The National Competitiveness Commission says persistent macroeconomic instability, delayed budget approvals and currency transitions continue to undermine its operational efficiency, despite the institution posting a surplus and generating positive cashflows during the year under review.

According to the Commission’s latest financial statements, NCC recorded a budget surplus of ZWG$12.6 million and net cashflows from operating activities of ZWG$15 million, indicating that its core operations remained financially viable.

“Our day-to-day operations were self-sustaining and produced positive cash inflows,” Executive Director Philip Phiri said.

However, Phiri cautioned that financial performance did not translate into smooth programme execution, citing delays in capital expenditure approvals as a major constraint.

“The Commission faced delays in the approval of its capital expenditure budgets in 2024, causing delays in the procurement of capital goods,” he said, adding that this disrupted the rollout of key initiatives aligned to the National Development Strategy 1 (NDS1).

The challenges were compounded by the April 2024 introduction of the Zimbabwe Gold currency, which replaced the Zimbabwe dollar. While the reform was intended to stabilise the economy, it introduced significant accounting and planning complications for the Commission.

“The introduction of ZiG created difficulties in converting opening balances, restating comparative figures, and aligning accounting systems to new currency requirements,” Phiri said.

NCC disclosed that it had to apply complex accounting adjustments, including inflation indexing and multi-stage currency translations, to comply with financial reporting standards following the currency change.

The transition also eroded the real purchasing power of budgeted funds, making it difficult to implement planned activities at original cost estimates.

Board Chairperson Patience Chimuka said the Commission operated in a highly volatile environment marked by inflationary pressures and exchange rate instability, but stressed that governance discipline had helped cushion the impact.

“The Commission continues to operate in a challenging macroeconomic environment characterised by inflation and currency volatility,” Chimuka said.

“Through prudent financial management, cost-containment measures and stakeholder collaboration, NCC has continued to discharge its statutory mandate.”

Despite these constraints, NCC invested ZWG$16.7 million in capital expenditure during the year, largely to strengthen operational capacity. Of this amount, 73 percent was spent on vehicles, 26 percent on computers and ICT equipment, and one percent on furniture and fittings. The Commission also received donated ICT equipment valued at ZWG$278,382.

Related Stories

Phiri said these investments were aimed at improving long-term service delivery rather than short-term financial returns.

“Capital expenditure during the year was focused on acquiring tools of trade necessary for effective execution of our mandate,” he said.

However, the heavy investment resulted in a cash outflow from investing activities, leaving NCC with cash and cash equivalents of ZWG$117,244 at year-end.

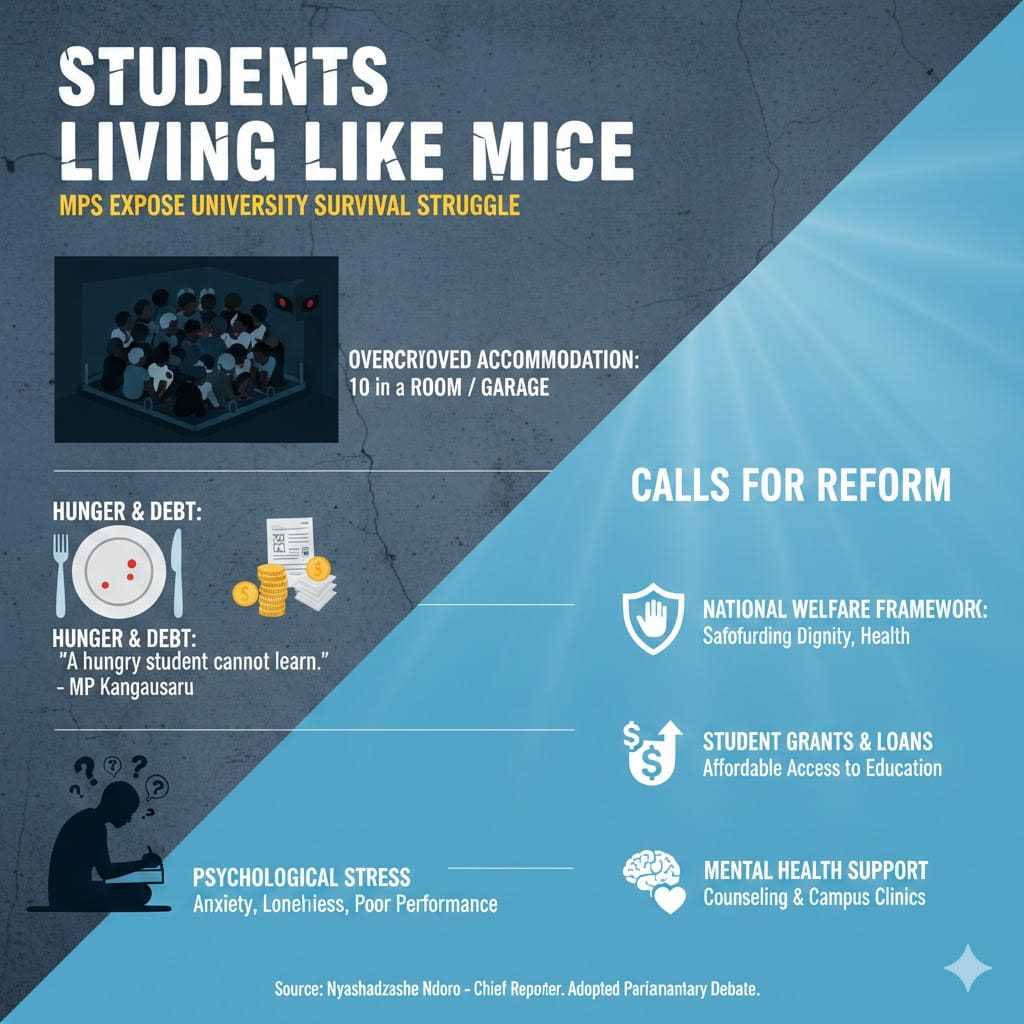

Beyond financial pressures, the Commission flagged low staff morale driven by subdued remuneration levels, as well as continued concerns from the business community over an uncompetitive operating environment shaped by restrictive regulatory policies.

“These challenges directly affect productivity and the pace at which reforms can be implemented,” Phiri said.

During the year, NCC continued its policy and value chain work, producing six cost and competitiveness analysis reports covering soybean, fertiliser, cement, sugar, cotton and leather value chains. These studies form part of efforts to lower production costs, improve contract farming viability and enhance sector competitiveness.

A key intervention highlighted was the soybean value chain, where delayed payments to farmers by the Grain Marketing Board were identified as a major constraint.

NCC recommended timely disbursement of funds to enable farmers to reinvest and sustain production — a challenge with broader implications for fertiliser demand and contract farming models.

Chimuka said governance and institutional credibility remain central to NCC’s effectiveness.

“Good corporate governance is not optional. It is central to maintaining stakeholder trust and delivering long-term value, especially in a difficult economic environment,” she said.

Despite the hurdles, NCC received a clean audit opinion for its 2024 financial statements and scored 4.22 out of 6 in an external governance assessment.

NCC is banking on improved fiscal coordination after receiving grant commitments totalling ZWG$130.7 million for 2025, covering both operational and capital expenditure.

“As Zimbabwe seeks to improve productivity and competitiveness, addressing these systemic constraints will be critical to unlocking the full impact of our work,” Phiri said.

Leave Comments