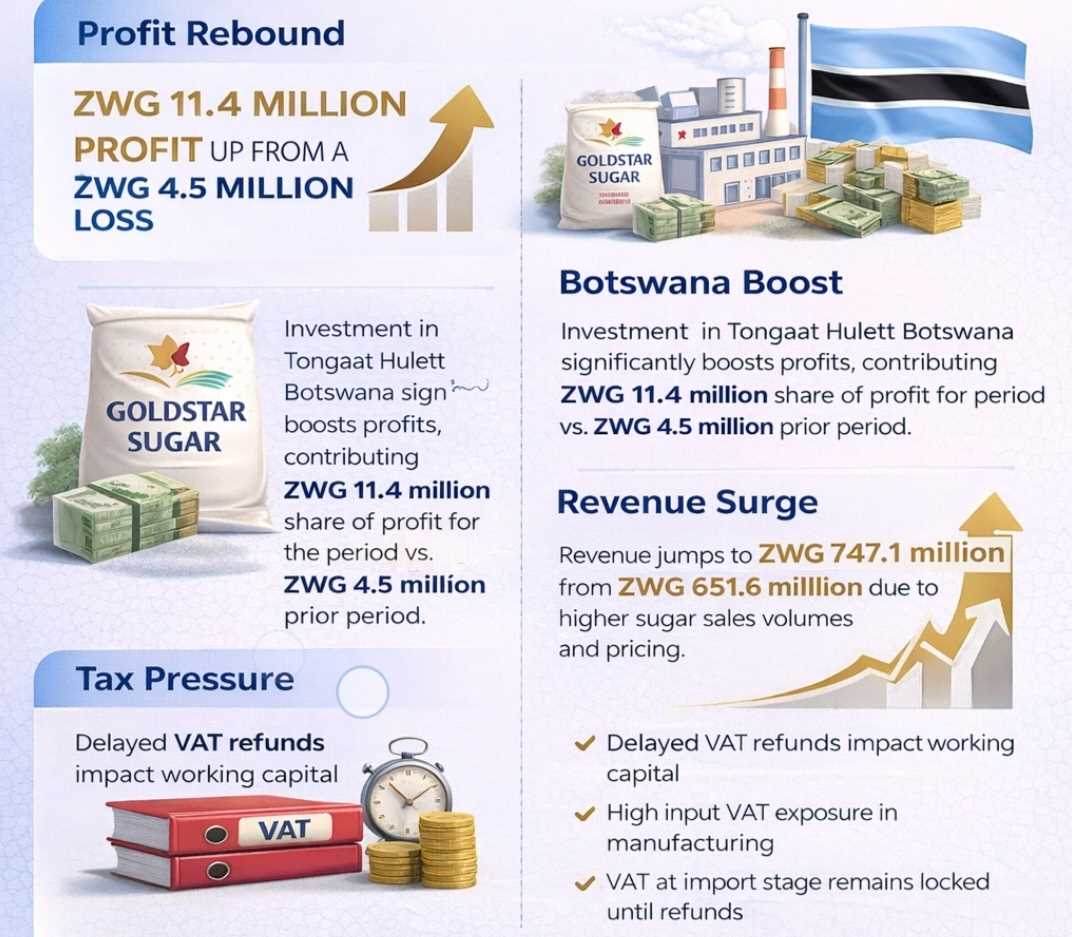

Star Africa Corporation has recorded a sharp turnaround in profitability for the six months ended 30 September 2025, driven largely by improved performance at its regional operations, with management pointing to Botswana-based investments as a key contributor to the rebound.

In its unreviewed interim abridged financial results, the sugar producer reported a profit for the period of ZWG$11.4 million, reversing a loss of ZWG$4.5 million recorded in the prior comparative period. The group attributed the improvement to stronger operational efficiencies and earnings from associates, particularly Tongaat Hulett Botswana.

“The investment in Tongaat Hulett Botswana made a notable contribution to profitability, with our share of profit totaling ZWG$11.4 million for the period as compared to ZWG$4.5 million achieved in the prior period,” the board said in its chairman’s statement.

Revenue from contracts with customers rose to ZWG$747.1 million from ZWG$651.6 million, reflecting higher sugar sales volumes and improved pricing dynamics across selected markets. However, cost pressures remained evident, with cost of sales increasing to ZWG$613.4 million, underscoring the continued strain from input costs, utilities and statutory charges.

At operating level, Goldstar Sugars emerged as a stabilising force, delivering sales volumes of 32,000 tonnes during the period, while refining margins showed modest recovery. Management noted that the operation benefited from a more predictable operating environment, although margins remained vulnerable to tax-related costs embedded across the value chain.

Beyond operational performance, the group’s results once again highlighted the structural burden of indirect taxes, particularly Value Added Tax, on manufacturing and agro-processing businesses in Zimbabwe. While VAT is designed to be neutral, delays in refunds and compliance costs continue to constrain cash flows for corporates, especially those involved in essential commodities such as sugar.

Related Stories

“In theory VAT should not affect profitability, but in practice delayed refunds become a financing cost, especially for manufacturers with high input VAT exposure,” said a Harare-based tax expert familiar with the sector.

This pressure is reflected in the group’s cash flow position. Despite returning to profitability, Star Africa reported constrained operating cash flows, a trend consistent with firms operating in VAT-intensive sectors where refund timelines remain uncertain.

The challenge is compounded by the fact that sugar production relies heavily on imported inputs, attracting VAT at point of entry before finished goods are sold.

Management acknowledged the broader policy environment remains complex. “Notwithstanding the lack of progress in addressing key value chain issues on the Sugar Tax and VAT classification anomalies, the group remains committed to improving efficiencies and strengthening regional operations,” the board noted.

The group also cited ongoing uncertainties in Zimbabwe’s operating climate, including currency volatility and inflationary pressures, which continue to distort cost structures and pricing decisions.

However, diversification into regional markets and earnings from associates have provided a hedge against domestic shocks.

No dividend was declared for the period, with the board opting to preserve cash amid ongoing capital requirements and tax-related liquidity constraints. Management said the focus remains on balance sheet stability and sustaining the profitability momentum into the second half of the financial year.

Star Africa expressed cautious optimism, anchored on stable sugar demand, regional performance and the potential for policy clarity on indirect taxes.

Leave Comments