Gold enters 2026 on the back of an exceptional year in which it gained more than 60%, fuelled by geopolitical conflict, sustained central bank purchases and a weakened US dollar.

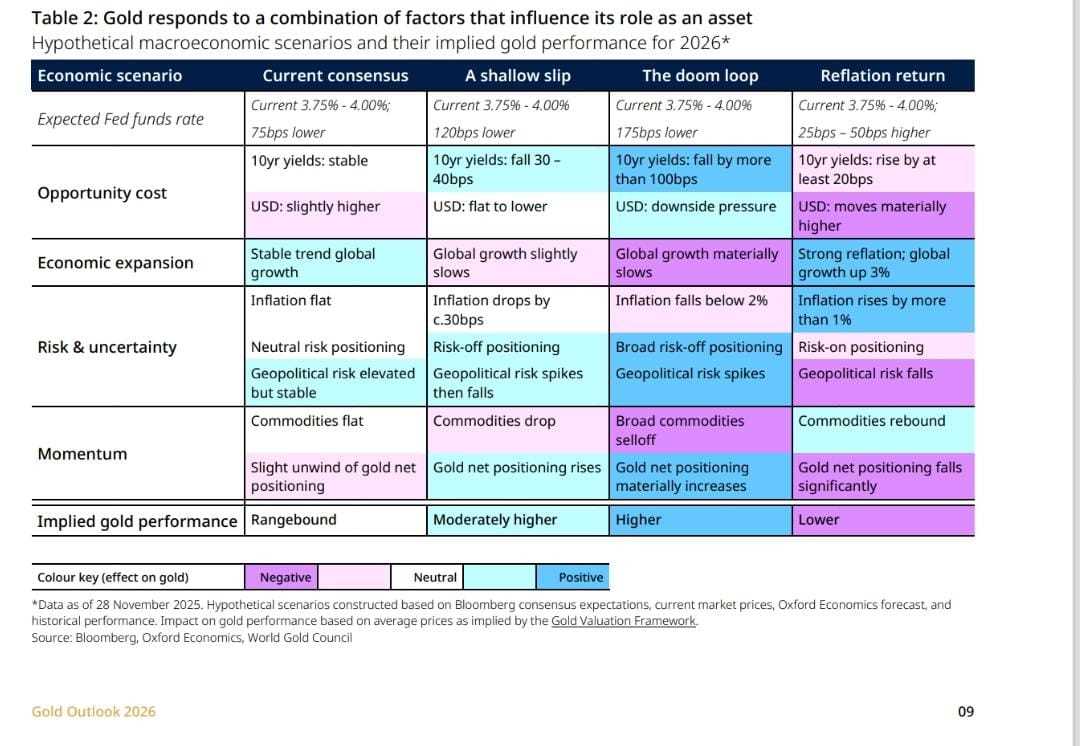

But the metal’s next chapter is far less predictable, with the World Gold Council warning that shifting global growth prospects and incoming policy directions under President Trump could tilt prices sharply in either direction.

In its Gold Outlook 2026 report, the Council sets out a range of possible paths for the market, from steady but modest appreciation to steep corrections. While the baseline expectation across global markets is for largely stable trading ranges, analysts caution that the growing number of “tail risks” could upend those forecasts.

Potential Upside as Global Momentum Softens

The report outlines two main routes through which gold could extend its rally. The first involves a mild cooling of the US economy, seen through softer labour figures and a tapering of the market optimism that surged during the AI boom. In this case, if the Federal Reserve opts to deliver more interest-rate cuts than the currently expected 75 basis points, the resulting weaker dollar and decline in yields could lift gold by 5–15%.

A second, more dramatic scenario centres on a synchronised global downturn. If recessionary pressures deepen, trade tensions escalate and central banks revert to aggressive monetary loosening, the Council projects gains of 15–30%. Under such stress, demand from gold-backed ETFs would likely recover after years of outflows.

Central bank appetite, which saw 750–900 tonnes added to official reserves in 2025, is expected to remain strong—particularly among emerging markets still working to diversify away from the US dollar.

Related Stories

Risks from Stronger Growth and Policy Shifts

The Council also warns that gold could face significant headwinds if Washington successfully engineers a strong economic expansion. A scenario of faster US growth, firmer inflation and renewed Fed tightening would weigh heavily on the metal. Under this outlook, prices could fall by 5–20% as investors rotate back into equities, while a firmer dollar trims safe-haven flows. ETF outflows would likely intensify, though some value-driven buying in consumer markets could cushion the downside.

Consensus forecasts for 2026 global GDP growth, currently around 2.7–2.8%, and expectations for largely stable yields point to limited price swings of roughly -5% to +5% from late-2025 levels. But analysts stress that these projections depend on macro stability that remains far from guaranteed.

Supply-Side Factors Add Another Layer of Risk

Market volatility may be amplified by supply trends that are proving difficult to predict. Gold recycling remains relatively low, partly because more than 200 tonnes of Indian jewellery remain tied up in loan collateral programmes.

This has supported prices, but the Council warns that an economic shock could trigger forced liquidations that flood the market with additional supply.

Elevated measures of market stress—such as rising skew and kurtosis in major equity indices—continue to make gold an attractive hedge for investors seeking insulation from uncertainty.

The report notes that investment demand still sits below the peaks of past bull runs, leaving room for further upside if risk aversion increases.

Leave Comments