Audrey Galawu- Assistant Editor

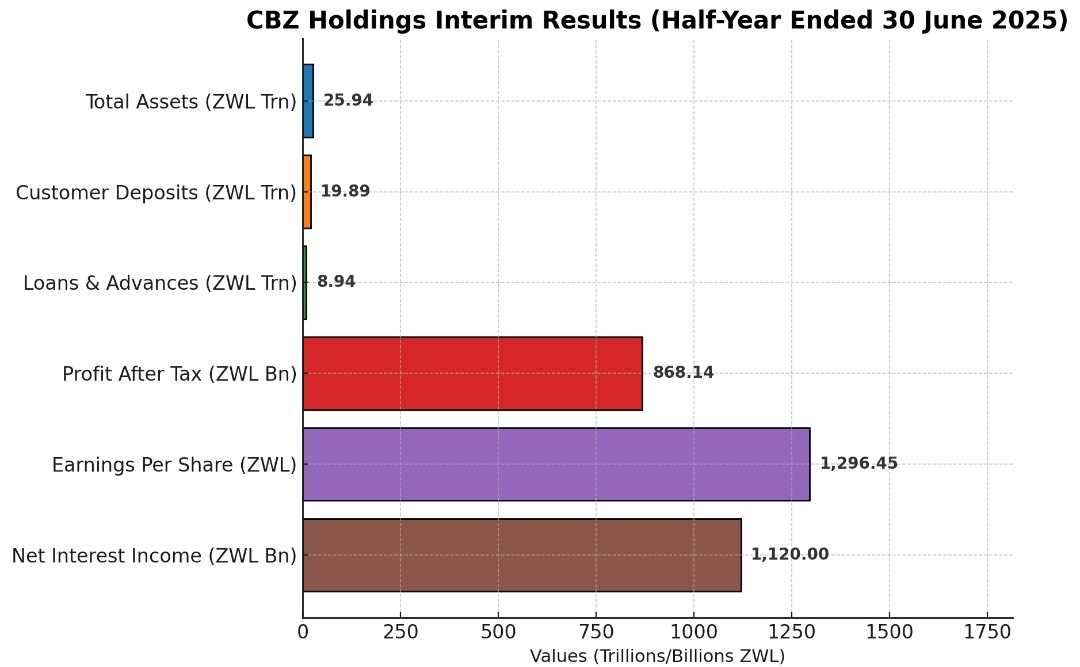

CBZ Holdings Limited has strengthened its balance sheet with total assets rising 17% to ZWL$25.94 trillion for the half year ended 30 June 2025, up from ZWL$22.1 trillion in the comparative period last year.

The asset growth underscores the group’s expanding market footprint and its ability to mobilise deposits while advancing credit across key sectors of the economy.

Group Chairman Marc Luxon Zembe said the performance reflects resilience in a difficult economic environment.

“The group delivered a commendable set of results, underpinned by focused execution of its growth strategy, continued efficiency gains, and a strong emphasis on sustainability,” he said.

Profit after tax grew 32% to ZWL$868.14 billion compared to ZWL$658.52 billion in 2024, supported by robust growth in customer loans, effective cost management, and stronger earnings from the group’s diversified business portfolio.

Earnings per share stood at ZWL$1,296.45, while net interest income reached ZWL$1.12 trillion.

Customer deposits rose 19% to ZWL$19.89 trillion, reflecting stronger public confidence in the Group’s banking operations. Loans and advances to customers climbed 17% to ZWL$8.94 trillion, driven largely by lending into agriculture, infrastructure, and other productive sectors.

Related Stories

“We remain committed to playing our part in financing key sectors of the economy, while ensuring prudent credit risk management to safeguard the Group’s financial soundness,” Zembe said.

CBZ also declared an interim dividend of ZWL$125.50 per share, payable to shareholders registered at close of business on 30 August 2025.

Beyond financial growth, Zembe emphasised sustainability as a strategic pillar.

“CBZ Holdings continues to embed sustainability at the core of its business model, recognizing that long-term profitability is inseparable from responsible business practices,” he said.

The group is investing in digital transformation to improve efficiency, enhance customer experiences, and support financial inclusion.

CBZ said it would leverage its strong balance sheet, diversified services spanning banking, insurance, investments, and agro-business, as well as its dedicated workforce to sustain growth in a volatile operating environment.

“The group remains well-positioned to navigate the evolving operating environment, leveraging its strong balance sheet, diversified business model, and dedicated workforce,” Zembe said.

Leave Comments