Audrey Galawu- Assistant Editor

Access to credit in Zimbabwe is tightening, with many borrowers struggling to repay loans amid high interest rates and shrinking disposable incomes.

The latest figures from the Reserve Bank of Zimbabwe’s Mid-Term Monetary Policy Statement paint a stark picture of a population increasingly strained by debt obligations.

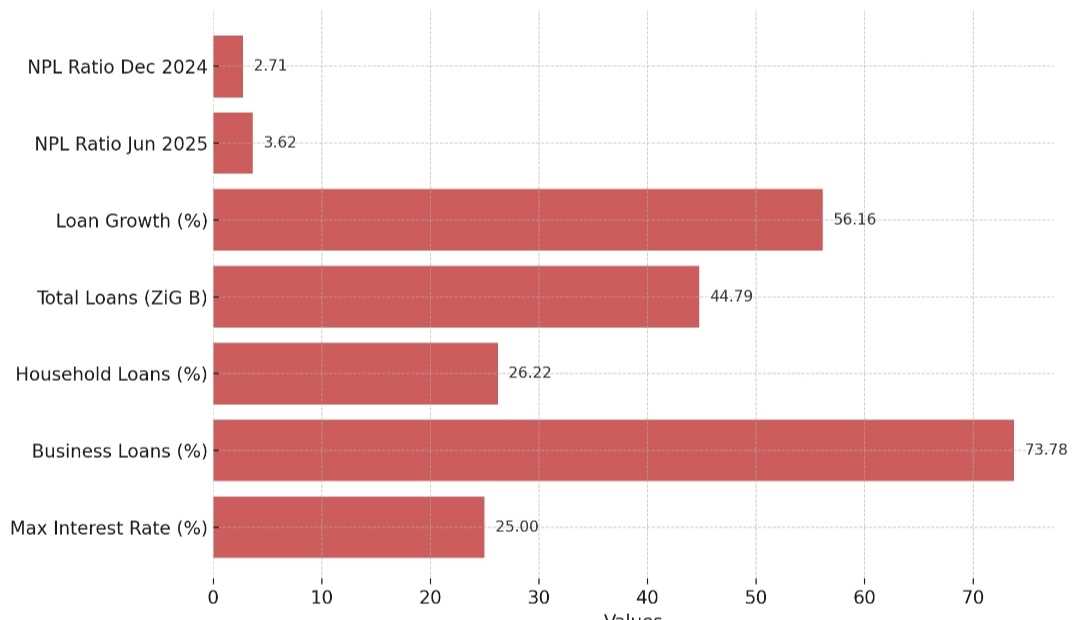

As of June 30, 2025, the banking sector’s non-performing loans ratio rose to 3.62%, up from 2.71% in December 2024. While the figure remains below the internationally acceptable threshold of 5%, the uptick reflects growing repayment challenges across sectors.

Borrowers are particularly burdened by the cost of credit. Lending rates, especially in the microfinance sector, have soared to levels that many households cannot sustain. Some institutions are charging as much as 25% monthly interest, well above the average of 7%–15%.

“The Reserve Bank is instituting appropriate corrective supervisory actions on these microfinance institutions,” reads the MPS, referencing Section 37 of the Microfinance Act. It adds that exploitative pricing and over-indebtedness are now under scrutiny.

In the broader banking system, affordability remains a critical concern despite increased credit activity. In the first half of 2025, total loans and advances from banks increased by 56.16% to ZiG$44.79 billion, up from ZiG28.67 billion in December 2024.

But this growth has not translated into economic relief for borrowers. The sharp increase in loan volumes, coupled with rising living costs and limited wage growth, has led many to default or delay repayments.

Although business borrowers account for the bulk of loan value — 73.78% of total loans — the remaining 26.22% taken up by households represents a significant stress point. Many individuals took out loans during currency transitions and are now facing tighter repayment conditions under a more stable but less forgiving ZiG regime.

Financial experts warn that without robust debt management education and stricter regulation of lending practices, Zimbabwe could face a worsening debt trap among lower-income earners.

The Reserve Bank has committed to enhancing credit risk management across institutions and promoting responsible lending.

“To curb over-indebtedness and protect consumers, the Bank continues to monitor interest rate practices, enforce capital adequacy, and push for digitised credit checks,” the MPS states.

Leave Comments