Zim Now Analysis Desk

The government has launched a ZWG$100 million (roughly equivalent to US$3.9m at current rates) Industrial Development Fund, an intervention intended to breathe life into a manufacturing sector that has, for years, been constrained by outdated equipment, high borrowing costs, and heavy dependence on imports.

Who qualifies?

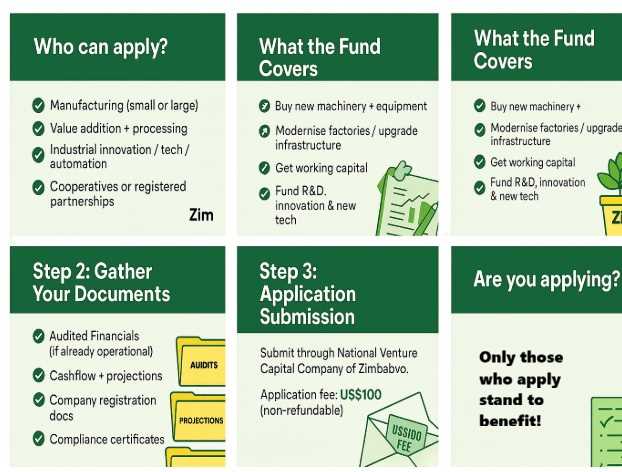

Eligible applicants include manufacturing companies at any scale, cooperatives, registered partnerships, and value-adding processors. Innovation-driven firms that develop industrial technology or seek to adopt automation and research-led improvements may also qualify. The strongest prospects are likely to be those that unlock value chains, for example, textile firms linked to cotton growers, food processors connected to horticulture, or proposals that complete the chain from mine to mineral beneficiation.

Cost and criteria

Applications must include a bankable business plan, audited financials for existing operations, capacity and compliance documentation, as well as acceptable security. There is also a nonrefundable application fee of US$100. While security requirements may limit SME participation, they exist to safeguard the fund against abuse or loss.

The good news

Related Stories

Unlike commercial loans that demand high collateral and expensive interest, the IDF is structured as patient capital. Beneficiaries are expected to enjoy more flexible repayment terms, which, if efficiently administered, may allow them to retool, automate, and scale production rather than operate in crisis mode. The National Venture Capital Company of Zimbabwe will manage applications, and firms across all ten provinces are eligible to apply.

But…

At current exchange levels the facility is valued at just under US$4 million, a figure that immediately raises questions about real purchasing power since most machinery, technology, and industrial inputs are priced in United States dollars. Without a viable conversion mechanism or partial foreign currency allocation, there is a risk that the fund could lose value before capital equipment is acquired.

Putting the fund to the test

A ZWG$100 million facility will not transform the industrial landscape overnight. However, if allocations are merit-driven, transparently administered, and concentrated on catalytic projects rather than familiar favorites, the IDF could spark meaningful renewal in an economy that has seen too many factories fall silent.

If effectively deployed, the fund could help modernize inefficient plants, increase domestic manufacturing output, reduce imports, and stimulate local supply chains from raw materials to finished goods. This is the pathway that moves the country away from raw commodity exports towards higher-value finished products and long-term wealth creation.

The key questions now are whether approvals will favor performance over proximity, whether SMEs will genuinely access support, and how outcomes will be tracked. The value of this fund will not be measured in announcements but in factories running, machines turning, and Zimbabwean goods returning to the market.

Leave Comments