By Oscar J Jeke - Zim Now Reporter

When Zimbabwean engineer Edzai Kachirekwa stood before reporters in June 2024, flanked by officials from China’s Global Nexus Energy, his words were bold. “We will have plants in all provinces, rendering Hwange and Kariba power stations redundant for emergency use only,” declared the Power Giants CEO.

It was a powerful vision and one that resonated in a country where blackouts can last up to 18 hours a day. In a nation beset by economic fragility, energy instability is not just a technical concern it is a symbol of national dysfunction.

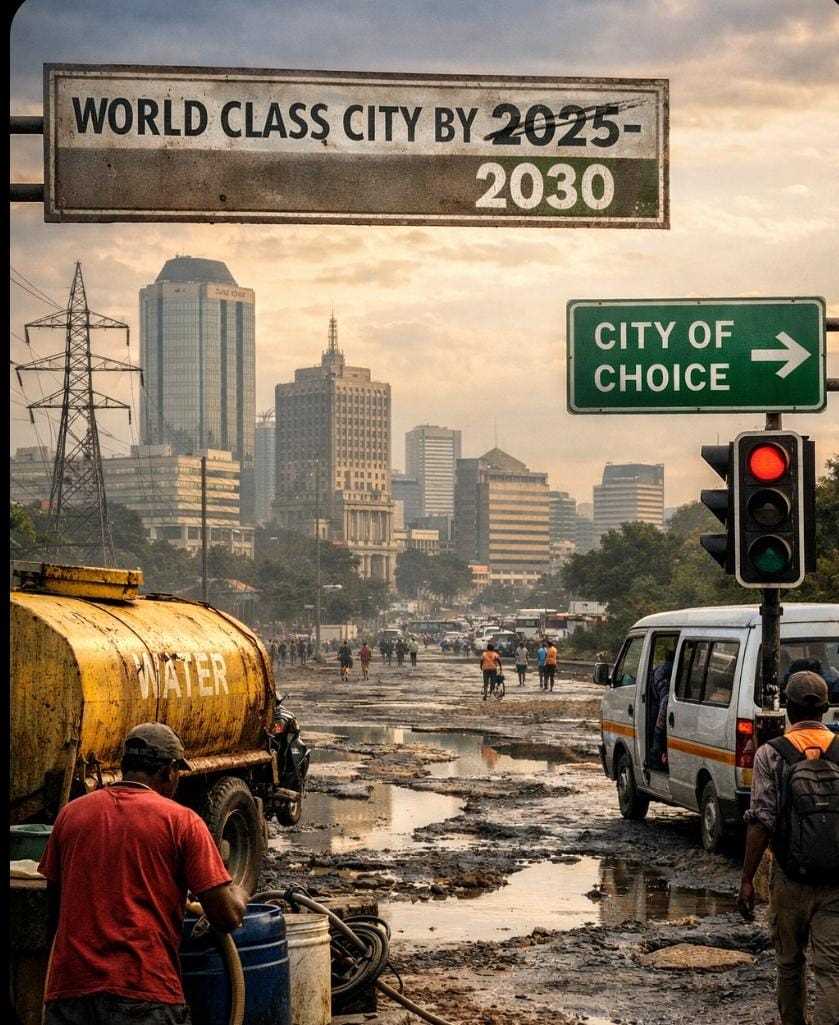

Zimbabwe’s energy sector is now the critical battleground for its economic recovery. With rising investment interest in solar, and growing public frustration over prolonged outages, the time for transformation feels urgent. Yet between the promise of abundant sunshine and the reality of nationwide power shortages lies a thicket of challenges: archaic infrastructure, weak regulatory frameworks, institutional mistrust, and policy inertia.

Zimbabwe’s electricity crisis is both historic and immediate. The Kariba Dam once the nation’s hydroelectric workhorse has suffered catastrophic reductions due to climate-induced drought, slashing its output from over 1,000 MW to just 185 MW. Hwange Thermal Station, while recently boosted by two 300 MW units, continues to suffer from frequent breakdowns due to age and mismanagement.

According to official estimates, national power demand sits around 2,200 MW, but supply struggles to cross 1,400 MW on most days. This yawning deficit has made load-shedding a fixture of Zimbabwean life.

In urban centers like Harare and Bulawayo, residents go without electricity for 15–18 hours a day. In the countryside, fewer than 20% of households have access to consistent grid power. “Sometimes I go for days without welding because there’s no power,” said Brighton Mahuni, a self-employed metalworker in Glen View. “Generators are too expensive, and the solar panel I installed at home can’t power my tools.”

Businesses are similarly handicapped. The Zimbabwe National Chamber of Commerce estimates that enterprises lose up to 40% of productivity due to power interruptions. In the mining sector Zimbabwe’s largest foreign currency earner companies are now investing in captive solar and diesel backup systems, viewing self-generation not as an option, but as a necessity.

Against this grim backdrop, solar power has emerged as a lifeline. Zimbabwe receives over 3,000 hours of sunshine each year, with solar irradiance levels among the highest in Southern Africa. Yet, for decades, this resource went largely underutilised. That is beginning to change.

Government policy has shifted. Under the National Renewable Energy Policy, Zimbabwe aims to generate 1,100 MW from solar by 2025 and 2,100 MW by 2030. Over 100 Independent Power Producers have been licensed since 2010, and dozens more have submitted applications in the past two years.

Among the most prominent is the billion-dollar partnership between Power Giants Zimbabwe and China’s Global Nexus Energy. Their proposal to roll out solar plants in every province represents a potential game-changer for decentralized, climate-resilient power. “We want to ease the power shortage in Zimbabwe as soon as possible,” said GNE CEO Wan Ke. “Our plants will not just generate power, but transform how power is delivered in rural areas.”

Other players are also stepping up. The Zimbabwe Power Company’s Melfort solar facility has begun operations with 25 MW, targeting 100 MW upon full completion. Zimplats has installed 35 MW, aiming for 185 MW by 2028. Indo Africa Solar has brought 10 MW online in Mutorashanga. In Lupane, a Rural Electrification Agency (REA) solar mini-grid is powering 38 previously off-grid villages.

Meanwhile, smaller IPPs have deployed between 2.5 and 10 MW across Guruve, Kwekwe, and Mashonaland East. Private rooftop systems under the net-metering framework are estimated to add another 75 MW.

However, as energy consultant Tendayi Marowa cautions, “Even if all current licenses go live, we might only see 400 to 500 MW of solar capacity by 2026. That’s progress but still a fraction of the 2,000 MW we need to stabilise the grid.”

Related Stories

Zimbabwe’s grid is a legacy relic built for a centralised system dominated by Kariba and Hwange. Today’s energy ecosystem demands a flexible, decentralised network that can integrate multiple solar inputs. But with outdated lines, dilapidated substations, and a transmission loss rate of over 18%, that integration remains difficult.

“Transmission is a key enabler of clean generation,” said Kachirekwa. “But transmission has become a major bottleneck. We need to invest in green transmission that integrates new sources with real-time monitoring and storage.”

GNE has proposed building smart-grid-ready solar facilities capable of functioning both independently and in concert with national supply. Yet, like many developers, they are constrained by long permitting delays, bureaucratic opacity, and financial risk. ZESA, the state utility, owes hundreds of millions in back payments to power providers. Even when PPAs are signed in USD, currency conversion restrictions and poor creditworthiness have made most contracts “unbankable.”

“ZESA can’t keep buying foreign power while starving its own generators,” said economist Ashleigh Mandaba. “It’s self-defeating. We’re paying outsiders while pushing local investors away.”

Minister of Energy Edgar Moyo has acknowledged the scale of the challenge. He has urged industries to develop their own energy sources and promised to streamline project approvals and tariff structures. Deputy Minister Simbanegavi confirmed in Parliament that the government is expanding net-metering, offering import duty waivers on solar equipment, and negotiating currency convertibility protocols to attract foreign capital.

Yet investor confidence remains fragile. “We need a guaranteed feed-in tariff, proper grid integration, and policy consistency,” said Marshall Mpofu, CEO of SolarPro, which recently completed a 3 MW plant in Mashonaland East. “We can’t plan on promises.”

The government’s policy ambition is commendable, but experts agree that execution is lagging. Delays in environmental clearances, land leases, and PPA approvals can stretch up to 18 months. Meanwhile, energy access in rural areas remains alarmingly low.

Researchers like Ellen Chipango and Long Seng To warn that Zimbabwe’s solar rollout risks becoming elitist. “Solar adoption has been skewed toward wealthier urban households,” Chipango said. “Those who need it most—the rural poor—are being left behind.”

More than 60% of rural households rely on biomass (mostly firewood) for cooking and lighting. The cost of even a basic solar home system remains prohibitive.

Chipango argues for an “ubuntu-centric” model of energy planning one that prioritises collective well-being, dignity, and justice over profit margins.

Solutions like donor-funded village mini-grids, community energy cooperatives, and solar-as-a-service models are gaining traction. The UN-backed Renewable Energy Fund, capitalised at US$45 million, aims to scale such interventions with a goal of expanding clean generation to over 2,000 MW by 2030.

Zimbabwe is not alone in its struggles.

South Africa’s embattled Eskom utility has undergone significant reform. By early 2025, load shedding had been suspended for over four months thanks to improved plant performance and over 12 GW in installed renewable capacity. Zambia has introduced energy auctions and fast-tracked approvals for new solar farms, including a 100 MW project in Chisamba. Namibia is targeting 70% renewables by 2030, having already commissioned over 90 MW in new solar and wind projects.

“Regional integration and cross-border power trading will be crucial,” said SADC energy policy analyst Tawanda Nkomo. “But each country must first secure its own grid.”

Zimbabwe’s solar potential is not in question. The resource is abundant, the technology is proven, and the investor interest exists. What remains is the will political, institutional, and financial to turn potential into power.

Leave Comments