Audrey Galawu- Assistant Editor

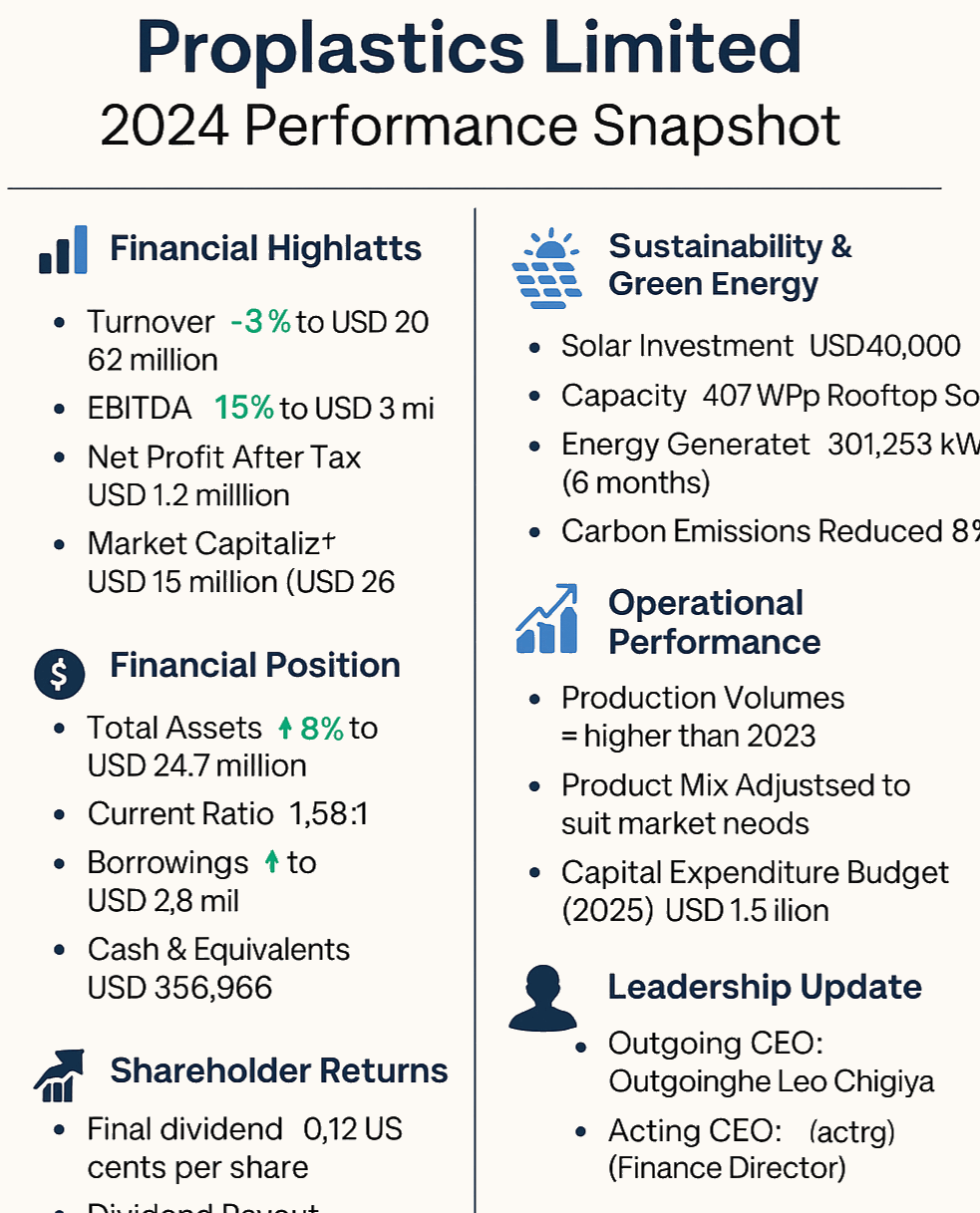

Despite a marginal 3% dip in turnover to US$20.6 million in 2024, Proplastics Limited delivered an impressive financial performance powered by higher volumes and operational efficiency.

The decline in revenue—mainly caused by an unfavorable product mix and aggressive pricing in a highly competitive environment—did little to undermine the group’s profitability. A 15% increase in EBITDA to US$3 million underscored the resilience of Zimbabwe’s sole listed plastic piping manufacturer.

The results reflect Proplastics’ ability to recalibrate and thrive under pressure, navigating a turbulent macroeconomic landscape marked by currency instability, inflationary pressures, and power supply disruptions.

The group’s after-tax profit surged by 131% to US$1.2 million from US$519,877 in the prior year, a result of tight cost controls, strategic restructuring, and a notably stronger second half. The first half of 2024 was marred by economic chaos, including a 400% devaluation of the Zimbabwe dollar, which was eventually scrapped and replaced by the new Zimbabwe Gold currency.

Proplastics Chairman Gregory Sebborn said the business remained grounded during the volatility, with swift adjustments to procurement and operating strategies.

“We were able to contain overheads, ramp up production in the second half, and maintain profitability despite market and currency shocks,” he said in his statement accompanying the results.

One of the standout achievements of the year was the successful commissioning of a 407kWp rooftop solar system at the company’s Harare plant. Costing over US$340,000, the solar installation generated 301,253 kWh within six months and reduced the firm’s carbon footprint by 8%.

Related Stories

This move is part of a broader commitment to environmental, social, and governance values. Proplastics reported recycling the majority of its waste, maintaining compliance with environmental laws, and achieving full adherence to ISO 9001 and ISO 14001:2015 standards. No fines or sanctions were recorded in the reporting period.

Despite the marginal drop in revenue, Proplastics strengthened its financial position. Total assets grew by 8% to US$24.7 million, while the current ratio improved to 1.58:1, reflecting strong short-term liquidity.

The company’s gearing ratio increased to 15% (up from 1.5%) as borrowings rose to US$2.8 million, signaling a strategic effort to inject working capital and fund growth.

Cash and cash equivalents at year-end stood at US$356,966. A capital expenditure budget of US$1.5 million has been earmarked for 2025, aimed at acquiring new production machinery and deepening investment in efficiency and quality.

Despite a contraction in market capitalization to US$15 million—down from US$26 million in the prior year due to share price depreciation—the board declared a final dividend of 0.12 US cents per share, slightly higher than the 0.11 cents declared in 2023. This move reaffirms the company’s commitment to delivering shareholder returns, even amid a cautious market sentiment.

The year also marked a leadership transition, with long-serving Chief Executive Officer Kudakwashe Leo Chigiya stepping down in February 2025 after over a decade at the helm. He played a key role in modernizing operations and guiding Proplastics through some of Zimbabwe’s toughest economic cycles. Finance Director Paschal Changunda is currently serving as Acting CEO as the board evaluates permanent succession options.

With the construction and civil engineering sectors expected to remain strong and infrastructure projects on the rise, Proplastics is positioning itself to benefit from increased demand in 2025. Improved water levels at Kariba are also expected to ease electricity supply constraints, boosting productivity.

“Though the environment remains unpredictable, our foundations are firm and our outlook positive,” Sebborn added.

Leave Comments