Philemon Jambaya

Zim Now Editor

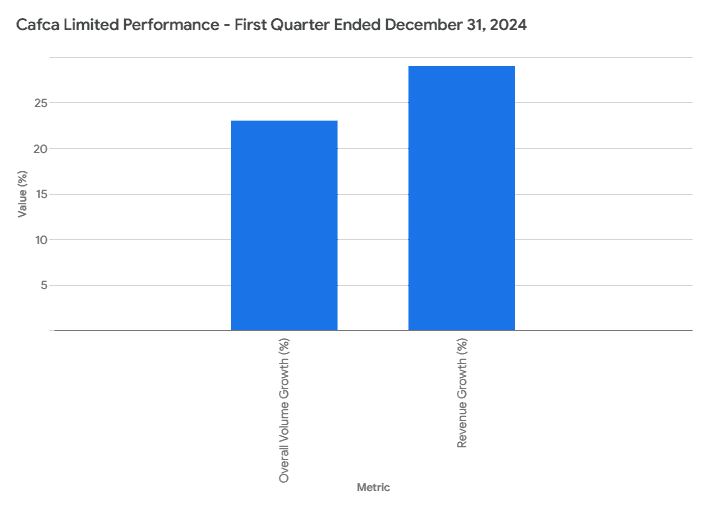

Cable manufacturing giant Cafca Limited has revealed a complex picture of resilience and challenge in its latest trading update, reporting a 29% surge in revenue for the first quarter ended December 31, 2024, amidst a backdrop of persistent economic volatility. The company’s performance reflects the broader economic landscape of Zimbabwe, where businesses are grappling with a confluence of policy shifts, currency instability, and power supply disruptions.

Despite the impressive revenue growth, driven by a 23% increase in overall volumes and a remarkable 74% jump in aluminum volumes, Cafca’s report paints a vivid picture of the headwinds faced by Zimbabwean industries. The period under review was marked by significant adjustments, including the September 2024 currency devaluation, a slowdown in government infrastructure spending, and escalating power outages. These factors, coupled with the rise of informal retail and a surge in smuggled goods, created a challenging operating environment.

Related Stories

"The market experienced an increase in smuggled products, disrupting value chains and forcing retailers and manufacturers to adapt rapidly," Cafca stated, highlighting the competitive pressures facing domestic producers. The shift towards US dollar transactions, driven by market preferences and the limited circulation of Zimbabwe Gold, further complicated the economic landscape.

The mining sector, particularly gold production, provided a degree of stability, but its positive impact was offset by the severe drought affecting agricultural output and the softening of commodity prices. "The relatively stable performance in the mining sector, buoyed by gold production, was unable to offset the negative impact of the drought on agricultural output and the weak commodity prices of other minerals on the Zimbabwean economy," the company noted.

Recognizing the persistent nature of these challenges, Cafca is now focusing on bolstering its operational capabilities. "The operating environment in Zimbabwe continues to pose challenges, influenced by policy changes, currency instability and power supply challenges," the company acknowledged. To navigate these turbulent waters, Cafca is prioritizing operational effectiveness to protect margins and drive profitability.

"While it is expected that the government will take measures to address these gaps, Cafca is working to improve its operational capabilities to constantly compete and meet our customers’ needs," the company stated. "To that end, Cafca will focus on operational effectiveness to protect margins and drive profitability."

Despite the economic uncertainties, Cafca's robust volume growth, particularly in aluminum, demonstrates the company's ability to adapt and capitalize on market opportunities. The 13% growth in its copper-based business further underscores its resilience. However, the company's future performance will depend heavily on its ability to navigate the ongoing economic challenges and implement effective strategies to mitigate their impact.

Leave Comments