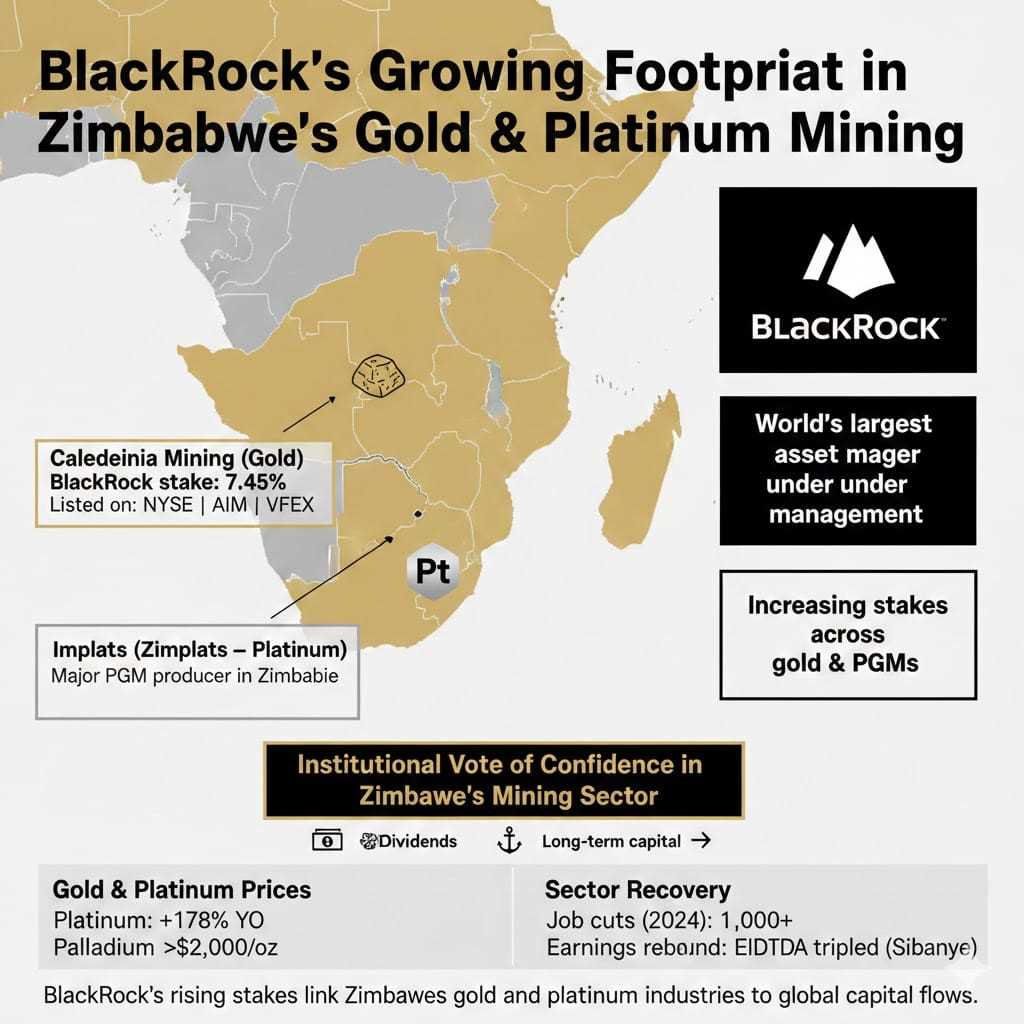

The world’s largest asset manager, BlackRock Inc., is steadily expanding its influence across Zimbabwe’s mining sector, signalling rising global institutional confidence in the country’s gold and platinum assets.

Recent regulatory disclosures show that BlackRock increased its stake in Caledonia Mining Corporation Plc, one of Zimbabwe’s leading gold producers, to 7.45% of voting rights as of January 22, 2026. The holding comprises 6.51% in direct equity and 0.93% via financial instruments, up from 6.20% previously.

By crossing a key UK reporting threshold, the move places BlackRock among Caledonia’s most influential shareholders.

Caledonia operates the Blanket gold mine, Zimbabwe’s largest producing gold asset, and is listed in New York, London and on the Victoria Falls Stock Exchange.

With a market capitalisation of about US$609.5 million, strong profitability metrics and a dividend-paying profile, Caledonia fits squarely into BlackRock’s strategy of targeting cash-generative miners with improving balance sheets in frontier and emerging markets.

But Caledonia is only one part of a broader pattern.

In parallel, BlackRock has also lifted its exposure to platinum group metals (PGMs), increasing its stakes above the 5% disclosure threshold in both Sibanye-Stillwater and Impala Platinum (Implats) in recent weeks.

While these are South Africa-listed companies, both have material operations in Zimbabwe, anchoring BlackRock’s footprint firmly in the country.

Related Stories

Implats owns Zimplats, Zimbabwe’s largest platinum producer and one of the country’s biggest foreign investors, while Sibanye-Stillwater has PGM and gold exposure across South Africa, Zimbabwe and the United States.

This means BlackRock now holds influential positions across Zimbabwe’s two most strategic mineral value chains: gold and platinum.

The timing of BlackRock’s moves appears data-driven. Platinum prices have surged 178% year-on-year, driven by persistent supply deficits, tariff uncertainty and renewed demand from internal combustion engine markets.

Prices are now flirting with US$3,000 per ounce, while palladium has rebounded above US$2,000 per ounce, restoring profitability even for higher-cost producers.

At the same time, gold prices remain elevated, supporting strong margins for producers such as Caledonia. Analysts currently rate Caledonia stock a Buy, with a US$37 price target, while AI-driven analysis flags strong profitability, low leverage and improving cash generation despite rising cost pressures.

The renewed institutional interest follows a brutal downturn. In 2024, more than 10,000 jobs were cut across the PGM sector as electric vehicle concerns and weak prices hammered earnings. That cycle has now turned.

Sibanye-Stillwater reported EBITDA tripling to R9.9 billion, while Implats has resumed dividends after nearly two years, declaring 165 cents per share for the year ended June 2025.

These earnings recoveries matter for Zimbabwe, where platinum and gold mining underpin foreign currency inflows, employment and infrastructure investment.

Leave Comments