Audrey Galawu- Assistant Editor

The Zimbabwe Investment and Development Agency has reported a strong start to the year, with the energy sector emerging as the top destination for projected investment in the first quarter of 2025.

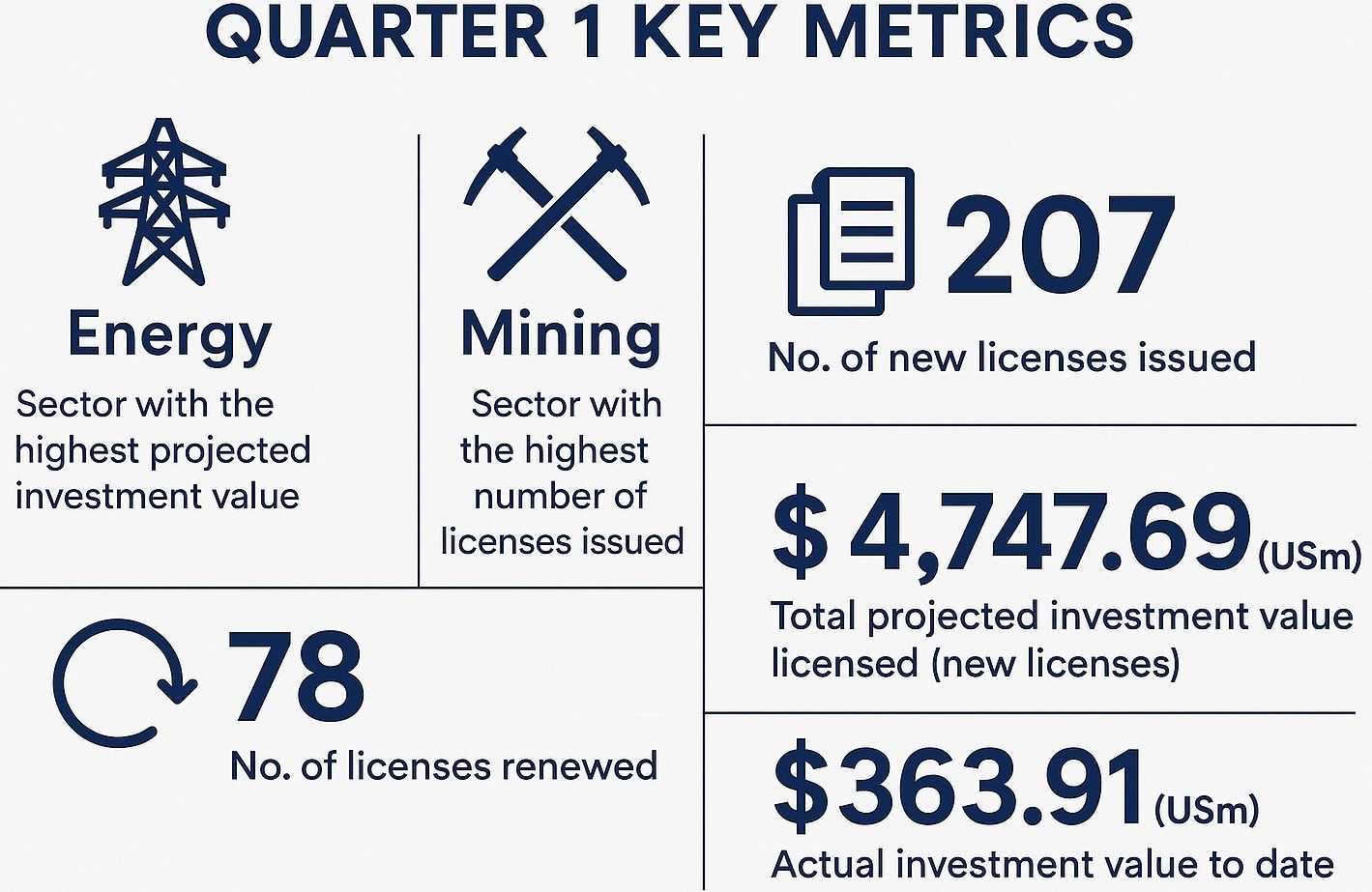

According to ZIDA's Q1 report, the energy sector accounted for a staggering US$2.72 billion of the US$4.75 billion total projected investment value licensed for the period. This represents more than 57% of all approved investments, underscoring Zimbabwe’s growing appeal as a hub for large-scale energy infrastructure development.

“This quarter’s performance shows that energy is no longer just a potential growth area — it is now the cornerstone of Zimbabwe’s investment strategy,” said ZIDA CEO Tafadzwa Chinamo. “The commitments we are seeing in this sector reflect investor confidence in Zimbabwe’s long-term energy framework and our ability to facilitate high-value projects.”

The sharp rise in energy investment is largely attributed to a major thermal power project in Matabeleland North, where a single initiative — the proposed 600MW coal-powered thermal plant in Binga — carries an estimated cost of US$2 billion. Matabeleland North, as a result, topped the list of provinces in terms of investment value, accounting for over 54% of all new investment projections.

Related Stories

Beyond traditional energy, renewable power is also gaining momentum. In February, ZIDA convened a Renewable Energy Roundtable in partnership with the World Bank Energy Group and International Finance Corporation, gathering independent power producers, legal experts, and financiers to deliberate on unlocking Zimbabwe’s clean energy potential. Central to these talks was the Mission 300 initiative, which seeks to connect 300 million people across Africa to electricity by 2030.

The roundtable tackled the need to streamline the regulatory environment, speed up government approvals, and define clear targets for public-private collaboration. Should Zimbabwe meet set parameters, the Mission 300 programme is expected to begin operating in the country by the second half of 2025.

While energy led the charge, mining and manufacturing followed with significant projected investment values of US$906.8 million and US$877.7 million, respectively. The mining sector also topped in terms of activity, with 88 new licences issued, making it the most active sector by number of investments. Meanwhile, manufacturing attracted 56 licences, reflecting continued confidence in Zimbabwe’s industrial base.

Despite the focus on these key sectors, the agriculture sector also made an appearance with US$84.17 million in projected value, boosted by renewed focus on horticulture and agro-processing. ZIDA is actively promoting horticulture as a high-impact opportunity, projecting over US$2.4 billion in potential annual export value and 580,000 new jobs, with a funding need of around US$795 million.

Overall, Q1 saw 207 new investment licences issued, a 44.8% jump compared to the same period in 2024. The adoption of a fully digital licensing system was credited for improving efficiency and accessibility, enabling smoother processing and tracking for investors.

Leave Comments