Audrey Galawu | Assistant Editor

Old Mutual Zimbabwe continues to be a key contributor to the group’s footprint, even as currency changes and capital restrictions weigh on headline results.

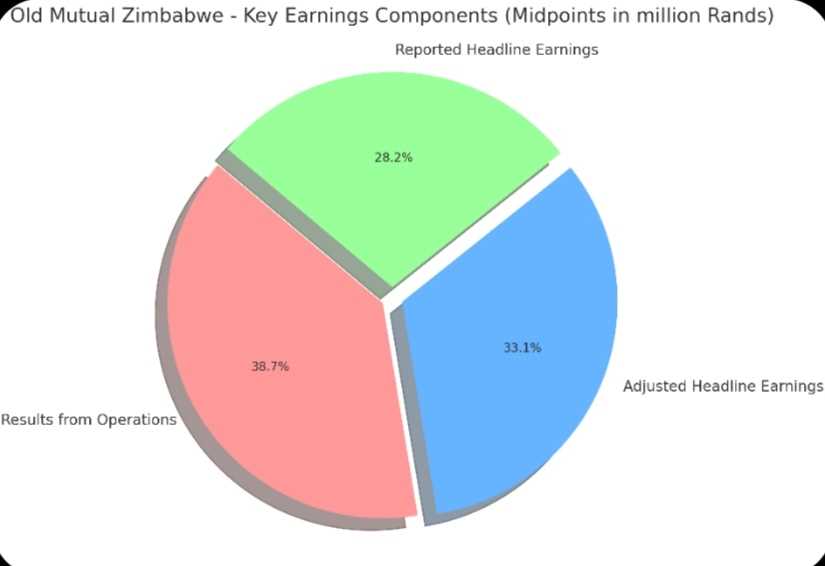

Results from operations in Zimbabwe increased between 6% and 26%, reaching between R4,498 million and R5,346 million, up from R4,243 million in the prior period.

Adjusted headline earnings also saw strong growth of 19% to 39%, totaling between R3,888 million and R4,541 million (prior period: R3,267 million).

Adjusted headline earnings per share are projected between 88.9 and 103.6 cents, up from 73.5 cents previously, while results from operations per share are expected between 104.1 and 123.2 cents (prior period: 95.5 cents).

However, reported headline earnings and IFRS profit after tax declined, primarily due to a change in functional currency for the Zimbabwean business from the Zimbabwean dollar to the United States dollar.

Related Stories

Headline earnings per share are now estimated between 84.2 and 110.9 cents, down from 133.6 cents in the prior period.

In its Q2 2025 interior report, the group highlighted the operational resilience of the Zimbabwean business, noting: “The change in functional currency for our Zimbabwean business significantly impacted IFRS profit and headline earnings but had a limited impact on net asset value.”

Despite these challenges, Old Mutual’s regional operations benefited from favourable market conditions, including strong equity market performance in South Africa and Malawi, and the group’s 2024 share repurchase programme, which helped boost overall shareholder returns.

For Zimbabwean investors, the update reflects the dual reality of strong operational performance tempered by structural constraints.

Trading activity further highlights these constraints. In the 12 months to December 2021, Old Mutual Limited’s shares recorded total indicative liquidity of US$156,640 (ZWG$18.8 million), averaging just over US$13,000 (ZWG$1.57 million) per month — a stark contrast to its regional scale and capabilities.

Leave Comments