Zimbabwe's government will now closely regulate voluntary carbon offset trading in a bid to curb greenwashing and ensure benefits for local communities.

"We are determined to make sure that climate finance resources, meant to empower the country, accrue to the most deserving. We do not want instances of climate washing," Zimbabwe's environment and climate minister Mangaliso Ndlovu said during the launch of the new carbon market policy.

Minister Ndlovu said all carbon projects must be registered with authorities within the next two months and government will take 50% of all revenue from carbon projects.

He also said foreign investors will now be limited to 30% maximum shareholding while locals must have a minimum of 20%.

The minister said organisations operating carbon credit projects in the country were largely unregulated as they were only registered with local councils and traditional community leaders -- a result of which there is no reliable data on the size of Zimbabwe's carbon market.

Carbon Green Africa, a Zimbabwean company which has partnered Switzerland's South Pole in the 785,000 hectare Kariba forest protection project which has sold 23 million carbon credits since 2011 told Reuters that it was waiting to see how the new policy would impact existing projects.

CGA managing partner Charles Ndondo said he hopes the carbon revenue rules will encourage greater community involvement in conservation projects.

"We need to see the money going to the respective communities so they don't continue decimating forests if they understand that they will be deriving benefits from them," Ndondo said.

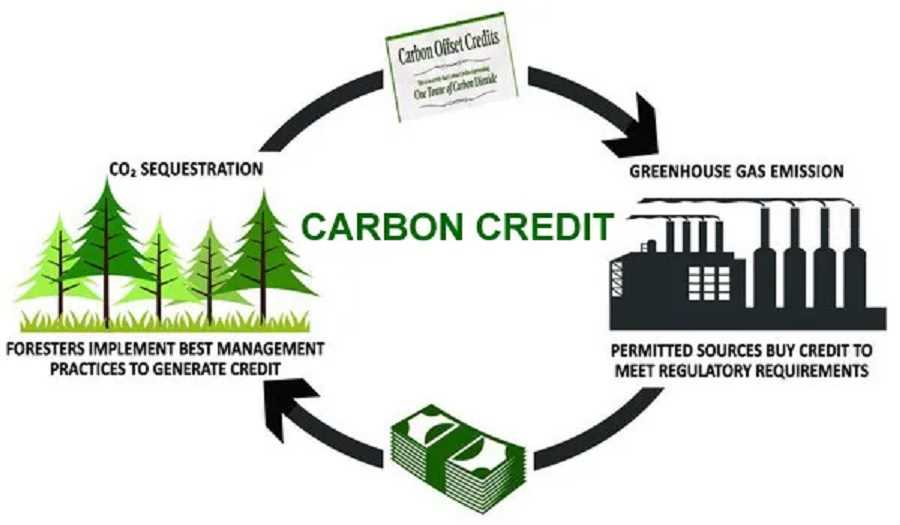

The global $2 billion voluntary carbon offset market revolves around companies buying credits from emission reducing projects such as renewable energy or planting trees to offset their own emissions.

Related Stories

In January this year, the Africa Carbon Markets Initiative - which was launched at COP27 with the aim of dramatically scaling voluntary carbon markets across Africa -announced 13 action programs. Countries that had signed up included Kenya, Gabon, Malawi, Mozambique, Togo, Nigeria, Burundi and Rwanda

ACMI’s action programs include:

Scaling the market to 300 million carbon credits retired annually by 2030, and 1.5 billion credits annually by 2050

Unlocking $6 billion in revenue by 2030 and over $120 billion by 2050

Supporting 30 million jobs by 2030 and over 110 million jobs by 2050

$200 million advanced market commitments

“Our people have the potential to play a unique, indispensable, and globally significant role in the prevention and mitigation of emissions, protection of crucial ecosystems and the restoration of precious carbon sinks. The urgent actualisation of these critical interventions offers humanity its best chance of prevailing in the existential contest with climate change-induced catastrophe. The good news is that the world has a golden opportunity to rapidly achieve these objectives. By developing a robust, transparent and sustainable mechanism through which a carbon credits market can yield attractive income and development opportunities for communities at the frontlines in the fight against climate change,” said Kenyan president William Ruto, during the launch of ACMI at COP27

On the same occasion UN Climate Change High Level Champion COP 27 Presidency Dr Mahmoud Mohieldin said, “The world has no shortage of financial resources, scientific ingenuity, and technological wherewithal to deal with the climate crisis. What has been lacking is leadership that will marshal the resources and solutions for the parts of the world that desperately need them for the sake of the protection of nature assets and actioning a just transition that will help us all attain our 1.5 degrees ambition. ACMI is designed to create space for the public & private sectors to marshal assets to financial flows”

Leave Comments