Zim Now Writer

The Reserve Bank of Zimbabwe’s Financial Intelligence Unit has frozen the bank accounts of 12 major suppliers of goods and services, including four supermarkets in the capital, for allegedly refusing to transact in the local currency and engaging in forward pricing practices that are believed to be causing exchange rate volatility.

Ten of the companies are accused of forward pricing, while two others are charged with pricing goods exclusively in foreign currency. The FIU says that repeat offenders will have their licences revoked.

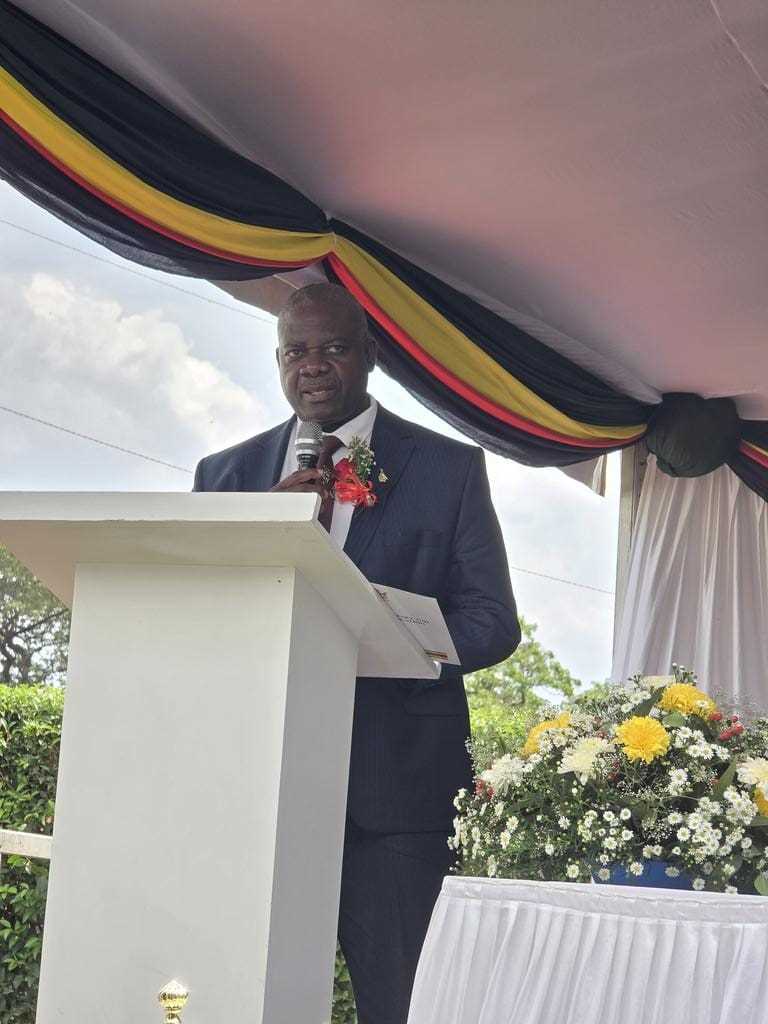

FIU director-general Oliver Chiperesa said: “We uncovered 12 violators of our regulations and we have frozen their bank accounts. Two of them were businesses refusing to accept Zimbabwe dollars, while 11 were businesses using forward pricing.

“The law only allows businesses to charge 10 percent above the interbank exchange rate, but we saw people who were using exchange rates of up to US$1: ZWL$6 000 and some as much as ZWL$7 000 to the US dollar. So, we have frozen their accounts for the time being.

Related Stories

“Like we said, we are not just focusing on fining them. We are going to freeze those accounts indefinitely for the time being,” said Chiperesa.

Permanent Secretary in the Ministry of Industry and Commerce Dr Mavis Sibanda said the Ministry has established that “market malpractices” are to blame for recent price hikes, and a high-level committee has been set up by the government to undertake regular market surveillance. Sibanda is quoted as saying:

“The depreciation of the local currency against the United State dollar and the dollarisation of the value chain, which has resulted in over 70 percent of transactions being conducted in the United States dollar, has had an inflationary impact on the prices of basic commodities.

“Market malpractices, which include the redirecting of goods from the formal to the informal sector, has been one of the major causes of the artificial shortages of basic commodities in the formal market,” said Sibanda.

The Finance ministry, Sibanda said, is finalising regulations on consumer protection, which will include punitive measures for violators of consumer rights.

Leave Comments