies come in terms of medium- to long-term mobilisation of resources through policies and a lot of other instruments.

Leave Comments