Tinashe

At the time when Old Mutual share price stopped trading on the Zimbabwe Stock Exchange the parallel market rate was a benign tempest.

Havoc, pandemonium and panic would ensue as the rate went berserk and four years later the ZWL has moved from 37 to 12,000.

Yet, OM still remains suspended. Pension funds, personal and others monies is stuck unable to trade - was the government sincere in its allegations of OM fuelling inflation?

Never mind what government thought, what was surprising, to this day, is that the public believed the lie and sadly many in business did too.

Therefore, there is no energy to right the wrong and OM remains suspended.

The Leviathan did not end with OM, it turned its envious lust on banks and ever since that fateful May day when bank lending was stopped, bank lending has been severely curtailed.

In 2024, the beast turned its malice on manufacturers. No matter what happens, the sector will not be the same.

All this points to the insatiable need to blame business for the collapse of the economy, when nothing could be further from the truth, business is a victim.

Rather than fight back or push back, business has accepted its lot and in the process faded away.

The once mighty giants are now past four o’clock, their shadows taller than themselves.

What is quite revealing when one looks at the ZSE is that owner managed firms have substantially dwindled.

Managers don’t have as much incentive to make the stock market work as do entrepreneurs.

Therefore the cannibalisation of the stock market has happened without much push back.

It’s now over regulated, lethargic and unresponsive to members’ needs.

There is no incentive for anyone to list or look forward to listing.

The stock market has trailed inflation with a ridiculous circuit break that is out of sync with reality.

Banks no longer take shares as security and small/retail investors have decided to take more risks as entrepreneurs than investors.

There are more successful unlisted businesses than listed. The OM debacle, broke the dam wall and with it the stream of destruction that has rendered the ZSE and its side kick VFEX, ineffective and unattractive for both investors and entrepreneurs.

What if business had fought back to keep the sanctity of the market?

Steve Jobs and Bill Gates were arch enemies of mediaeval proportions. They had a low opinion of each other and would openly sabotage the other's firm.

Bill wanted, rightly so, to dominate the information technology space.

For the longest Jobs was the smaller (by the longest margin) rival. But he did not quit- though at some point he was fired- nor give in to Microsoft. The enmity fired his pistons.

They had court suits and counter suits against each other. And the cultish supporters did not mingle.

Yet, faced with bankruptcy, Jobs was rescued by Bill when literally the lights were off.

Related Stories

Today, Apple dominates not only the industry but is the world’s largest company. Microsoft is not far off.

There was space for both after all. Heck for Amazon, Google and Facebook, there is space for all and society benefits.

Zimbabwean businesses have an uncharacteristic norm of not creating alliances and working together.

In our most successful years in the 90’s, what we saw was rivalry and far less cooperation.

The indigenous banks could’ve banded together and formed formidable enterprise as happened in Nigeria and South Africa during their banking crisis.

Unfortunately this was never on the table, so as individual units the Leviathan was able to consume them.

ZIBG could never work because it simply lacked the very raison d’etre why those banks were started in the first place.

The lack of cooperation robbed Zimbabwe of perhaps its greatest entrepreneurs yet. Something Bill Gates recognised in his nemesis.

America and indeed the world would be worse off if Steve Jobs and Apple collapsed.

In Zimbabwe the bankers laughed and toasted as each bank fell. Today, there is no owner controlled bank of note and only two perhaps three, if we are generous, indigenous banks.

Japanese firms have a unique way of penetrating foreign markets.

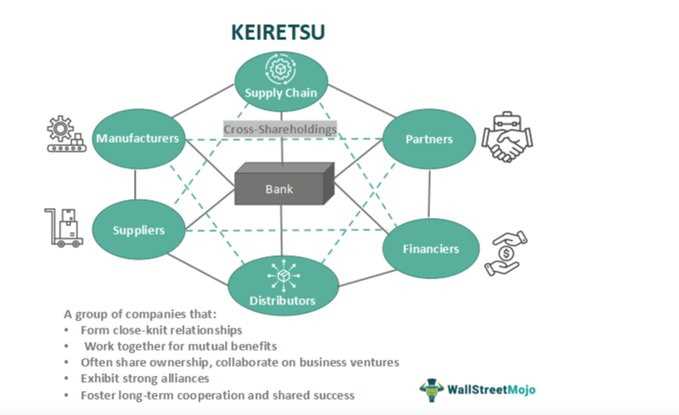

They piggy back on the concept of Keiretsu. Alliances of Japan companies that form an ecosystem sharing ideas, supplies, human resources and technology.

By doing so they reduce the cost of business, losses and risk.

It’s the success of Keiretsu that saw Japan businesses from cars to household appliances dominate America and the world.

South Korea and China have used the same exporting model.

Zimbabwean firms go it alone in the region. This is unwise. What is best is to create a home grown Keiretsu from funding, manufacturing to technology companies that then move together in targeted markets.

Again this requires leadership.

Brutalised at home and shy abroad, what can Zimbabwean business do?

It takes senior business leaders to take the mantle and lead the way. What is required is boldness, vision and tenacity to recreate or perhaps reimagine something great.

It’s important to put aside personal differences and form home grown Keiretsu.

It’s important pension funds and bankers support the initiative of local businesses going abroad. Meaning managers that run the financial institutions must become entrepreneurial.

Whatever little we have can be harnessed into something great abroad beyond the US$18bn economy that is fast shrinking.

Reproduced from X essay by Tinashe who is “Here to promote free markets in Zimbabwe. “ever more deeds, ever more victories” Schumpeter”

X handle: @baba_nyenyedzi

YouTube: ZFN Friday Drinks https://www.youtube.com/watch?v=7tggsx5vobE

Leave Comments