Zim Now Writer

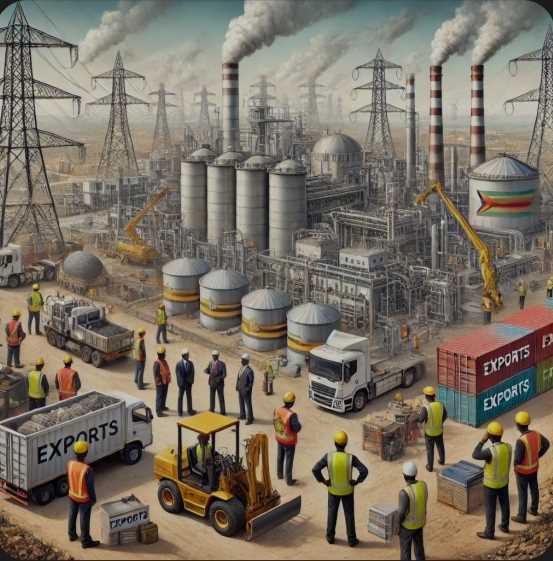

Zimbabwe’s manufacturing and mining sectors remain constrained by persistent challenges, including electricity shortages, limited access to finance, and economic uncertainty—despite pockets of improvement recorded in the fourth quarter of 2024.

A new business tendency survey by the Zimbabwe National Statistics Agency shows that these structural issues continue to dampen production capacity, investor confidence, and employment growth in two of the country’s most vital economic sectors.

Across both manufacturing and mining, power shortages were listed as the most pressing challenge. Coupled with tight cash flow and an unstable economic environment, these factors are stalling efforts to scale up production and expand operations.

Confidence levels mirrored the tough operating environment. The Manufacturing Confidence Index slipped into negative territory, falling from 2.1 in Q3 to -4.6 in Q4 2024. The Mining Confidence Index followed suit, plummeting from 7.3 to -4.9 over the same period.

Despite the challenging climate, capacity utilization in the manufacturing sector showed marginal gains. The sector’s overall utilization rose slightly from 47.1% in Q3 to 47.9% in Q4 2024. Large firms performed better, operating at 57.9% capacity, while small and medium-sized enterprises lagged at 46.2%.

Related Stories

In terms of production output, 40.2% of manufacturers reported no changes in activity during Q4, while only 19.3% recorded increases. In mining, a majority—53.0%—also reported stable production levels.

Employment trends followed a similar pattern of stagnation. About 68% of manufacturing companies and nearly 70% of mining firms reported no changes in their workforce numbers in the fourth quarter.

Expectations for the business environment remain cautious. Just 20.5% of mining firms said they were optimistic about the business climate going into 2025, slightly ahead of manufacturers, where only 19.8% shared similar sentiments.

Meanwhile, the Purchasing Managers’ Index for the manufacturing sector—a measure of business activity—rose modestly from 35.0 in Q3 to 35.9 in Q4.

Although still below the 50-point threshold that signals expansion, the uptick points to some resilience in the sector.

Leave Comments