Nyashadzashe Ndoro

Chief Reporter

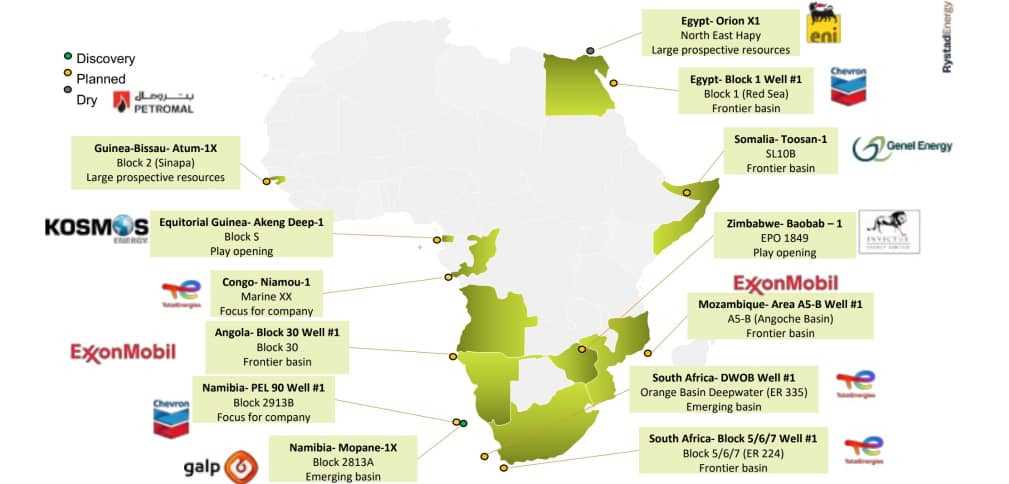

As global energy demand continues to rise, Africa is emerging as a key player in the oil and gas industry, with several countries, including Zimbabwe, set to benefit from a significant increase in exploration activity.

Zim Now analyzed a recent report by the African Energy Chamber, which revealed that Africa is poised to dominate global high-impact drilling, with over 150 wells set to be completed in 2024.

This surge in exploration activity is expected to have a significant impact on the continent's energy landscape, with Zimbabwe standing to benefit from the trend.

According to the report, Africa's oil and gas exploration landscape is experiencing a significant revival, marked by an upward trend in spending that has been gradually increasing since the pandemic-induced lows. The resurgence is led by North and West Africa, with substantial contributions from Egypt, Algeria, Angola, and Nigeria.

For Zimbabwe, the country's potential to become a major player in the continent's energy sector is noteworthy. The Baobab-1 well, currently being drilled by Invictus Energy in the Cabora Bassa Basin, is considered a significant milestone. The well follows the successful Mukuyu-1 well, which indicated the presence of gas-condensate, a working hydrocarbon system, and potential for light oil.

The discovery of helium gas in commercial concentrations in the Mukuyu-1 well is also significant, as it presents an opportunity for Zimbabwe to become a major supplier of this rare and valuable gas.

It is noted that Africa's oil and gas exploration landscape is experiencing a significant revival, marked by an upward trend in spending that has been gradually increasing since the pandemic-induced lows. The resurgence, according to the report, is led by North and West Africa, with substantial contributions from Egypt, Algeria, Angola, and Nigeria.

These regions are key players in driving exploration investments, particularly with major discoveries in Namibia's Orange Basin by Total Energies and Shell plc. Namibia's exploration activities have garnered global attention, especially with Total Energies' Venus and Shell's Graff finds, followed by further investments from Galp Energia, Chevron, BP, and Eni. Looking ahead, Africa's exploration spending is anticipated to surpass US$6 billion in 2024, returning to pre-pandemic levels.

"This increase is largely attributed to West Africa, where there has been a surge in spending in countries like Côte d'Ivoire, with notable offshore drilling by Eni and Foxtrot International. North Africa continues to be a significant focus, particularly in the Nile Delta offshore Egypt, where major oil companies like Shell, Eni, BP, and Chevron are ramping up efforts to discover new gas reserves. In East Africa, exploration activities are being spearheaded by Invictus Energy in Zimbabwe and planned well drilling in Uganda.

"Meanwhile, South Africa is witnessing substantial investment from Total Energies in the ultra-deep waters of the Orange Basin, where the company holds three active licenses and has secured environmental approval for further drilling. Shell also plans to explore this region, aiming to build on the successes of its Namibian block discoveries.

"Namibia remains a hotbed of activity, with exploration spending expected to exceed US$1.5 billion. Companies like Chevron, BP, and Eni are poised to continue exploration in the Orange Basin through joint ventures and partnerships. Onshore, Reconnaissance Energy is launching a frontier drilling campaign in the Kavango Basin, targeting new prospects.

"This surge in exploration spending across Africa underscores the continent's potential to become a major energy hub. With ongoing investments and ambitious drilling campaigns, Africa is set to significantly enhance its oil and gas output, attract further international investment, and strengthen its position in the global energy market," the report noted.

The current exploration activities with massive energy potential include:

Egypt: Orion×1, North East Hapy (Large prospective resources)

Egypt: Block 1Well# Block 1 (Red Sea) Frontier basin

Somalia: Toosan, 1 SL10 B Frontier basin

Related Stories

Zimbabwe: Baobab-1 EPO 1849 Play Opening

Mozambique: Area A5-B Well#1 A5-B (Angoche Basin) Frontier Basin

South Africa: DWOB Well-#1 Orange Basin Deepwater (ER 335) Emerging Basin

South Africa: Block 5/6/7 Well #1, Block 5/6/7 (ER 225) Frontier Basin

Namibia: Mopane-1× Block 2814A Emerging Basin

Namibia: PEL 90 Well# 1 Block 2913B (Focus for company)

Angola: Block 30 Well# 1 Block 30 Frontier Basin

Congo: Niamou, 1 Marine× X (Focus for company)

Equatorial Guinea: Akeng Deep, 1 Block S (Play opening)

Guinea-Bissau: Atum-1× Block 2 (Sinapa) (Large prospective resources)

For the continent, the surge in exploration activity is expected to significantly enhance Africa's oil and gas output, attract further international investment, and strengthen its position in the global energy market.

Interestingly, during the writing of this article, Shell, an international exploration entity that discovered oil and gas resources in Block PEL39 back in 2022 in Namibia, announced plans to write off US$400 million after declaring its offshore oil discovery commercially unavailable due to technical and geological challenges.

Shell's discovery, coupled with another by Total Energies in a nearby block, had ignited global interest in Namibia, which currently has no oil and gas production.

Despite discovering hydrocarbons after drilling nine wells over a three-year period, the company has found that low rock permeability and high natural gas content render extraction a formidable task.

According to Shell's CEO, Wael Sawan, the prospects for extraction are "very challenging." As a result, the company is set to report a loss in its financial results for January, in addition to a separate US$300 million write-off in Colombia.

Headquartered in London, England, Shell plc is a multinational energy conglomerate that ranks among the world's largest oil and gas entities. Its diverse operations encompass the exploration, production, refining, and marketing of oil and natural gas, in addition to providing renewable energy solutions.

QatarEnergy, a state-owned petroleum company based in Qatar, holds the distinction of being the world's largest producer of liquefied natural gas (LNG). The company is also a significant player in the global oil industry, with extensive involvement in exploration, production, and refining. QatarEnergy plays a vital role in both Qatar's domestic economy and the global energy landscape.

Leave Comments